Two stocks were on the move from both a price and message volume perspective after they reported earnings. Let’s recap. 📝

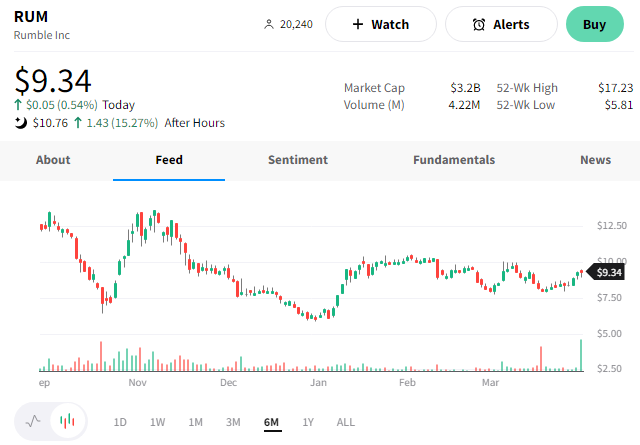

First up is the EV charging network operator EVgo. 🔋

The company reported a fourth-quarter loss per share of $0.06 on $27.3 million in revenue. That topped the expected $0.16 per share loss and $21.8 million in revenue. 👍

Executives say they added about 59,000 new customer accounts, grew network throughput by 76% YoY to 14.4 GWh, and ended the year with 2,800 fast-charging stalls in operation. Its eXtend unit saw sharp growth, rising to 61% of the company’s total revenue. The program has attracted customers like General motors, Pilot, and JPMorgan Chase.

However, its 2023 guidance came with a caveat, given it’s unsure how many U.S.-made chargers it will be able to procure. As a result, it expects revenue of $105 to $150 million, an adjusted EBITDA loss of $60 to $78 million, and roughly 3,400 to 4,000 fast-charging stalls in operation or under construction. ⚡

Revenue guidance was slightly less than the $153.7 million expected. But investors appeared to look past that shortfall. $EVGO shares rose 22% on the day. 📈

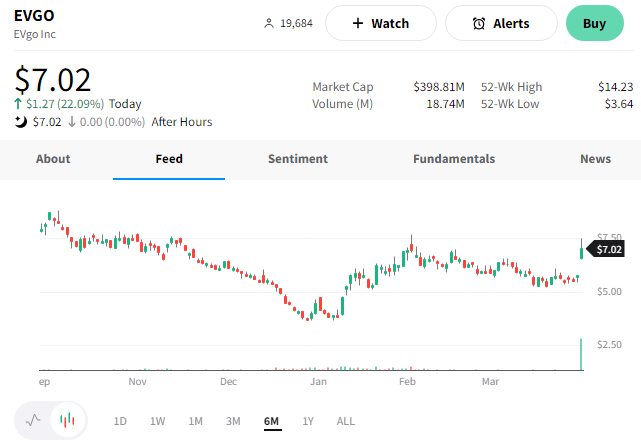

Next is the online video platform and popular YouTube alternative, Rumble. 💻

The company reported a breakeven fourth quarter, while analysts expected a $0.06 per share loss. Revenue of $20 million also topped the $10.2 million expected by analysts. Executives say the platform’s global monthly active users grew 142% YoY to 80 million.

$RUM shares rose 30% on the news, still up about 15% as of writing this. 👍