It’s been a heavy week of earnings recaps, so we will keep today’s three main stories pretty light. Speaking of light, Dollar Tree shares are shedding some weight today after reporting lighter-than-expected profits.

Ok, we promise to stop using the word light from here on out. So let’s see what caused shareholders to turn to the dark side today. 👇

The dollar-store chain reported adjusted earnings per share of $1.47, which missed the $1.52 analysts expected. However, sales grew 6.1% YoY to $7.32 billion and topped the $7.28 consensus view.

On the positive side, inflation and economic uncertainty continue to push more shoppers down the value chain to dollar stores. However, they’re spending money on lower-margin items and are apparently stealing a lot more. 🥸

CEO Rick Dreiling said, “While we are maintaining our full-year 2023 sales outlook, we are adjusting our EPS outlook as we expect the elevated shrink and unfavorable sales mix to persist through the balance of the fiscal year.” The sentiment echoes commentary from several other retailers that noted an uptick in organizing robberies in their stores.

As a result, the company’s revised full-year earnings forecast dropped from $6.30-$6.80 to $5.73-$6.13 per share. 🔻

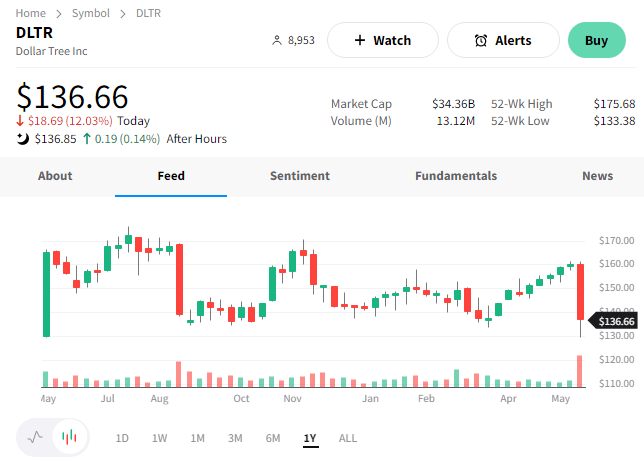

On a positive note, executives do expect the benefits of lower ocean freight rates to flow through to earnings in the second half of the year. But that’s unlikely enough to offset the other factors’ negative impact. $DLTR shares traded down 12% toward one-year lows following the news. 📉