Let’s see how clothing retailers are faring this earnings season. 👚

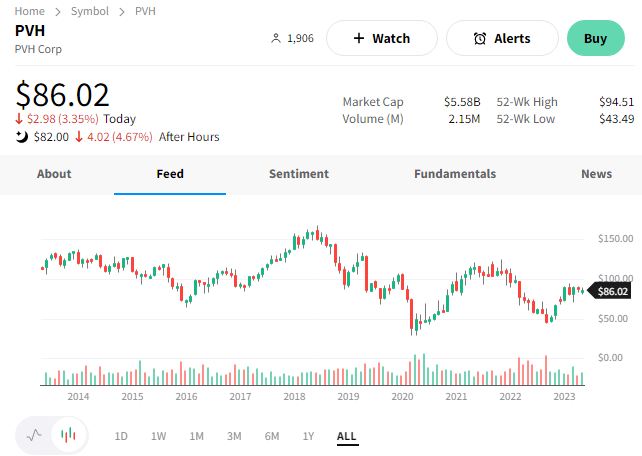

First, we’ll start with Nordstrom, which beat on the top and bottom lines.

The department store’s adjusted earnings per share of $0.07 beat the $0.10 loss anticipated by analysts. Revenues of $3.2 billion also beat the $3.1 billion expected. 🏬

The company saw sales decline YoY across most categories, though activewear, beauty, and men’s apparel were above-average performers. Gross margins also jumped 1.1% YoY as the company pared down its inventory levels. 🛒

Despite the challenging macroeconomic environment, executives remain optimistic due to their higher-end customer base. As a result, they reiterated their fiscal 2023 outlook. They now see revenue declines of 4% to 6% YoY and adjusted earnings per share of $1.80 to $2.20.

Shares of $JWN are up about 7% after hours, offsetting a similar regular session decline. 🤷

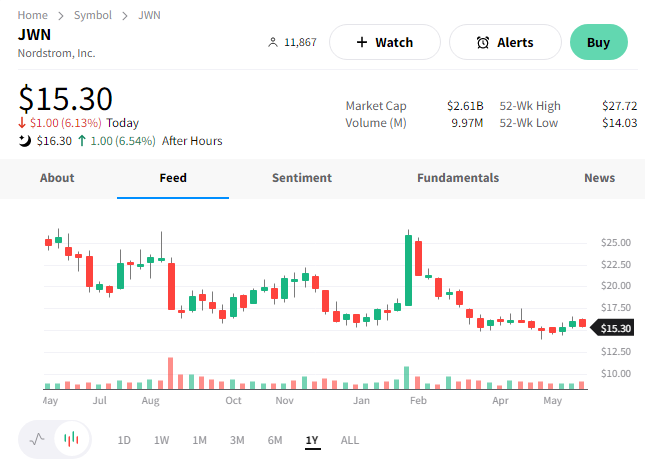

Meanwhile, PVH is extending its losses after hours following mixed results.

The Calvin Klein parent’s adjusted earnings per share of $2.25 on revenues of $2.16 billion beat the anticipated $1.94 and $2.12 billion. The company also reaffirmed its full-year guidance for 3% to 4% revenue growth and adjusted earnings per share of $10.

However, where the issue came in was the company’s rising inventories. That number rose 24% YoY due to what executives said were “abnormally” low levels in the first quarter of 2022, early receipts of inventory, and higher product costs. 📦

Other companies have been reducing inventory aggressively at the expense of their margins. So investors are concerned about potential inventory mismanagement impacting future results here.

$PVH shares are down about 3% after hours. 🔻