One of the core themes we’ve been discussing for a long time is the “ad-ification” of everything. No matter where you go or what you do, you’re likely being targeted by some form of advertising. And the reason why is because it’s such a high-margin, profitable business opportunity. 🎯

As a result, it’s no surprise to see America’s largest employer and big-box retailer, Walmart, leaning heavily into that narrative during its earnings call.

The retailer posted $1.80 per share in adjusted earnings on revenues of $173.39 billion during its holiday quarter. That topped estimates of $1.80 and $170.71 billion, with 6% YoY revenue growth being driven by its global e-commerce sales growing by double digits.

Notably, customer transactions rose 4.3% YoY, but its average ticket declined by 0.3%. That’s a great sign for the Fed and other inflation watchers but also suggests that spending on higher-priced, higher-margin discretionary items remains soft. 🔺

With customers flocking towards those lower-margin “basics” like private label goods, grocery items, and others, Walmart is leaning heavily into other business segments. It’s making money from packing and shipping online orders for its third-party marketplace of sellers. It’s also selling more ads, with that business jumping 33% YoY globally and 22% in the U.S.

On that front, the company announced it would acquire smart TV maker Vizio to help accelerate growth. It’s acquiring the company for $2.3 billion in cash and plans to use the distribution (and customer data) to help fuel its opportunity in the ad-serving space. 📺

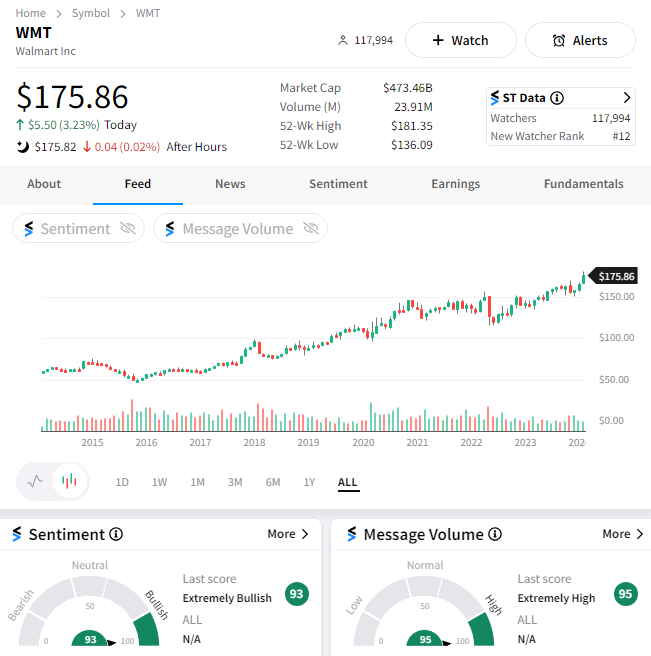

With its share price rising towards $200, the company is splitting 3-for-1 and raising its dividend by 9% to help broaden its investor base. The Stocktwits community pushed into “extremely bullish” territory, and message activity surged on the news. 📈