There’s positive news, guidance, and fundamentals, and then there’s whatever $DKNG‘s earnings are. 😲

- Loss Per Share (LPS): DraftKings is trimming the fat, slimming down to a 61-cent loss per share, a solid sprint from last year’s $1 loss.

- Total Revenue: $790 million in revenue, a 57% jump that’s got investors doing the touchdown dance.

- Customer Acquisition: They’re reeling in the bettors like a pro, with monthly unique payers spiking 40% YoY.

- Average Revenue Per User (ARPU): Each user is now worth $114 on average, up 14%.

- Expansion Plays: With Kentucky in the pocket and Maine and North Carolina warming up, DraftKings is spreading faster than strep throat in a coed dorm.

- Market Share Mojo: DraftKings just outflanked FanDuel, seizing the throne with 31% of the online gambling kingdom.

- Revenue Outlook: They’re forecasting $3.67 billion to $3.72 billion for the fiscal year. And a cool $4.50 billion to $4.80 billion projected for 2024.

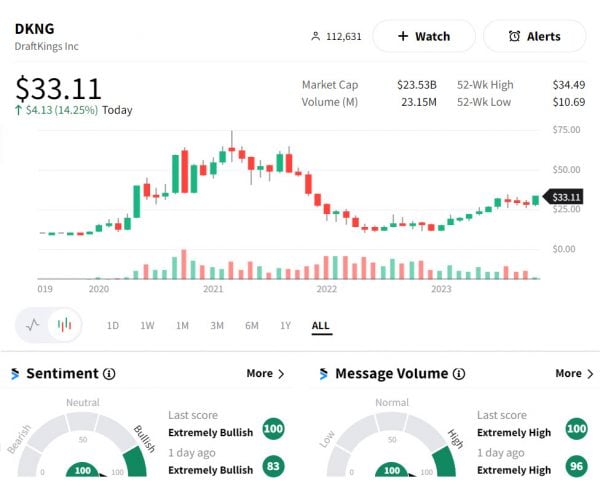

If confidence were currency, DraftKings would be minting its own money. It’s up +16.46% today and nearly +27% for the week! 🪙