Despite all the fear-mongering about the U.S. Dollar losing its status as the global reserve currency, it continues to trend higher relative to many other foreign currencies. 😱

As the global battle against inflation rages on and recession fears rise, market participants continue to find safety in U.S. Dollars. Given that real interest rates in the U.S. are higher than many alternatives around the world, demand for dollars remains strong.

Here’s a chart showing U.S. Dollar Index futures hitting their highest level since late 2002. 📈

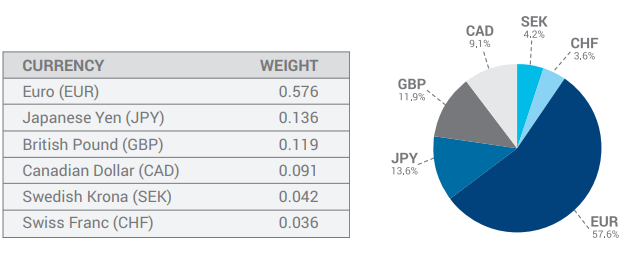

As a reminder, this futures index is heavily weighted towards the Euro. Still, it is often used as a quick barometer to see how the U.S. Dollar is performing versus other developed currencies.

And on that note, the Euro/U.S. Dollar pair is approaching parity (1:1 conversion) for the first time in about twenty years. 💱

The U.S. Dollar is also faring well against Emerging Market currencies as well. For example, the WisdomTree ETF $CEW, a basket of 14 Emerging Market currencies, is approaching its all-time low set in 2016 and 2020.

And lastly, the so-called “best inflation hedges” Gold and Bitcoin are sitting at their lowest level of the year. 📉

In the face of all the “U.S. Dollar and cash are trash” rhetoric, it seems to be working pretty well this year compared to most alternatives. 👍

I guess we’ll have to wait for the Dollar’s impending collapse just a little bit longer… 📆