My first Litepaper and first Technically Speaking since my short break and the transition to a new newsletter service have me swamped. 🥵

But there was no way I was not going to a Technically Speaking – so we’ll keep this one short and sweet.

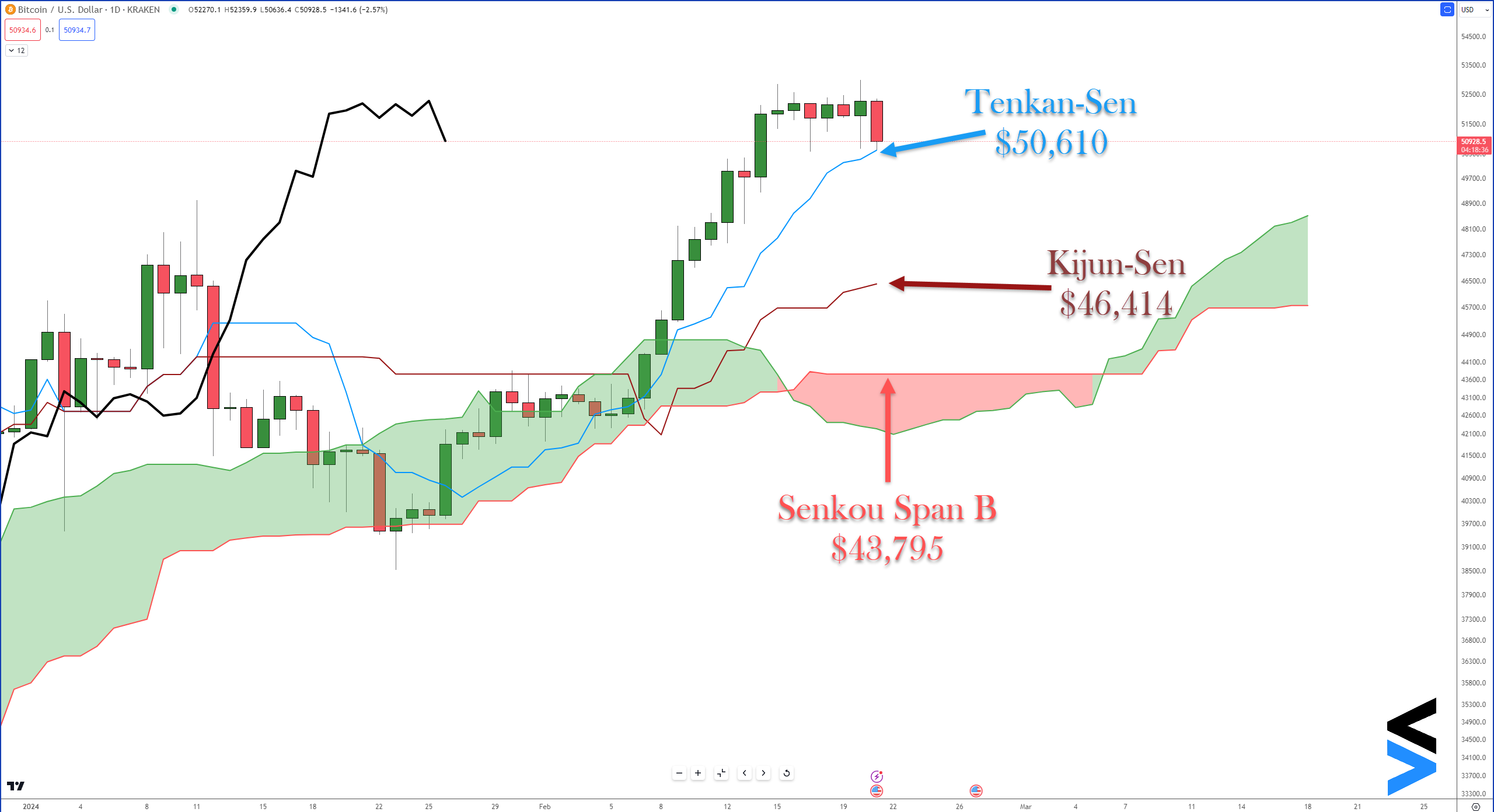

The sad fact is that nothing goes up forever – even $BTC. Eventually, people will take profit. At the time of writing this Technically Speaking (1500 EST), the Tenkan-Sen at $50,610 is holding as support, and, most importantly, the large gaps between the bodies of the candlesticks and the Tenkan-Sen are resolved.

If the Tenkan-Sen fails to hold as support, the next support level is the Kijun-Sen at $46,414 – but after today’s daily close, it will probably shoot up towards the $48k value area.

We’ll have much more to review on Friday, with more sexy charts and setups to look at. Damn, I’m glad to be back! 😁