The World Bank says the global economy is on course to record its worst half-decade of growth in about 30 years. 😬

The organization’s “Global Economic Prospects” report is now forecasting global growth to slow for the third year in a row during 2024, falling from 2.6% last year to 2.4%. Even if it rises to 2.7% in 2025, the acceleration over the last five-year period will be about 0.75 percentage points below the average rate of the 2010s.

The bank ultimately warned that without a “major course correction,” the 2020s will go down as “a decade of wasted opportunity.” ⚠️

Developing economies are anticipated to be the hardest hit by tight financial conditions, slowing global trade, and geopolitical conflicts across the globe. They’re expected to grow just 3.9% in 2024, a full percent below the last decade’s average. 🔻

The data suggests the world is falling behind its goal of making the 2020s a “transformative decade” in which it tackles extreme poverty, major infectious diseases, and climate change. To course correct, it will take countries using comprehensive fiscal and monetary policies, as well as global cooperation.

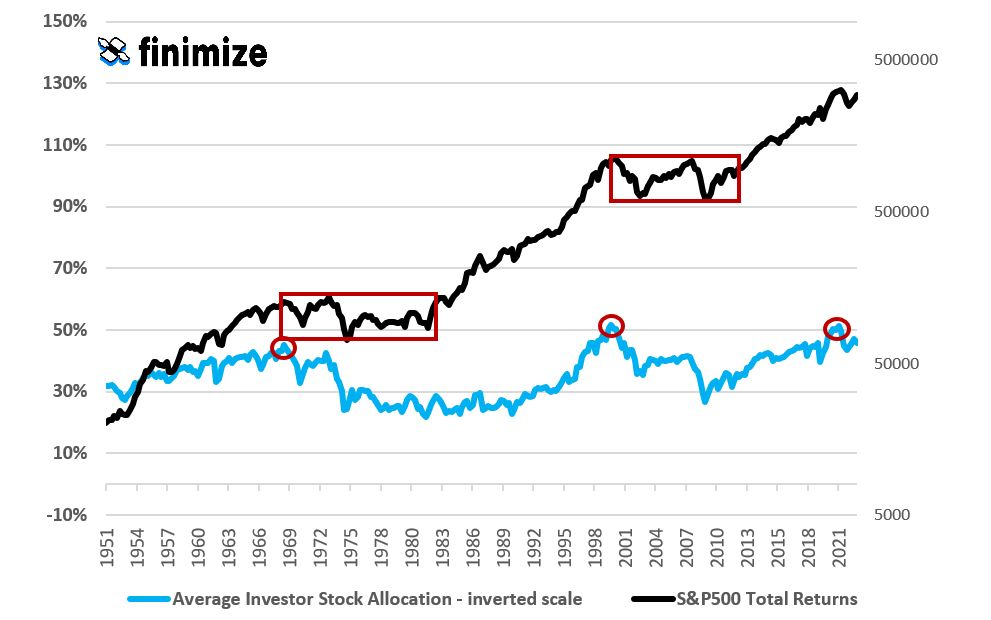

As for markets, some analysts are concerned that U.S. stocks could be setting up for their own “lost decade.” The chart below from Finimize shows that the average investor allocation to the stock market has risen to levels previously seen at significant peaks in the market. 🤔

Should things follow a similar pattern this time, investors could be dealing with a much different return environment than they have since the Great Financial Crisis.

As always, we’ll have to wait and see whether these cautious forecasts about the global economy and markets come to fruition. But for now, investors are on alert for any unforeseen risks. 👀