It wouldn’t be an inflation data day without some drama, so let’s get into what happened. 👇

First off, the headline consumer price index (CPI) rose 0.4% MoM and 3.7% YoY. That was ten bps above estimates, driven primarily by higher energy prices. As for core consumer prices, they rose 0.3% MoM and 4.1% YoY, as expected.

Services prices rose 0.6% when excluding energy services and were up 5.7% YoY. Within that number, shelter prices remain the main culprit in sticky services inflation, accounting for more than half the rise in September’s CPI reading. 🏘️

Overall, it was not a terrible reading. Core prices continue to decline, albeit at a slower pace each month. Ultimately, the market didn’t react much because it doesn’t think this report will do anything to change the Fed’s recent hawkish guidance. 😴

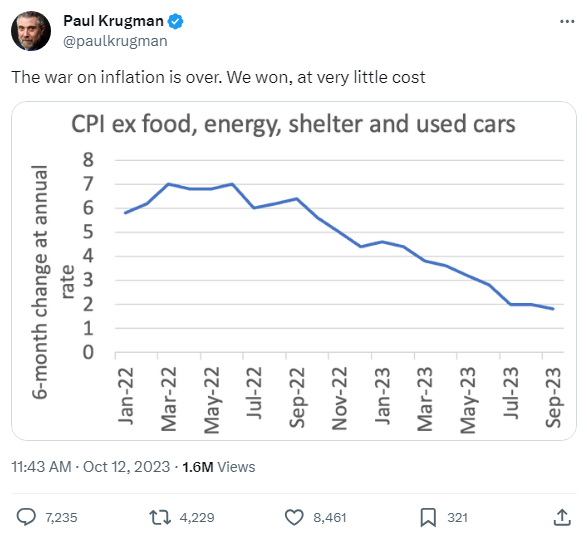

But the inflation take that got the internet riled up was from famed economist Paul Krugman, who tweeted the chart and caption below. In it, he essentially declares victory in the Fed’s war on inflation. Well, that is if you exclude basically all the items people buy regularly. 🤦

This chart, which excludes food, energy, shelter, and used cars, highlights the difference between how economists/analysts view inflation and how consumers experience it. 🙄

While economists are worried about the slope of price changes, consumers are worried about the absolute price changes. Prices rising a little less each month is undoubtedly a sign of progress, but it means that prices are still growing (just more slowly). That’s the reality consumers are experiencing in their everyday lives.

And that’s likely why recent data suggests that consumers remain concerned about inflation and are turning more pessimistic about the U.S. economic outlook. Energy prices have jumped significantly over the last four months, which has a way of impacting people’s mood about their wallets and the overall economy. 👎

That essentially explains the dunk fest Paul Krugman experienced on X today. But other than that, it was a pretty uneventful inflation report. 🤷