After another long month of speculating about its decision, the Fed finally delivered the expected 25 bp hike and “pause” language. And yet stocks went…down. How’s that for irony?

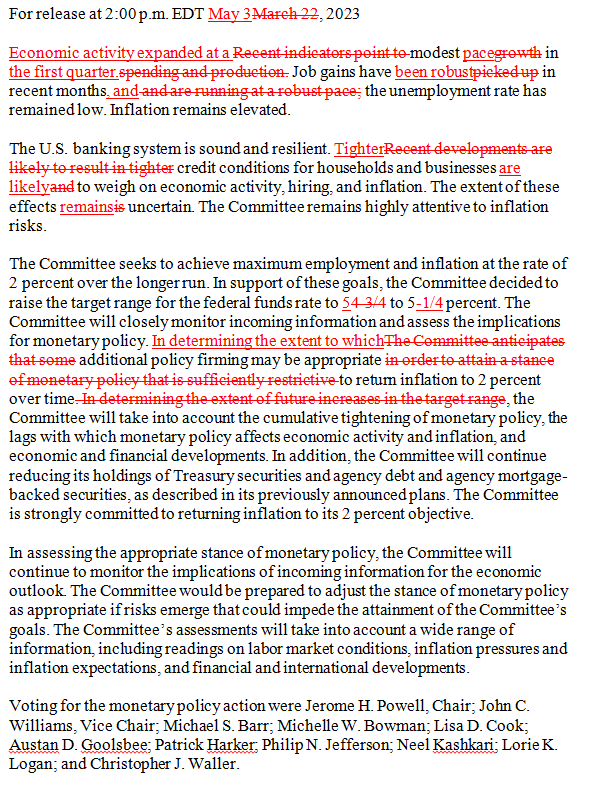

Let’s start with a red-lined version of the statement, courtesy of WSJ Reporter Nick Timiraos. 👇

There were a couple of key takeaways from this month’s decision, the first of which is that the 25 bp hike was unanimous. Fed governors love to talk and constantly stir up confusion in the media. But at the end of the day, they were all leaning towards at least one more 25 bp hike. And that’s what we got. 📦

Secondly, the statement softened its language in a way that suggests a pause is ahead at the June meeting. It did so by eliminating the phrase, “The committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive…” and replacing it with, “In determining the extent to which additional policy may be appropriate to return inflation to 2% over time, the Committee will take into account…”

The Fed has essentially closed the rate hiking door but left it unlocked so it can be opened again if conditions deem necessary.

After the usual knee-jerk market moves upon this statement’s release, all eyes turned to Powell’s press conference. 💬

In classic fashion, Powell repeated that the Fed would continue its data-dependent approach in determining its next steps. However, stocks fell when Powell said the Fed is “prepared to do more” if warranted. He added to the market’s anxiety by saying, “…a decision on a pause was not made today.” Still, he noted that the change in statement language around future policy firming was “meaningful.” 📝

As for the elephant in the room, Powell repeated that the banking system remains “sound and resilient” despite the recent banking failures. Moreover, he noted that even with stress in the banking sector, the Fed is trying to avoid taking its eye off the “inflation” ball by cutting rates too soon.

Overall though, he noted that First Republic’s acquisition by JPMorgan Chase was an “exception.” He went on to say, “I think it’s probably good policy that we don’t want the largest banks making big acquisitions.” As for whether the Fed has an“agenda” to continue consolidating banks, Powell said he sees value in the banking system having different size institutions focused on different goals. So no, the Fed does not have a consolidation agenda. 🏦

Despite Powell’s “cool as a cucumber” attitude towards regional banks’ current stress, the Fed may eventually be forced to acknowledge and address the issue they played a role in creating. 🐘

Just after the bell, PacWest warned investors it is weighing strategic options, including a possible sale. That sent shares down 60%, pulling many bank stocks (and the market) with them. 😱

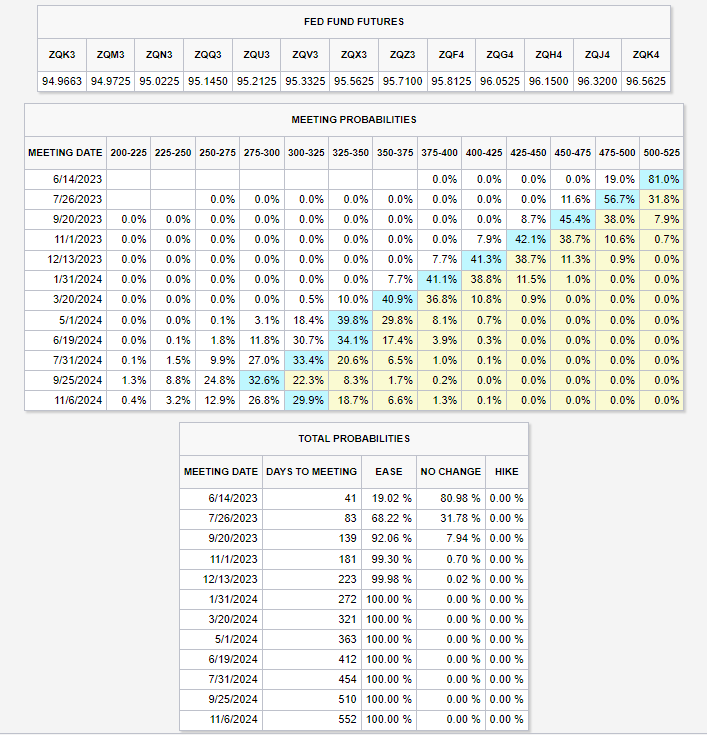

As for the bond traders, they continue to believe the Fed will have to cut sooner than it’s letting on. The CME Fed Watch tool, which uses Fed Fund Futures to identify the market’s rate path expectations, is pricing in an 82% chance of a pause at the June meeting. After that, it’s expecting the first rate cut in September, but maybe as soon as July if things get really rough. 🤷

As usual, we’ll have to wait and see how the market’s (and Fed’s) expectations change as more data comes in. Employment data remains very volatile, with ADP private payrolls coming in almost double the 150k expected in April. All eyes will be on Friday’s nonfarm payrolls number to see if it confirms this strength or offers the Fed signs of hope in its war against inflation. 👀