With travel demand remaining robust, airline investors are hoping for some pretty incredible results. However, Delta’s quarterly numbers and outlook today caused many to rethink their expectations for what’s ahead. 🤔

The company’s adjusted earnings per share of $1.28 on $13.66 billion in revenues topped the expected $1.17 and $13.52 billion. Revenues were up 6% YoY, driven by strong international travel demand that’s helped offset an oversupply of domestic flights. 🔺

A record number of flyers paid to sit in Delta’s higher-priced cabins, with premium cabin revenue up 15% YoY vs. coach’s 10% YoY growth. 💺

Despite the many positives impacting the airline industry right now, there remain significant challenges. For example, issues in the aerospace supply chain for parts and repairs have slowed maintenance times. According to executives, that’s the biggest part of the business that hasn’t returned to pre-pandemic levels. Boeing’s recent issues certainly won’t help that anytime soon.

Higher costs are the other big challenge, causing Delta to forecast 2024 adjusted earnings of $6 to $7 per share, down from the $7+ forecast it shared last year. Cooling fares are the other half of the equation, so analysts are closely watching consumer spending habits and sentiment. 🔻

Unfortunately for the airline business, simply having strong demand isn’t enough to guarantee success. These are complex, capital-intensive businesses that are heavily regulated. And as investors are finding out, just because many factors have returned to their pre-pandemic levels, that doesn’t mean the stock prices will.

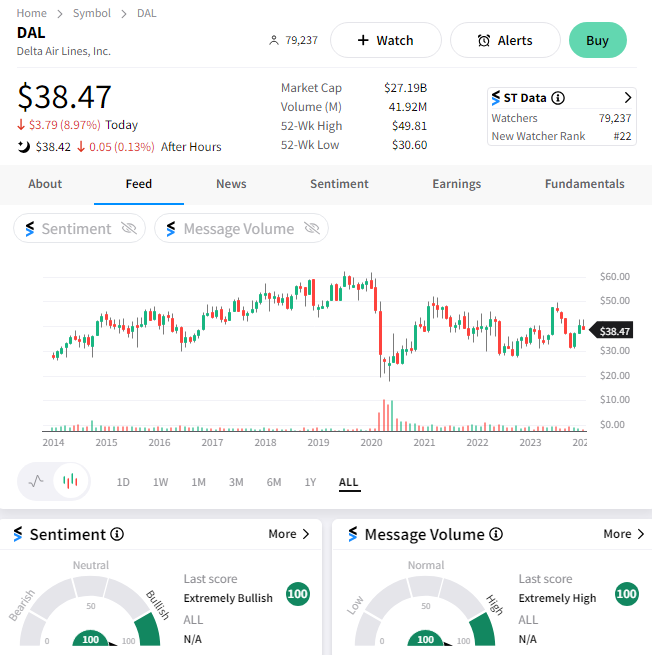

What was expected to be a beautiful jump turned into a sloppy dive. $DAL shares were down about 9% on the day, while the $JETS ETF that tracks airlines was down 5%. That didn’t seem to dent the Stocktwits’ community sentiment, which remains in “extremely bullish” territory. We’ll see if that pays off in the weeks and months ahead. 🤷