The U.S. stock market kicked off fourth-quarter earnings season with its biggest banks. Let’s see what they had to say about the U.S. consumer and economy. 👇

Before jumping into individual company results, it’s worth noting the overarching theme was that 2023 was likely the peak for net interest income.

Substantial net interest income was driven last year by higher interest rates, a deposit flight to safety, and sustained loan growth. However, many bank executives believe that the Federal Reserve’s rate cuts, slowing loan demand, higher credit losses due to a slowing economy, and the need to pay more for deposits will weigh on this metric. And since it’s the primary driver of most banks’ earnings, 2024’s numbers likely won’t be as strong as last year’s.

The U.S.’s biggest bank, JPMorgan Chase, reported adjusted earnings per share of $3.04 on revenues of $39.94 billion. Revenues beat, but earnings dipped 15% YoY due to a $2.9 billion fee related to the government’s seizure of failed regional banks last year. Better-than-expected net interest income and credit quality drove record results in 2024, with the bank emerging larger and more profitable from last year’s regional bank crisis. 💰

CEO Jamie Dimon continued to speak cautiously despite the bank’s strong results. He cited several risks to the market’s current “soft landing” view, noting they remain significant and somewhat unprecedented. ⚠️

Bank of America’s revenues fell well short of expectations at $22.1 billion vs. $23.74 billion. Adjusted earnings topped expectations even though it took a $1.6 billion charge related to the transition from the London Interbank Offered Rate. It also took a $2.1 billion fee charged by the Federal Deposit Insurance Corporation (FDIC) over its seizure of failed regional banks.

The second-largest bank in the U.S. raised its provision for credit losses from $12 million last year to $1.1 billion. Its net interest income also fell 5% YoY due to higher deposit costs and lower deposit balances. Unlike JPMorgan, it could not capitalize on last year’s higher interest rate environment as well as investors had hoped. 😞

Wells Fargo remains in cost-cutting mode, restructuring its business for a future less tied to residential mortgages. Earnings per share and revenues topped estimates as higher interest rates buoyed net interest income. Still, it also took several hefty “charges” related to last year’s regional bank crisis and severance expenses. 🔺

Citigroup’s massive restructuring efforts continue, causing it to post a $1.8 billion fourth-quarter loss. The bank preannounced that its charges would be higher than Wall Street anticipated earlier this week, causing a somewhat muted reaction to today’s results. Revenues also failed to keep pace, with analysts still unclear what the bank’s future vision looks like. 🔻

BlackRock is not a bank, but it is worth mentioning here as it also reported results. The world’s largest money manager saw assets jump above $10 trillion, with earnings and revenues beating expectations. Net inflows of $96 billion and rising asset prices helped its AUM top analyst estimates. However, the more significant news is that it’s acquiring Global Infrastructure Partners for $12.5 billion as it pushes further into the private markets. 🤝

Overall, the consensus among executives is that 2024 will not be as “smooth sailing” as last year. Several challenges remain for the banking industry, especially those outside their control, like what the Federal Reserve does to rates or how the economy performs.

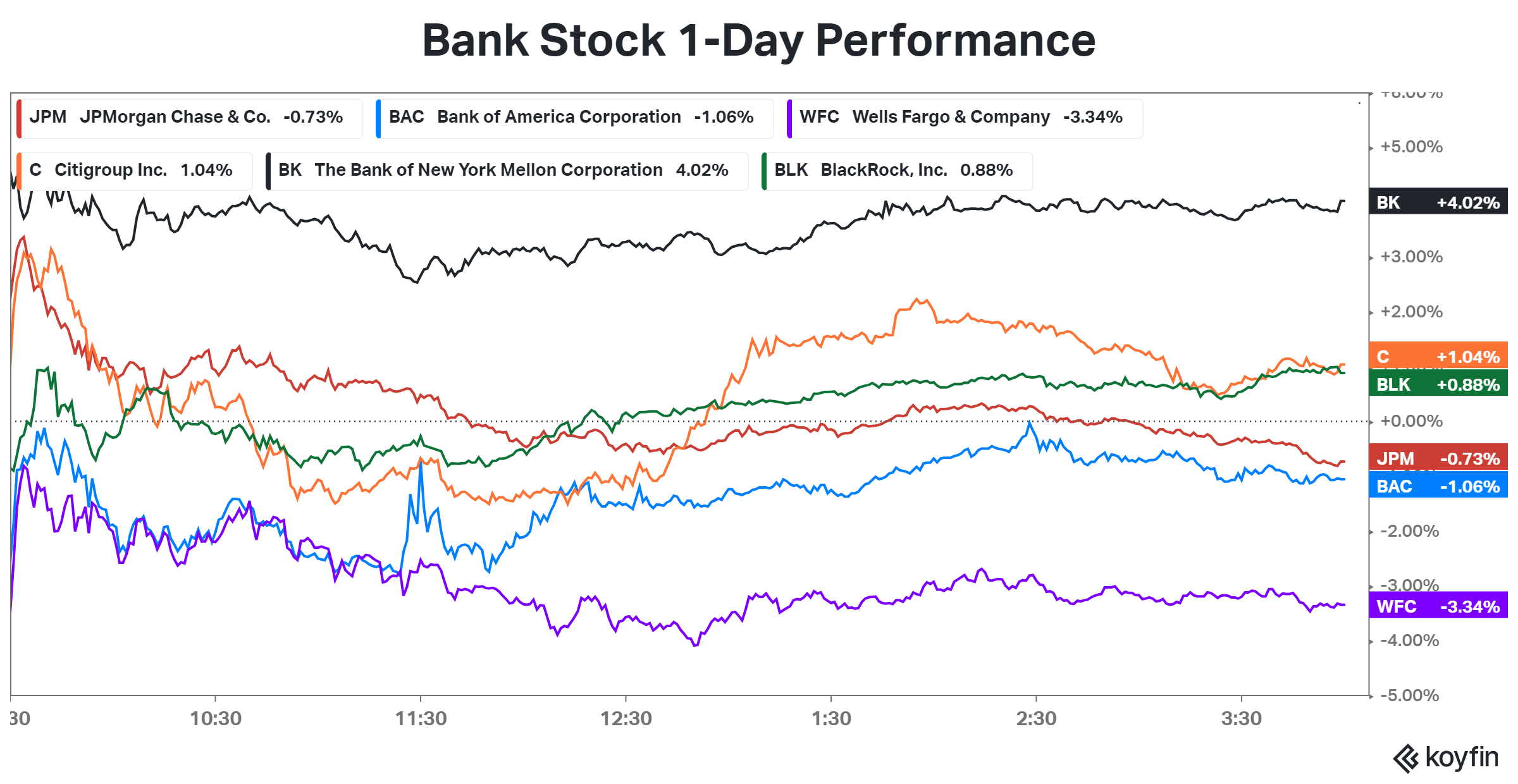

Shares of the major banks had a mixed day as investors digested the results. 📊