The U.S. labor market continues to cool, which is great news for the Federal Reserve and its 2% inflation goal. While we’ll get more employment data in the days ahead, the November Job Openings and Labor Turnover Survey (JOLTs) report was significant.

From a job openings perspective, they fell to their lowest level since March 2021 at 8.79 million. That pushed the ratio of job openings to available workers down to 1.4:1, well off its peak of 2:1, where it sat for most of 2022. 📊

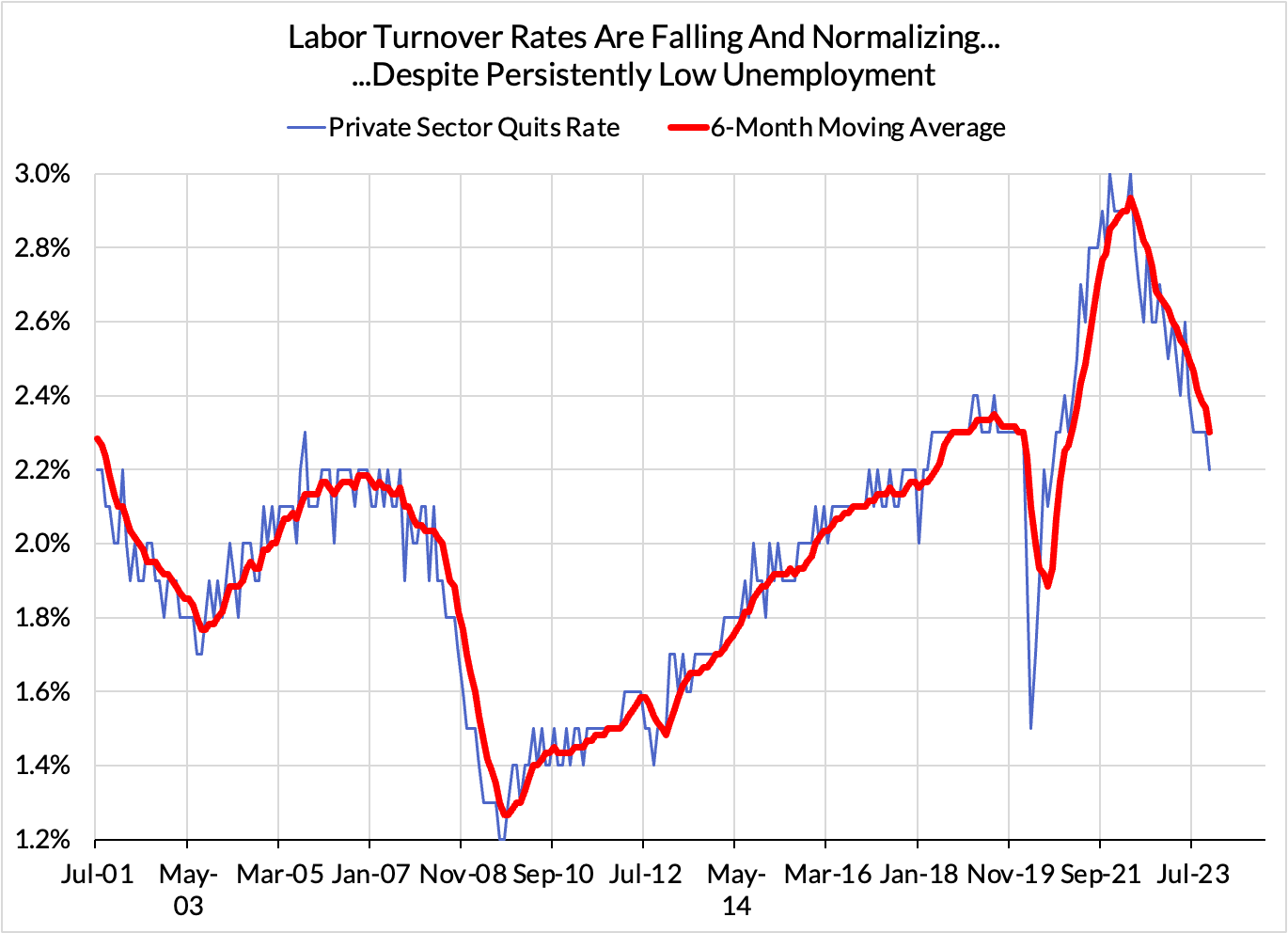

However, what was most notable was the level of quits. As the chart below from Skanda Amarnath shows, quits have steadily been trending lower and fell to 2.2% in November. That brings them back firmly below pre-pandemic levels. 🧑💼

This is a widely followed data point because it is a solid forecaster of wage growth. After all, people would only quit their jobs if they felt confident they could find a better one.

As we’ve seen from the rest of the JOLTs report, the number of available jobs to available workers has been slowly declining as companies pull back on hiring and the number of unemployed workers ticks up. And a looser labor market means companies have to raise wages less to attract workers. 🧭

A cooling labor market is one of the key reasons the market is pricing in three to six rate cuts in 2024. However, after a red-hot rally in the fourth quarter (and an overall great 2023) for stocks and other risk assets, Fed officials are subtly trying to tame the animal spirits.

The FOMC Minutes from December’s meeting were released today and cast doubt about the path of interest rates, noting a high level of uncertainty over when or how the committee will cut rates. 📝

But what they do seem certain about is that the economy will continue to grow at a modest pace going forward. They’ve appeared to achieve the “soft landing” everyone had hoped for, but are still cautious of unknown risks ahead of us. With geopolitical tensions rising across the globe, interest rates remaining elevated, and a U.S. presidential election staring us in the face, there are plenty of opportunities for the 2023 bull run to face some opposition. ⚠️

We’ll have to see if the rest of the week’s employment data provides further confirmation of slack building in the labor market. If it does, then the market’s hopes for rate cuts as early as the second quarter may live another day. 👀