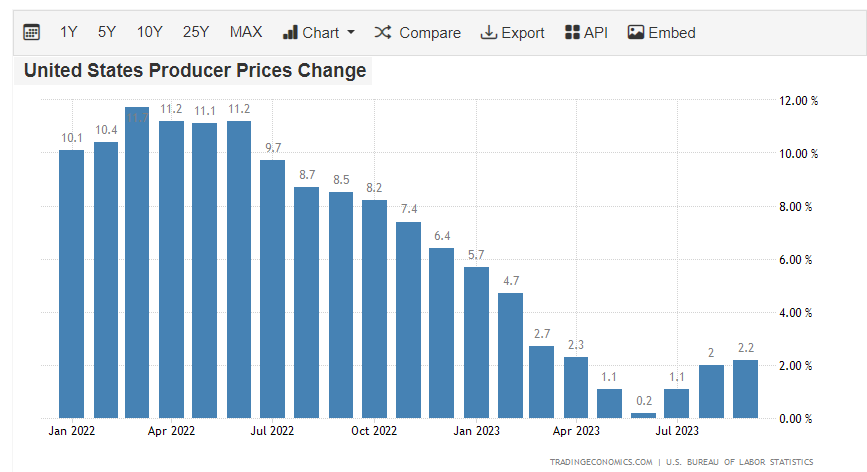

After twelve straight months of year-over-year declines, producer prices have stabilized and are back on the rise these last three months. That, combined with the stickiness in core consumer prices, has investors wondering if inflation could return from the dead. 😬

The headline producer price index (PPI) rose 0.5% MoM and 2.2% YoY in September. Excluding food and energy, core PPI rose 0.3% MoM as services drove the larger-than-expected increase. 🔺

Analysts say today’s report suggests that sticky inflation and higher interest rates are here to stay. Although inflation has fallen significantly from last year’s peak, getting it down to the Fed’s 2% target and keeping it there steadily will take time and patience. 🕰️

Investors hoping to gain additional insights from September’s FOMC Minutes were left disappointed, with the Fed echoing what it did in recent weeks. They’re remaining data-dependent and not taking another rate hike off the table until they’re fully convinced inflation has been conquered.

All eyes will turn to tomorrow’s consumer price index (CPI), where analysts will most closely assess the progress in services inflation. 👀