Shares of Samsung Electronics fell today after the consumer electronics giant warned about its fourth-quarter results. It now expects a 35% YoY decline in operating profit during the fourth quarter of 2023, coming in at 2.8 trillion South Korean won vs. 4.31 trillion a year ago. 🔻

Given it is the country’s largest company and the world’s largest maker of dynamic random-access memory chips, analysts closely watch it as a bellwether for the consumer electronics industry. 👀

With fourth-quarter revenues falling about 5% YoY and operating profit guidance falling well short of the 3.7 trillion won that analysts estimated, concerns about demand for smartphones, computers, and other consumer electronic devices are emerging.

Overall, the consensus view was that memory chip prices would begin to rebound in the fourth quarter of 2023, as production cuts by suppliers and a recovery in demand provided better pricing power. However, just because demand has bottomed out does not guarantee prices will sharply rebound. 📊

Analysts will closely scrutinize Samsung’s full earnings report on January 31st, looking for clues into how quickly prices and demand could return to the higher levels seen in prior years. They’ll also be watching other chipmakers like Broadcom and computer makers like Dell to see if the industry’s outlook is consistent or if company-specific issues are holding some stocks back more than others.

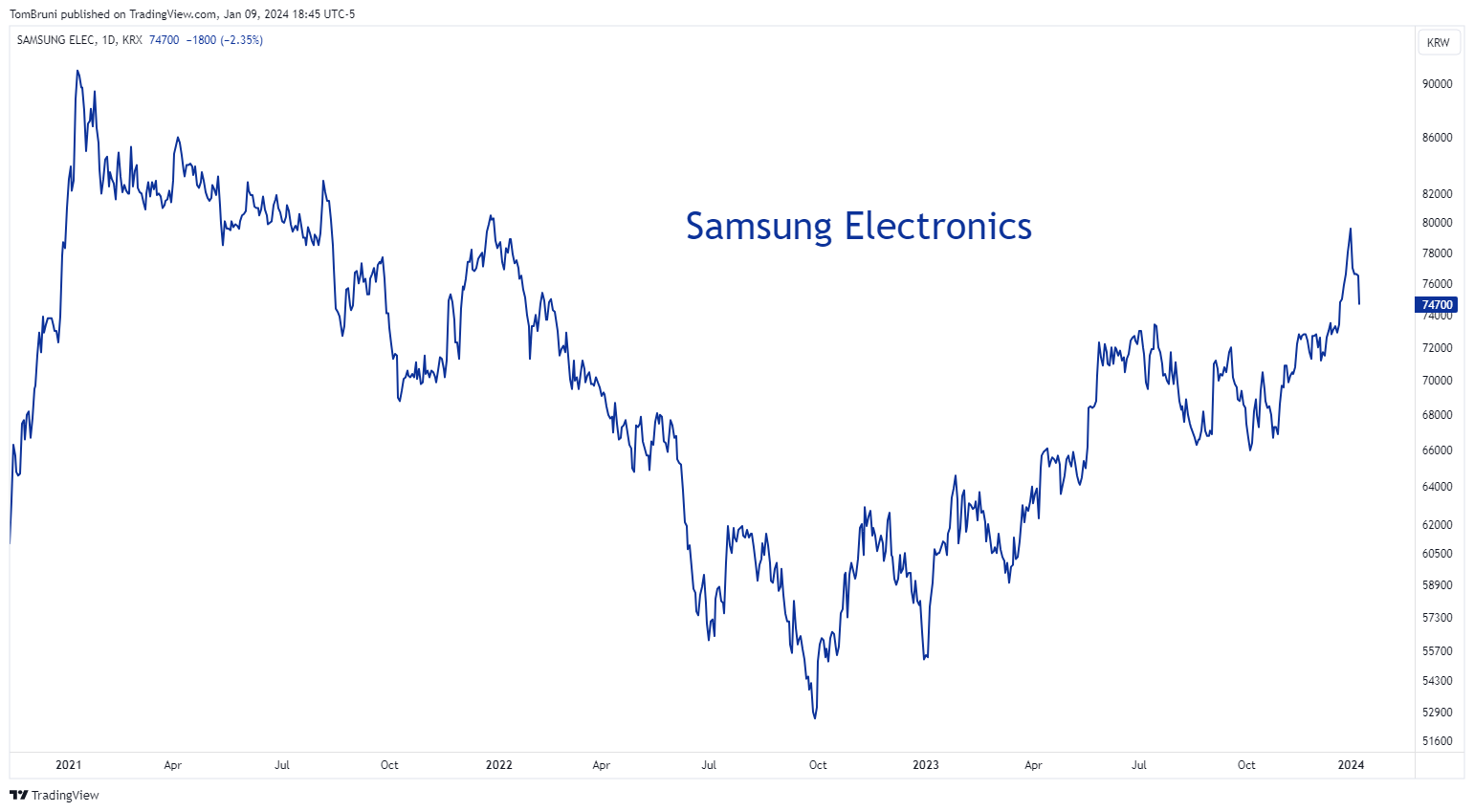

Samsung Electronics shares fell about 2% on the day, but the chart below shows they’re still about 30% below the highs set in 2021. In addition to the broader industry challenges, analysts say the stock continues to lag behind its peers because of weaker margins. 📉