It’s a slow week in the market, but as usual, there’s some news out of the semiconductor space. Let’s take a look. 👀

First up is Israel granting Intel $3.2 billion to support the company’s biggest investment in the country. Intel will not only build a $25 billion factory that creates thousands of jobs but will also buy $16.6 billion in goods and services from Israeli suppliers over the next decade. It is anticipated that the plant will open in 2028 and operate through at least 2035. 🏭

Intel has invested billions in building factories across three continents to compete better with AMD, Nvidia, and Samsung. It says this Israeli plant investment “…is an important part of Intel’s efforts to foster a more resilient global supply chain, alongside the company’s ongoing and planned manufacturing investments in Europe and the United States.”

Meanwhile, Israel’s finance and economic ministries said Intel’s investment is a significant expression of confidence in the country’s economy. It also highlights the highly competitive nature of the semiconductor industry as countries across the globe look to bring investment to their borders. 🌍

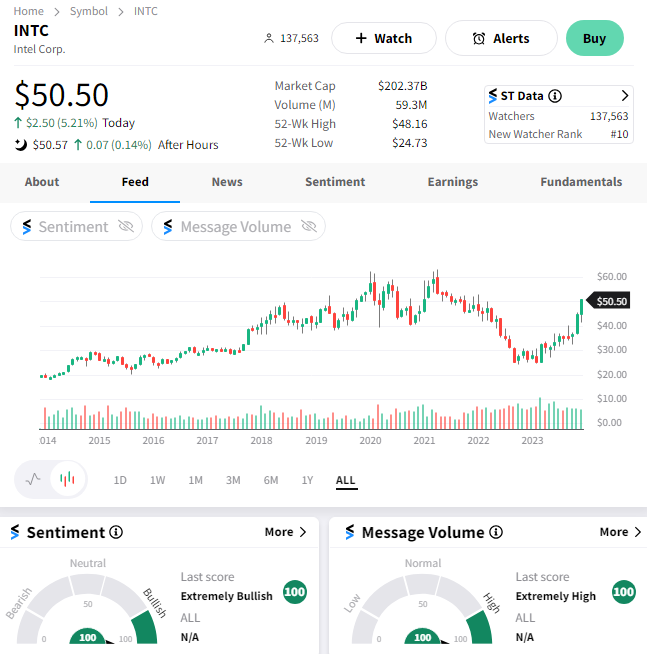

$INTC shares popped 5% on the day but remain about 30% below all-time highs.

While most semiconductor companies are optimistic about the industry’s long-term outlook, some are still concerned about the short term. For example, Samsung says it is delaying chip production at its new Texas plant until 2025, joining competitor Taiwan Semiconductor (TSM), which delayed the opening of its Arizona plant.

Although high-end chip products for artificial intelligence (AI) and cloud space remain strong, the market for chips in consumer electronics remains soft, given there’s yet to be a meaningful rebound in consumer demand for those products. Although Micron, Dell, and several other companies have hinted at an improving outlook, it’s expected that this market segment won’t pick up meaningfully until late 2024 or early 2025. ⚠️

With semiconductor stocks among the market’s best-performing sectors in 2023, investors are anxiously waiting to see what 2024 brings for the industry. 😰