Olive Garden parent Darden Restaurants had a rough July-October after weakness in its flagship brand led to a sales miss and disappointing 2024 guidance. However, today’s second-quarter results gave investors renewed hope that it’s getting back on track. 🤔

The company’s adjusted earnings per share of $1.84 topped the expected $1.74. Revenues were shy of expectations, coming in at $2.73 vs. $2.74 billion. Sales jumped 9.7% YoY, boosted by including Ruth’s Chris Steak House locations following its acquisition. 📈

Total same-restaurant sales rose 2.8% YoY, with Olive Garden sales up 4.1% YoY and LongHorn Steakhouse up 4.9% YoY. However, fine dining sales lagged for another quarter, falling 1.7% YoY.

Executives remain confident in their strategy to profitably grow market share, outperforming the industry in most closely-followed metrics. As such, they raised their full-year fiscal 2024 outlook for adjusted earnings per share from $8.55-$8.85 to $8.75-$8.90. They also expect total inflation of 3.0% to 3.50% and same-restaurant sales growth of 2.5% to 3.0%. 💸

The company also bought the dip in its stock, repurchasing 1.2 million shares for $181 million. It still has $328 million remaining under its current $1 billion repurchase authorization.

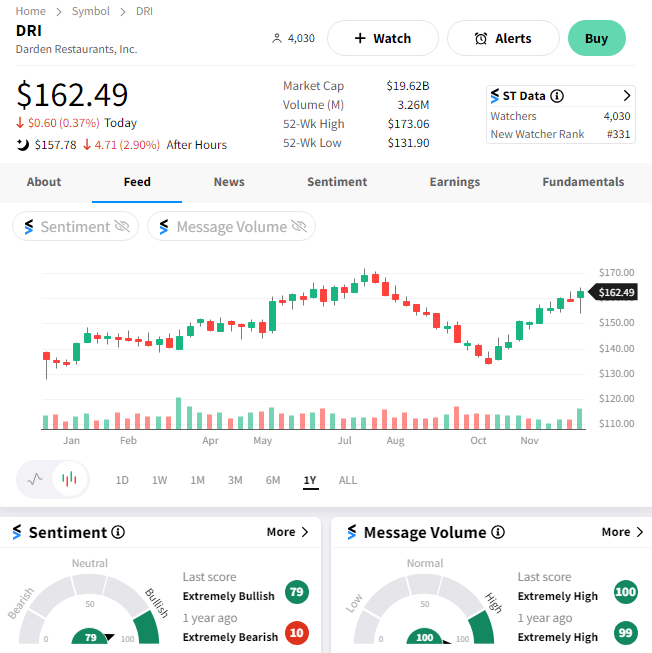

$DRI shares were down marginally on the day but have recovered most of their July-October decline from all-time highs. 👍