Ninja. Guppy. Yuppy. Widowmaker. 🕷️

These are all nicknames for the most traded Japanese Yen FX (Forex) pairs (Ninja – USDJPY, Yuppy – EURJPY, Guppy – GBPJPY).

But there is one nickname that FX traders use to describe the Yen, and it’s very appropriate: The Widowmaker. And that’s because the Yen is a dirty float.

A clean floating currency like the US Dollar and Euro have no direct central bank intervention, whereas dirty floating currencies allow for the government/central bank to intervene if it’s doing something they don’t like. 😖

Without going into a ton of detail, the Yen is one of the most important currencies in the world, the third most traded by volume, and Japan is one of the largest economies in the world (3rd or 4th, depending on how you measure).

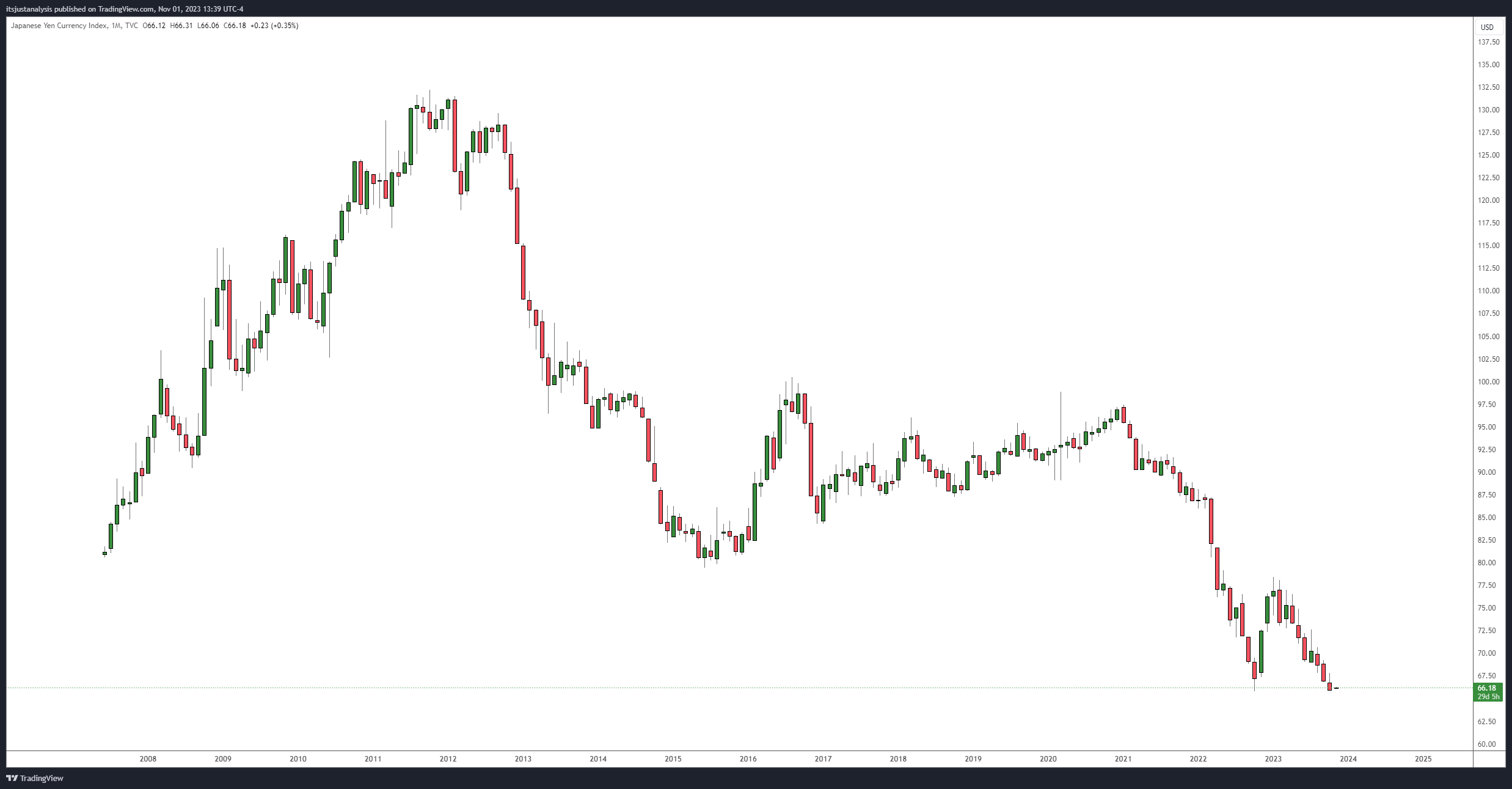

Yesterday’s close (October 31, 2023) resulted in the lowest daily, weekly, and monthly close in the Yen Index’s (JXY) history:

If the Japanese Ministry of Finance and Bank of Japan decide to intervene, something they’ve been warning they will do, then expect some crazy fluctuations across the board and in all markets. 😵💫