Inflation worries had all but disappeared recently. But as usual, the market likes to fool the majority, so we saw January’s consumer prices surprise to the upside today. 🫨

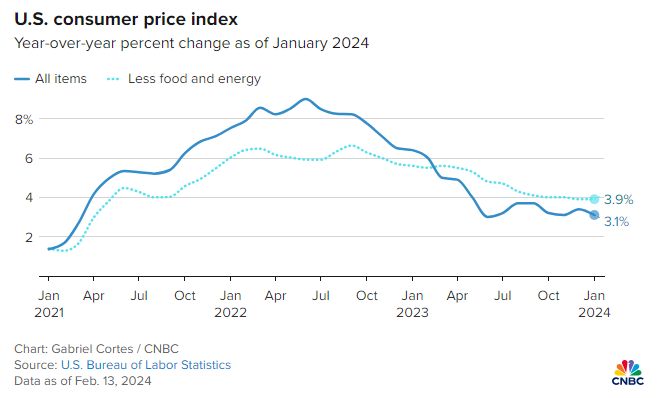

Headline CPI rose 0.3% MoM and 3.1% YoY, topping the 0.2% and 2.9% Wall Street had expected. Core consumer prices, which exclude food and energy prices, rose 0.4% MoM and 3.9% YoY. Shelter was again the largest component driving the increase, climbing 0.6% MoM and 6% YoY. 🔺

CNBC’s chart below shows that progress in these measures stalled in the middle of last year, well above the Fed’s 2% target. Lower inflation readings are great but not enough for the Federal Reserve to consider cutting rates anytime soon. Jerome Powell and the other FOMC members do not want to risk inflation flaring up again, especially given how well the overall economy has held up.

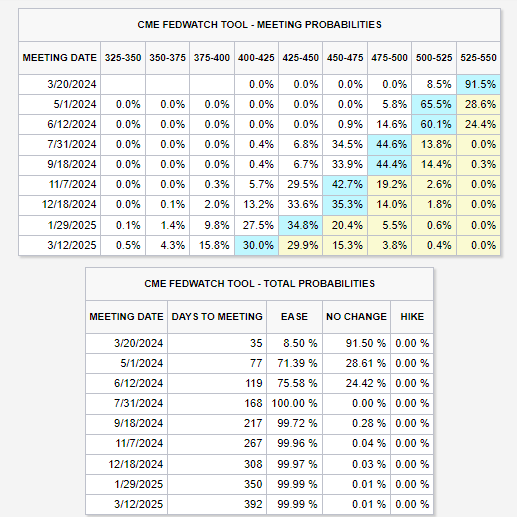

The Fed’s messaging, continued strength in the labor market, and today’s uptick in inflation data have pushed expectations for the first rate cut out until May. Interestingly enough, though, the odds of a rate cut in May actually increased today. So we’ll have to wait and see how it progresses in the weeks ahead. 🤷

In the meantime, an extended stock market needed an excuse to sell off, and it got one today. Whether this is a normal pullback or the start of something larger remains to be seen, but the short-term momentum change has certainly put many market participants on alert. 🚨