Although the initial public offering (IPO) market is trying its best to revive itself, investors remain skeptical of new issues. Birkenstock, the market’s latest suitor, failed to attract first-day fanfare. 🥱

The German shoemaker expected to price its IPO between $44 and $49 per share, according to its initial Securities and Exchange Commission (SEC) filings. However, it ultimately priced last night at $46 per share, raising $1.5 billion and giving it a market value of roughly $8.6 billion.

Still, at that valuation, it is still worth more than peers like Allbirds, Crocs, and Steve Madden. It was also double the $4.3 billion private equity firm L Catterton acquired it for in 2021. Because of that somewhat lofty valuation, investors hesitated to jump on board. ⚠️

Shares opened late in the day at $41.30, representing a roughly 10% discount from yesterday’s pricing. Although they saw an initial 4% pop, they could not make their way up toward that $46 level and quickly faded, closing down at the day’s lows. 🙃

Despite solid growth over the last few years, analysts say the company is fairly valued at current levels and doesn’t give the public markets much to chew on. Additionally, the recent fanfare from its appearance in the hit movie Barbie failed to impress retail investors, who worry that it’s simply a shoe company facing the same consumer slowdown the rest of the industry is battling.

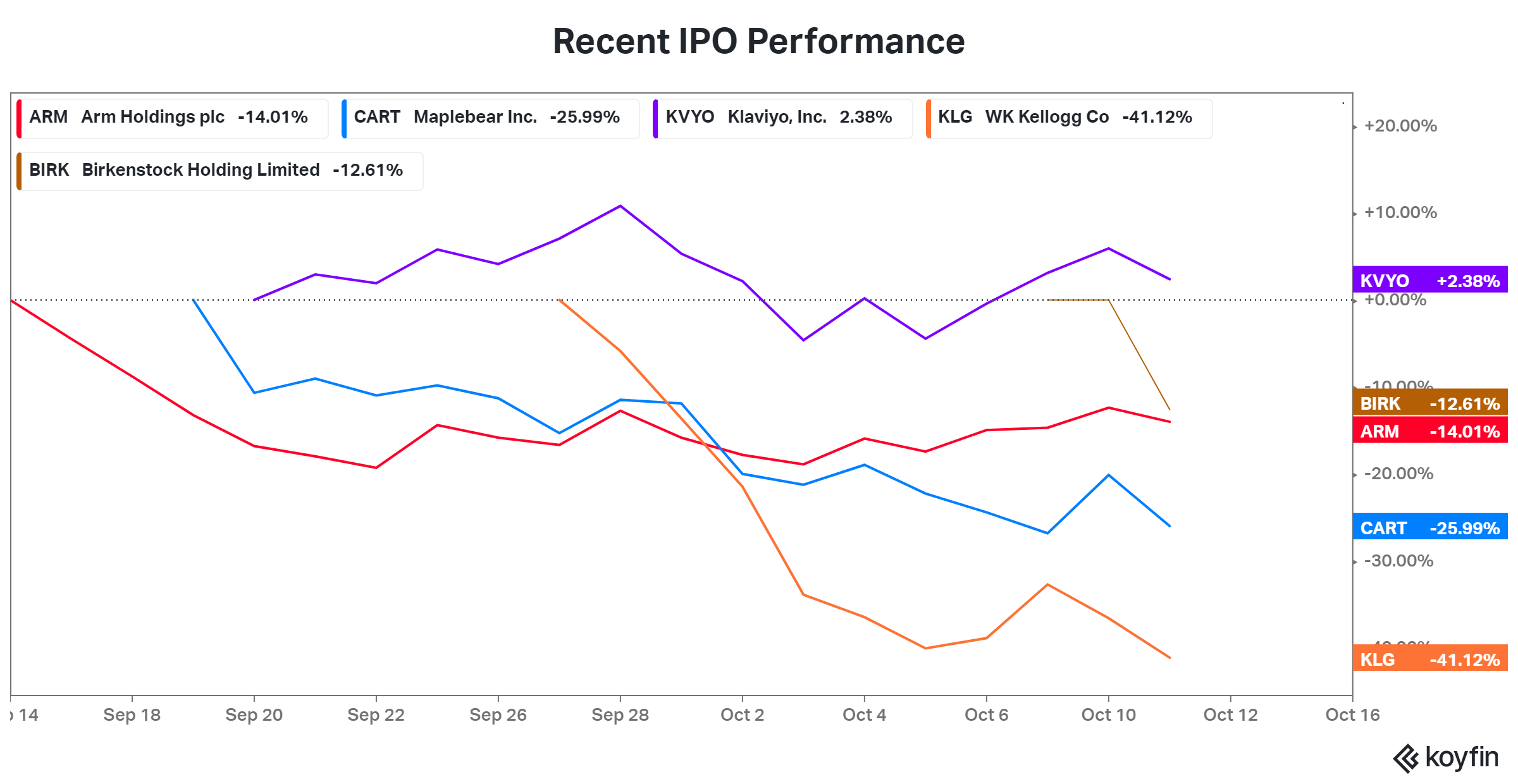

Given the lackluster performance from other high-profile IPOs, what will set Birkenstock apart from the rest of the group remains unclear. Some argue that its profitability is a major differentiating factor, especially in the current high interest-rate environment. 🤔

As always, we’ll have to wait and see. But for now, follow along with the 555 other $BIRK stream watchers and share your thoughts! 👀