The 2023 U.S. initial public offering (IPO) improved versus last year’s dismal turnout but was still lackluster considering the Nasdaq 100’s nearly 50% rebound. However, several big-name companies are prepping to test the market in 2024, including Shein, Reddit, and others. 🤩

First is Chinese fast-fashion retailer Shein, which is looking to raise funds to expand its global reach. The company confidentially filed to go public in the U.S., looking to top its last valuation of $66 billion in a 2024 IPO. People familiar with the matter said the company’s current valuation is a central topic of debate between Shein and its advisors. 👚

The confidential filing will allow the fashion giant to communicate with the U.S. Securities and Exchange Commission (SEC) and adjust its filings in private, only to make it public once ready to move forward with an IPO. With that said, the company will be testing both investors’ and regulators’ appetites. With tensions high between the U.S. and China, some analysts say the “mystery” in which the company operates could hamper its ability to win the trust of U.S. regulators. 🕵️♂️

Additionally, it’s been reported that social media giant Reddit is once again ready to test the IPO waters. Bloomberg reported on Monday that the company is holding talks with potential investors for an initial public offering, roughly two years after it confidentially submitted a draft registration statement to the SEC. It was considering a valuation of $15 billion at the time, but it’s unclear how it’ll be valued in today’s environment. 🗫

And lastly, cold-storage giant Lineage Logistics is reportedly eying a $30 billion IPO in what could be one of 2024’s largest listings. It’s called on Goldman Sachs and Morgan Stanley as lead underwriters, but no final decisions on the size or timing of any listing have been made. 🚚

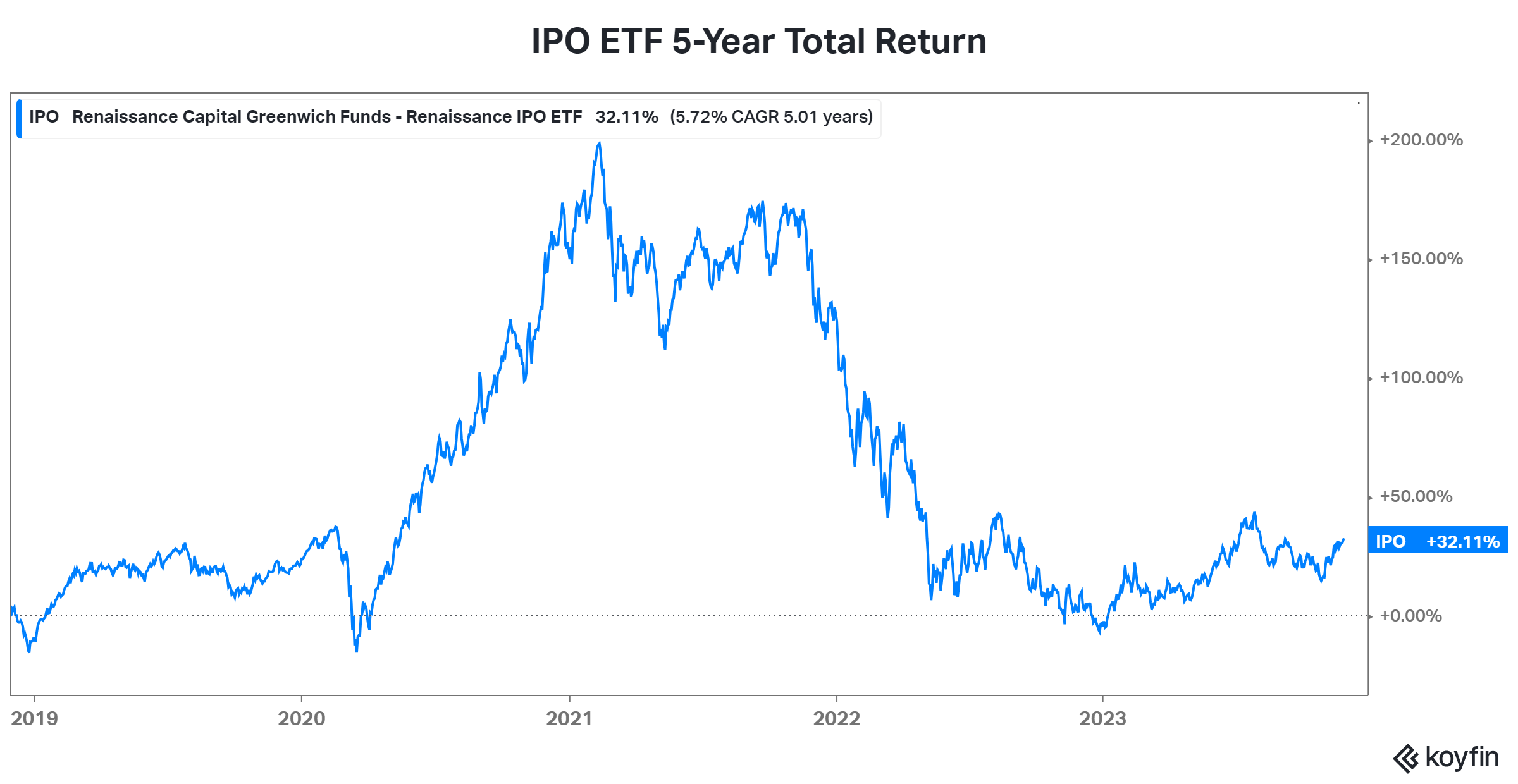

Overall, seeing how these giants fare in the public markets will be interesting. As the $IPO ETF below shows, it’s been a rollercoaster ride for investors in the space over the last five years. Although prices have stabilized and rebounded in 2023, they’re still well off their peak, lagging the broader market’s performance by a wide margin. 🎢