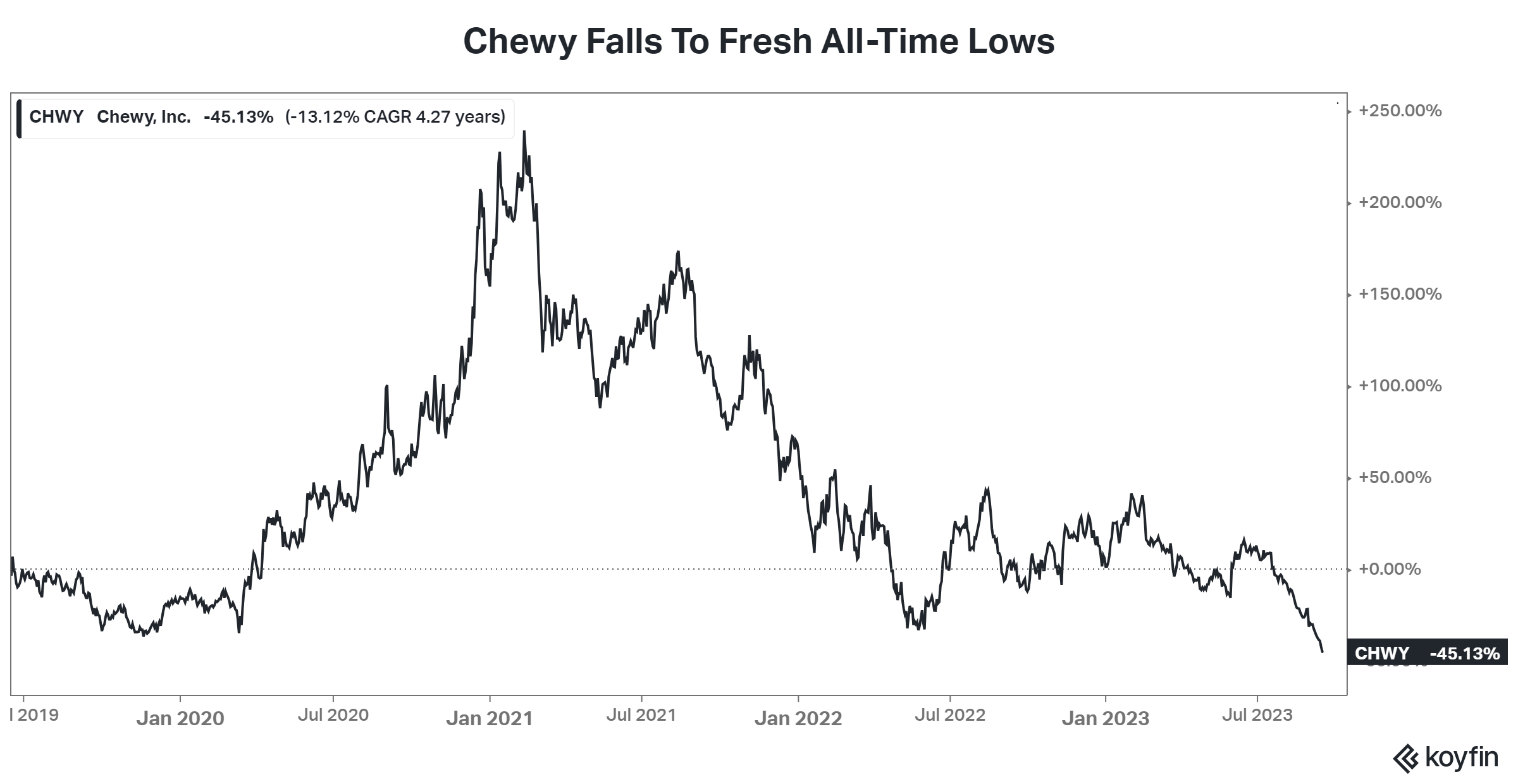

Shares of online pet retailer Chewy are working on their tenth-straight down week, with shares falling to fresh all-time lows today. 📉

Although the company has been expanding into higher-margin businesses like medications, insurance, and advertising, investors are worried about declining margins and activity in its core business. And in the current environment, investors are not looking to buy the dip in growth stocks that are no longer growing (at an “acceptable” rate).

Instead, they’re looking for other opportunities to play catch up as we head into year-end with the major stock market indices all up big in 2023—nothing like a little career risk to force short-term portfolio decisions. We’re not saying it’s right, but explaining why you own a stock that’s down 50% YTD is challenging in this environment if you’re a portfolio manager or analyst. 🤷

Shares of $CHWY were up nearly 250% from their IPO price at their 2021 peak but hit a new low return of -45% today. What will be the catalyst for this stock’s turnaround remains unclear, but for now, another private market unicorn is being vomited up by the public markets. 🤮