Tale of the Tape

Happy Sunday, everyone. And an especially happy Sunday to all of our crypto HODLers out there. It looks like crypto is finally making a comeback. 📈

Every trending ticker on Stocktwits had to do with crypto yesterday and it’s easy to see why: $BTC.X is up over 20% this week. So is $ETH.X, which has a highly-anticipated upgrade coming later this week…

A number of small-cap cryptos found particularly impressive gains this week: $QNT.X rose 92.6% and $RUNE.X rose 80.5%. 👀

Oh yeah, right: stocks exist. Maybe we’d like to pretend they don’t, though. The only major index that found upside this week was the Russell 2000, up 0.73%. The S&P, Nasdaq, and Dow Jones all fell.

Consumer discretionary stocks got baked this week, down -2.57%. Materials led all other sectors, up 2.79%.

It was a rocky week for earnings as Big Tech companies reported. The results were mixed. Peak earnings szn will tee off this week.

The IPOs this week were pretty lackluster… but we’re too busy watching the Grill Wars. Weber’s IPO this week will be the third big grill company to debut this month! More on IPOs below.🍖

Here’s the moves from this past week:

| S&P 500 | 4,395 | -0.32% |

| Nasdaq | 14,672 | -1.00% |

| Russell 2000 | 2,226 | +0.73% |

| Dow Jones | 34,935 | -0.34% |

Crypto

A Big Upgrade

The London hard fork, a highly-anticipated upgrade to Ethereum, is expected to take place this week.

A few proposals have been baked into London. The most prominent change is Ethereum’s fee structure. After the update, Ethereum will burn transaction fees instead of distributing them to miners (people who help verify transactions).

In effect, the changes in London could cause the circulating supply of Ethereum to drop. This has excited many analysts and ETH maxis because a reduced supply could make the crypto deflationary, which would likely increase the price. 😲

On the other hand, the changes have upset miners — but Ethereum isn’t really worried about appeasing miners anymore, they’re too busy making them obsolete.

London is a stepping stone to a larger update called Eth2, which will roll out next year. Eth2 will do away with Ethereum’s current system of mining, which depends on GPUs. A more efficient system called proof-of-stake will become the faster, better, stronger, and more secure future of Ethereum. 🛣️

The update is expected to take place Aug. 6 around 9 a.m. ET. $ETH.X was up 23% this week.

Earnings

Big Tech’s Big Week

It might have been a big week for Big Tech stocks reporting earnings, but unfortunately, the results were not nearly as exciting as we’d hoped for. 😩

Five of America’s largest tech companies reported strong earnings this week, then they started tumbling. The reason? Slowing revenue growth forecasts.

The selloff affected Amazon the most, which beat on EPS but fell short on revenue. Analysts expected $115.2B, but ended up with $113B. $AMZN dove 9.4% this week.

Google parent Alphabet brought the strongest performance. The company was expected to report $56.2B in revenue and $19.32/share in EPS. They knocked it out of the park with $61.8B in revenue and $27.26/share. Investors were initially satiated with the results, but the stock pulled back after earnings.

Strong Q2 earnings also came out of Apple, Facebook, and Microsoft. However, none of them avoided the post-earnings blues. 🥶🥶🥶

Investors aren’t sure what a post-pandemic world looks like for Big Tech, but a lot is riding on its success. The five companies which reported this week are the largest constituents in the S&P 500 and Nasdaq-100. In other words, most of America is betting on their continued success — whether they like it or not.

Stocks

Put It On My Tab

If you were going to make a big purchase a few years ago, you’d probably whip out your credit card. 💳

Over the last few years though, a number of startups have attempted to disrupt credit cards. You’ve probably seen them while checking out online. And now, investors are checking out the buy-now-pay-later (BNPL) industry.

Back in January, BNPL company Affirm went public. Their IPO was highly successful, gaining 90% in its debut. 🎆 Nowadays $AFRM is far off its highs, down more than 50% in the last six months. Ouch. 😬

Don’t be deceived, though. There’s a lot of evidence that BNPL services are growing spectacularly. According to research conducted by The Motley Fool, 56% of Americans have used a BNPL service. BNPL adoption among young and elderly people during the pandemic has been particularly impressive.

That growth might just be getting started. Research from Morning Consult says that only 17% of polled adults used a BNPL service in June, but 69% of polled households have a credit card. It also supports The Motley Fool’s earlier findings that BNPL has become a staple for Gen Zers, but it also goes further to show that BNPL users are traditionally lower-income and more diverse than credit card users.

That offers a lot of room for growth in BNPL firms (and a good reason to be bullish.) Maybe the results aren’t showing in the few publicly-listed companies in this space just yet, but it’s showing for companies building towards their IPOs. Klarna raised over $600M last month at a $45B valuation thanks to the newfound momentum.

During the pandemic, the IPO market was on fire. As we transition out of the pandemic? Not so much.

Recent US IPOs have lagged the S&P 500 this year. One ETF which tracks new IPOs, the Renaissance Capital IPO ETF, is up just 2.79% YTD. For comparison, the S&P 500 is up more than 18.6%.

The turn away from new listings has a lot in common with investors’ retreat from growth stocks. Investors are looking for solid stores of value given uncertainty in the markets.

Some have attributed the retreat in new listings to other reasons than stability, citing an abnormally strong IPO market in 2020. Research from Traders Magazine shows that most IPOs actually yield negative returns in the long-run. They also observe that an increasing share of IPOs are coming from companies which have not turned a profit. 😔

With results like these, one has to wonder what kind of demand awaits dozens of companies planning IPOs this year. However, there’s no denying that an unprecedented amount of money in the market is making the decision to go public much easier than usual.

And now a brief for the week of Monday, August 2, 2021:

Economic Calendar:

8/2 ISM Manufacturing Index (10:00 AM ET)

8/4 ISM Non-Manufacturing Index (10:00 AM ET)

8/5 Initial & Continuing Claims (8:30 AM ET)

8/6 Payrolls (8:30 AM ET)

Here’s the full Economic Calendar provided by Briefing.

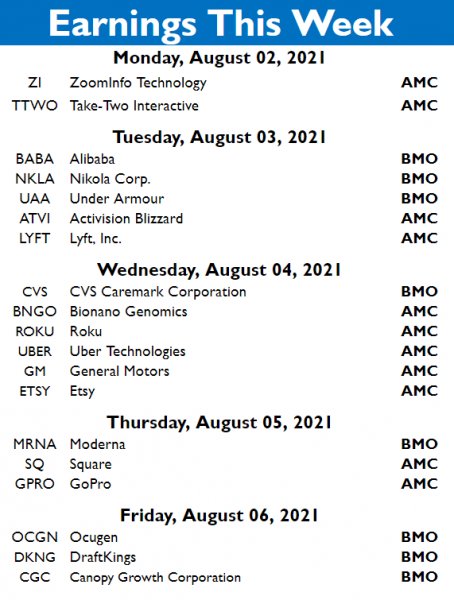

Earnings Calendar:

Be sure to know when your stocks are reporting. Check out the StockTwits earnings calendar.

Links That Don’t Suck:

💰Learn how to identify and buy high-quality growth stocks at the free IBD MarketSmith Virtual Trading Summit. Sign Up Today*

🤔 How Do You Decide If You Want To Be A Parent? Vox’s Cleo Abram Digs In.

🍹 China’s Largest Liquor Company Is Shoring Up A Cash-Strapped Corner Of The Country

🏠 Eviction Moratorium Expires: Millions Are At Risk

🥓 Bacon May Disappear In California Because Of “New Pig Rules”

🥇 Need A Recap Of The Olympics So Far? Bloomberg Has Your Medal Count Covered.

🎶 Artist Teflon Sega Is Hosting A Concert In The Metaverse

*this is a sponsored post