Good evening, everyone. Welcome to the Stocktwits Top 25 Newsletter for Week 46 of 2021

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD), and tracks their performances over time.

Here are your Stocktwits Top 25 Lists for Week 46:

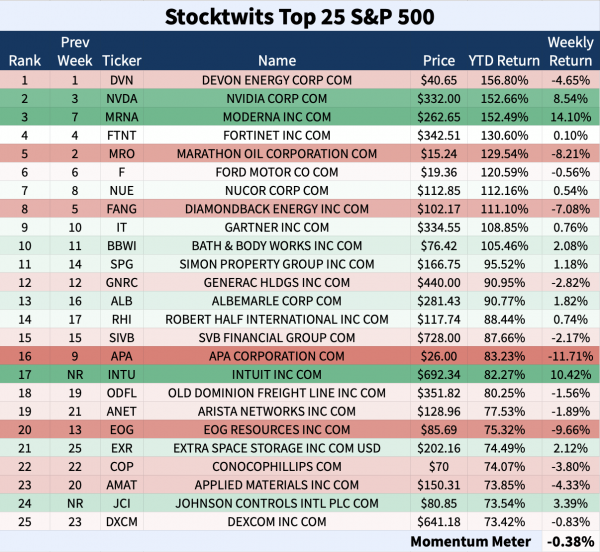

S&P 500

ST Top 25 S&P 500

The ST Top 25 S&P 500 List made it a second red week in a row.

13 of 25 names closed negative.

Intuit ascended to new highs after reporting earnings. $INTU is a Winner below.

Oil stocks fell once more – $MRO moved down 8.21%, $EOG plunged 9.66%, and $APA deflated 11.71%.

Two Freshmen made the list. The companies are Intuit and Johnson Controls.

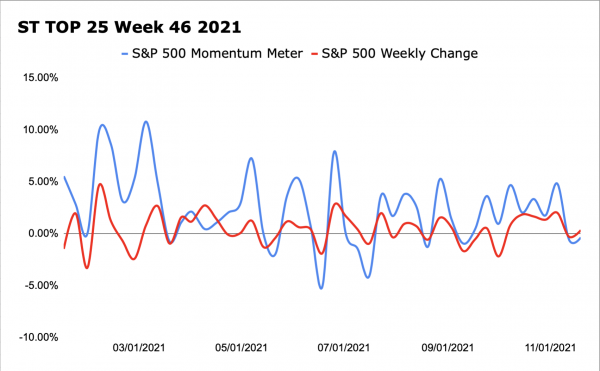

The Stocktwits Top 25 S&P 500 Momentum Meter decreased 0.38% while the S&P 500 rose 0.32%. The 0.70% difference indicates that the top stocks underperformed the full index.

Sponsored

NEW: Top 11 Stocks to Buy for 2022

He found Apple at $1.49… Oracle at $0.51… Amazon at $46. Marketwatch call him “The Advisor Who Recommended Google Before Anyone Else.” Now, investing legend Louis Navellier is revealing his Top 11 Stocks to Buy for 2022.

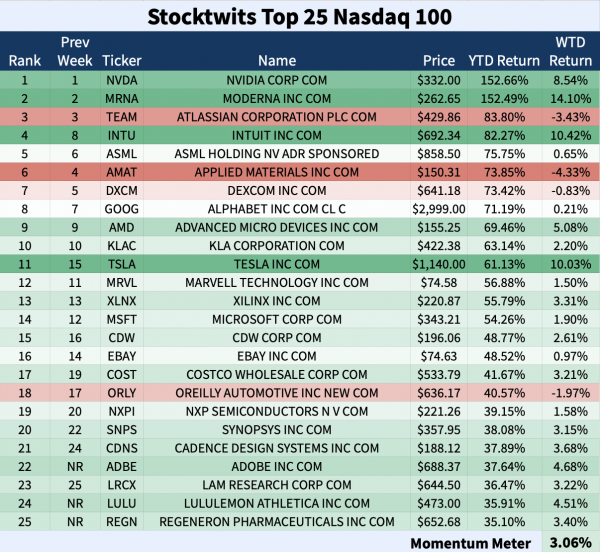

Nasdaq-100

The Big Cap Nasdaq 100

The ST Top 25 N100 List was the only green list in Week 46. ✅

21 names closed higher.

Moderna moved up 14% and remained in the second spot. It’s on the Winner’s List below.

Applied Materials was the list’s biggest loser and is a Sinner below.

Adobe, Lululemon Athletica, and Regeneron Pharmaceuticals are the list’s Freshmen.

The ST Top 25 Nasdaq 100 Momentum Meter fluttered 3.06% while the full Nasdaq 100 increased 2.31%. The 0.75% differential shows that the top stocks continue outperforming the full index.

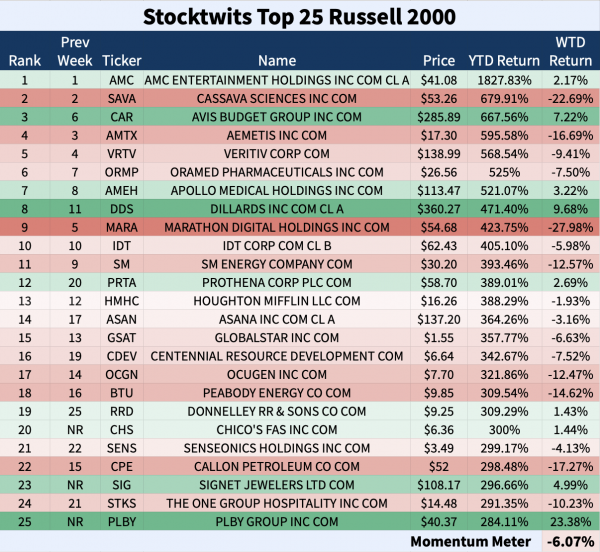

Russell 2000

Small-Cap Russell 2000

The ST Top 25 R2K List was not having it in Week 46.

16 names closed negative.

PLBY Group popped onto the list as a Freshman. Its 23.4% gain was good enough to claim the spot as Top Dawg of the week

$MARA gave up 28% as the biggest loser. It’s on the Sinner’s list this week.

The list’s Freshmen are Chico’s FAS, Signet Jewelers, and PLBY Group.

The ST Top 25 R2K Momentum Meter sank 6.07% and the Russell 2000 index lost 2.85%. The 3.22% differential favors the full index for Week 46.

🐶🐶🐶

ST Top 25 TOP DAWG OF THE WEEK 🐶

The ST Top 25 Top Dawg for Week 46, 2021 is #25 R2K – PLBY Group.

PLBY Group jumped onto the ST Top 25 R2K List as a Freshman ranked #18 this week.

$PLBY popped 31.6% to five-month highs on Tuesday after posting a third-quarter revenue beat. Revenue grew 77% YoY.

EPS: ($0.18) (vs. ($0.03) expected)

Revenue: $58.4 million (vs. $54.6 million expected)

Here’s the daily chart:

$PLBY is up 284.11% YTD.

📈📈📈

The Winners 📈

△ #17 S&P 500 – Intuit was the standout name on the ST Top 25 S&P 500 list in Week 46. The financial software company entered the list as a Freshman ranked 17th.

$INTU increased 10.1% on Friday and closed at all-time highs after a stellar earnings report. Earnings grew 63% year-over-year and the company raised the fiscal year 2022 revenue guidance to 26-28% growth.

EPS: $1.53 (vs. $0.99 expected)

Revenue: $2 billion (vs. $1.81 billion expected)

Here’s the daily chart:

$INTU is up 82.27% YTD.

△ #2 N100 – Moderna marched 14.1% and put together its best week months.

$MRNA closed positive four days this week but had saved the best for last. The biotech gained 4.9% on Friday after the FDA gave authorization of booster doses of COVID-19 Vaccine in the U.S. for adults 18+.

Here’s the daily chart attempting to fill its earnings gap from Nov 5:

$MRNA is up 152.5% YTD.

📉📉📉

The Sinners 📉

▼ #6 – N100 – Applied Materials moved 2 spots lower on the ST Top 25 N100 List after forfeiting 4.33% in Week 46.

$AMAT was stringing together a nice week until Friday came along. The semiconductor dipped 5.5% on Friday after releasing Q4 earnings data.

Applied Materials published a record annual revenue of $23.06 billion, which grew 34% YoY.

You can read the full report here

Here’s the daily chart:

▼ #9 R2K – Marathon Digital Holdings dipped 28% and dropped 4 spots from #5 to #9 on the ST Top 25 R2K List. $MARA was the biggest loser of all lists.

After announcing an upsized $650 million convertible senior notes offering to support its procurement of additional Bitcoin miners, $MARA fell 27% on Monday.

Marathon then said that it has received a subpoena from the Securities and Exchange Commission (SEC) for information connected to its data center contracts in Hardin, Montana.

$MARA is still up 423.75% YTD.

▼ #16 S&P 500 – APA Corporation collapsed 11.7% and was the ST Top 25 S&P 500 List’s biggest loser.

On Tuesday $APA announced a successful flow test at Sapakara south and sub-commercial black oil discovery at Bonboni offshore Suriname on Block 58.

Still, the good news couldn’t ward off the weakness as the entire energy sector pulled back.

Can $APA stabilize itself in Week 47 or will the weakness continue? Place your bets… Here’s the weekly chart:

$APA is still up 83.23% YTD.

See Y’all Next Week 🤙