Good evening, everyone. Welcome to the Stocktwits Top 25 Newsletter for Week 47 of 2021.

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD), and tracks their performances over time.

Here are your Stocktwits Top 25 Lists for Week 47:

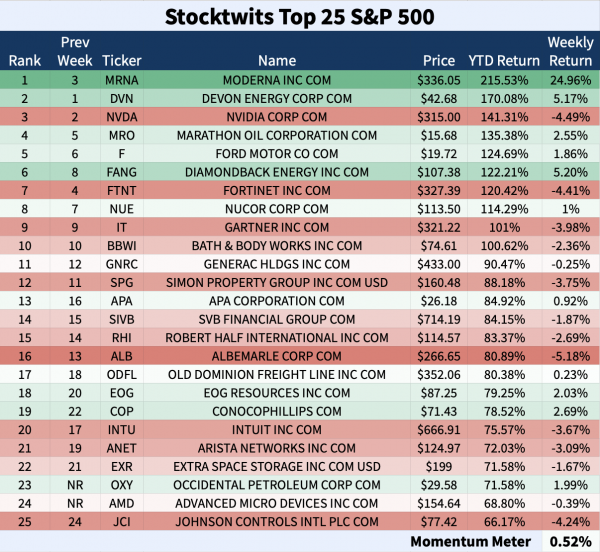

S&P 500

ST Top 25 S&P 500

The ST Top 25 S&P 500 List was the only list with a positive Momentum Meter.

11 of 25 names closed positive.

Oil stocks regained strength. $DVN increased 5.17%, $FANG flew 5.2%, and $MRO returned 2.55%.

Johnson Controls couldn’t keep it up. $JCI sank 4.24% as a Sinner.

Occidental Petroleum and Advanced Micro Devices are this week’s Freshmen.

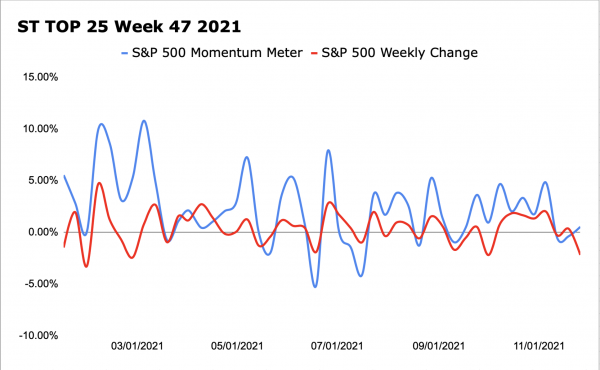

The Stocktwits Top 25 S&P 500 Momentum Meter rose 0.52% while the S&P 500 lost 2.2%. The 2.72% difference proves that the top stocks are leading the full index again.

Sponsored

Tap into liquid interest rate markets with Micro Treasury Yield futures

Active traders looking for more choice now have streamlined access to the $600B+/day U.S. Treasury market. Micro Treasury Yield futures in 2-, 5-, 10-, and 30-year maturities offer yield-based trading in conveniently sized contracts that can be traded outright or used to complement strategies.

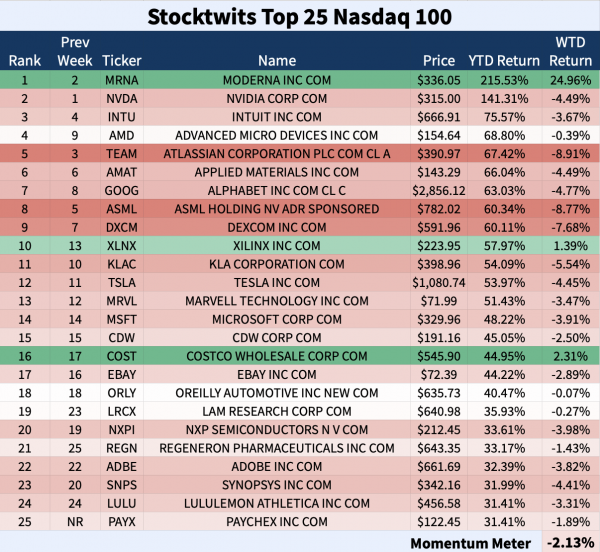

Nasdaq-100

The Big Cap Nasdaq 100

The ST Top 25 N100 List was overwhelmingly red in Week 47.

22 names finished lower.

Moderna surged 24.96% and reclaimed the top spot on the N100 list. It’s the Top Dawg below. 👑

Atlassian gave up 8.9% and earned a spot as a Sinner below.

Paychex was the list’s only Freshman.

The ST Top 25 Nasdaq 100 Momentum Meter dipped 2.13% while the full Nasdaq 100 decreased 3.31%. The 1.18% difference demonstrates that the top stocks continue to outperform the index as a whole.

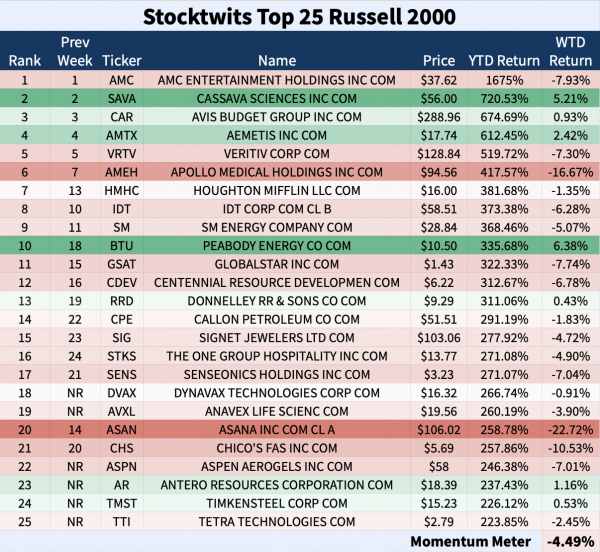

Russell 2000

Small-Cap Russell 2000

The ST Top 25 R2K List was a weakling once again.

18 names closed lower.

Peabody Energy expanded 6.4% as the top stock on the list. $BTU is now ranked 10th.

$ASAN plunged 22.72% as the biggest loser. It’s a Sinner below.

The list’s Freshmen are $DVAX, $AVXL, $ASPN, $AR, $TMST, and $TTI.

The ST Top 25 R2K Momentum Meter sank 4.49% and the Russell 2000 index lost 4.15%. The 0.34% differential favors the full index for Week 47.

🐶🐶🐶

ST Top 25 TOP DAWG OF THE WEEK 🐶

The ST Top 25 Top Dawg for Week 47, 2021 is #1 N100 – Moderna Inc.

Moderna moved back into the top spot on the ST Top 25 N100 List this week. The last time Moderna was ranked #1 on the list was in Week 43.

$MRNA marched 20.6% on Friday after a new covid variant was discovered in South Africa.

Before Friday ended, Moderna reported that it’s testing three Covid-19 boosters against the new omicron variant.

Stéphane Bancel, CEO of Moderna stated: “The mutations in the Omicron variant are concerning and for several days, we have been moving as fast as possible to execute our strategy to address this variant”.

Here’s the daily chart:

$MRNA is up 215.5% YTD.

📈📈📈

The Winners 📈

△ #17 S&P 500 – Peabody Energy Corp was the biggest gainer on the ST Top 25 R2K list in Week 47. The coal producer improved eight spots from #18 to #10 thanks to a 6.38% gain.

$BTU blasted 8.85% on Tuesday after announcing the expiration and final results of an offer to purchase up to $15.842 million in aggregate accreted value of its 8.5% senior secured notes due in 2024.

Here’s the daily chart:

$BTU is up 335.7% YTD.

△ #16 N100 – Costco Wholesale Corp climbed 2.31% higher this week and was the second strongest name on the ST Top 25 N100 List behind Moderna. The big-box store now sits ranked 16th.

$COST closed positive for the eighth straight week, it’s up 22% in that period.

Here’s the weekly chart since January 2020:

$COST is up 45% YTD.

📉📉📉

The Sinners 📉

▼ #20 R2K – Asana Inc gave up 6 rankings on the ST Top 25 R2K List after losing 22.72% in Week 47. The software company is now ranked twentieth on the list.

$ASAN got off to a horrendous start, nosediving 22.6% on Monday. High beta growth stocks struggled at the beginning of the week after Jerome Powell was nominated for a second term as Federal Reserve Chairman.

Will growth stocks rebound from this week’s weakness? Place your bets…

Here’s the daily chart:

$ASAN is up 258.8% YTD.

▼ #5 N100 – Atlassian Corp got clipped 8.9% and dropped 2 spots from #3 to #5 on the ST Top 25 N100 List. $TEAM was the biggest loser on the list.

$TEAM tumbled 6.25% on Monday and set the tone for the week. Shares of the Australian software company closed below the 50 day moving average for the first time since Jun 3.

Here’s the daily chart with the 50 day moving average in blue.

$TEAM is still up 67.4% YTD. Is more weakness to come or can Atlassian shake it off? Time will tell.

▼ #25 S&P 500 – Johnson Controls International surrendered 4.24% in Week 47 as the ST Top 25 S&P 500 List’s second-biggest loser.

Johnson Controls finished negative each day this week and gave up all of Week 46’s gains.

$JCI is retesting its prior-high from Sep 9. Can this level hold as support or will it falter further? It’s anyone’s guess. Here’s the daily chart:

$JCI is still up 66.17% YTD.

See Y’all Next Week 🤙