Good evening, everyone. Welcome to the Stocktwits Top 25 Newsletter for Week 52 of 2021.

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD), and tracks their performances over time.

Here are your Stocktwits Top 25 Lists for Week 52:

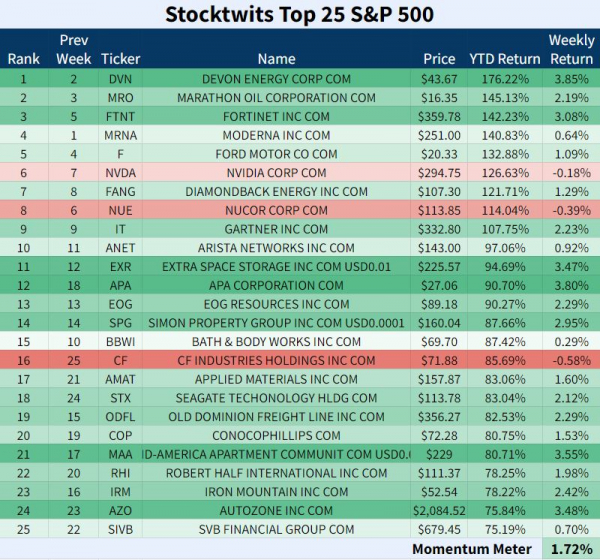

S&P 500

ST Top 25 S&P 500

The ST Top 25 S&P 500 List was a sea of green to finish the year. 💚

22 names finished higher.

Devon Energy returned to the top spot on the list. It’s featured in the Winners section below.

CF Industries was the list’s biggest loser and it only fell 0.58%. A sign of strength.

Zero Freshmen entered the list.

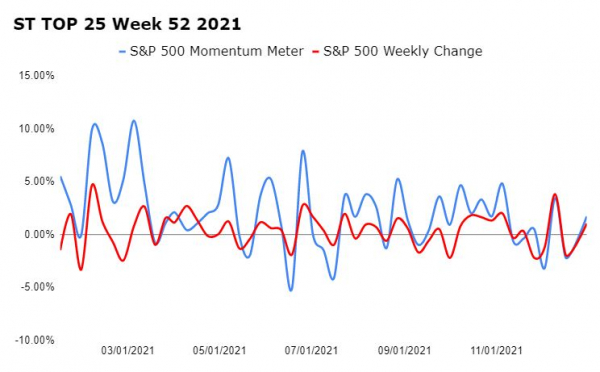

The Stocktwits Top 25 S&P 500 Momentum Meter rallied 1.72% while the S&P 500 grew 1.04%. The 0.68% differential shows top stocks flipped a switch and outperformed the full index.

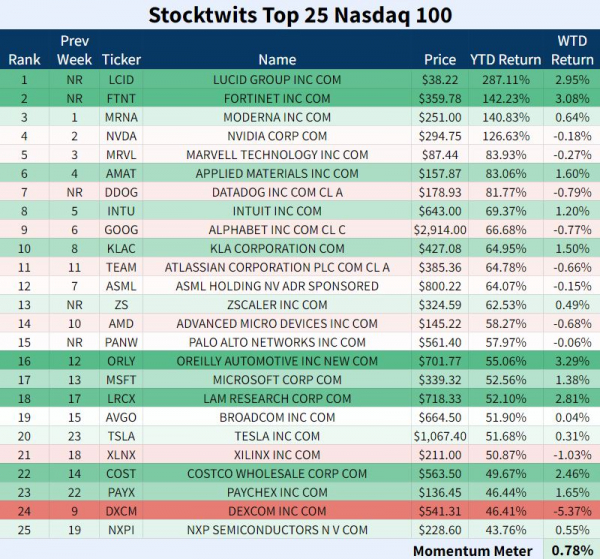

Nasdaq-100

The Big Cap Nasdaq 100

The ST Top 25 N100 List showed strength near the top of the list.

15 out of 25 stocks traded positive.

Lucid Group and Fortinet were included in the Nasdaq 100 index. $LCID took the top spot while $FTNT is ranked second.

DexCom dipped 5.37% and was the list’s biggest loser by a long shot. You can find this one on the Sinners list.

The list’s Freshmen are $LCID, $FTNT, $DDOG, $ZS, and $PANW.

The ST Top 25 Nasdaq 100 Momentum Meter jumped 0.78% while the full Nasdaq 100 increased 0.02%. The 0.76% difference indicates that the best-performing equities outperformed the whole index by a healthy amount.

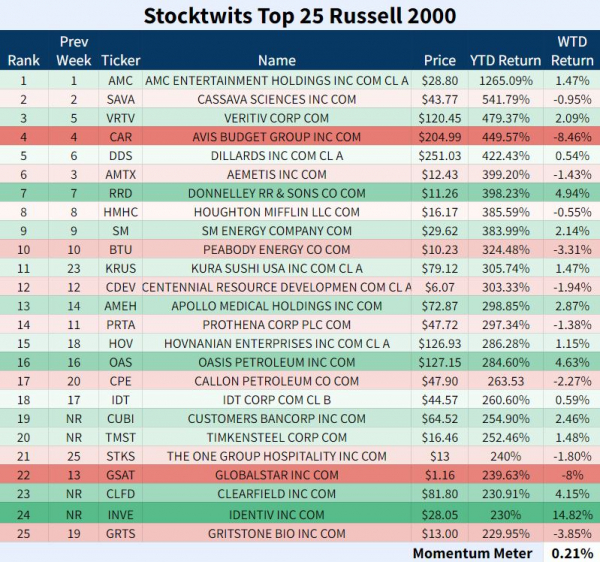

Russell 2000

Small-Cap Russell 2000

The ST Top 25 R2K List was the quietest list during Week 52.

14/25 names registered gains.

$INVE surged 14.82% and claimed the Top Dawg honors. The tech stock was the largest gainer on all three lists.

Avis Budget Group crashed 8.46% as the list’s weakest stock.

The Freshmen in Week 52 are $CUBI, $TMST, $CLFD, and $INVE.

The ST Top 25 R2K Momentum Meter expanded 0.21% and the Russell 2000 index improved 0.40%. The 0.19% difference in favor of the full index proves top stocks lagged once again.

🐶🐶🐶

ST Top 25 TOP DAWG OF THE WEEK 🐶

The ST Top 25 Top Dawg for Week 52, 2021 is #24 R2K – Identiv Inc.

Identiv Inc entered the ST Top 25 R2K List as a Freshman in the final week of the year and claimed the 24th ranking.

$INVE made quite the splash on Monday, marching 16% to ten-year highs. The tech stock broke out of an eight week long base on volume 4x greater than average. 🔥

Identiv is now up 42% since reporting earnings on Nov 2.

Here’s the daily chart:

$INVE is up 230% YTD.

📈📈📈

The Winners 📈

△ #2 N100 – Fortinet Inc flew 3.08% in Week 52 as the list’s second-biggest gainer. The cybersecurity stock is now ranked #2 on the ST Top 25 S&P 500 List.

$FTNT was included in the acclaimed Nasdaq 100 index on Dec 20. Since then, the stock has jumped 8.5% and set a new all-time high. If that isn’t bullish, what is??

Ken Xie, CEO of Fortinet said: “We expect our innovative ASIC-supported security fabric platform and converged Security-driven networking approach to uniquely position Fortinet for long-term growth. Taking our place on the Nasdaq-100 Index amongst other category-defining companies is another proofpoint of Fortinet’s successes and future growth opportunities.”

The cybersecurity company has closed positive four weeks in a row and sits at all-time highs. Here’s the weekly chart:

$FTNT is up 142.23% YTD.

△ #1 S&P 500 – Devon Energy Corp climbed back into the top spot on the ST Top 25 S&P 500 List in the final week of 2021. The energy company rose 3.85% and stole the top spot back from Moderna.

$DVN ascended 6.1% on Monday which was enough to set the stock in positive territory for the week. The stock fell Tuesday through Thursday but still managed to close the week at six-year highs.

Here’s the daily chart:

$DVN is up 176.22% YTD.

📉📉📉

The Sinners 📉

▼ #4 R2K – Avis Budget Group gave up 8.46% in Week 52 and was the ST Top 25 R2K List’s biggest loser.

$CAR has been a car wreck since its Q3 earnings report on Nov 1. The stock doubled initially on the news, but, things took a turn for the worse.

The rental company gave up a quarter of its value in December and sits 42% away from its record-high close on Nov 2.

Here’s the daily chart:

$CAR is still up 449.57% YTD.

▼ #24 N100 – DexCom dropped fifteen spots from #9 to #24 on the ST Top 25 N100 List thanks to a 5.37% weekly loss. $DXCM was the most fragile stock on the list.

To begin the year, DexCom bursted out of the gates like a Russian race horse. The medical equipment company quickly ran up its digits, reaching a YTD gain of 78% by November.

Since then, $DXCM shares have faded and dropped back below $600/share.

$DXCM is up 46.41% YTD. We’re anxious to see how this performs in the New Year.

See Y’all Next Year 🤙