Good evening, everyone. Welcome to the Stocktwits Top 25 Newsletter for Week 13 of 2022.

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD), and tracks their performances over time.

Here are your Stocktwits Top 25 Lists for Week 13:

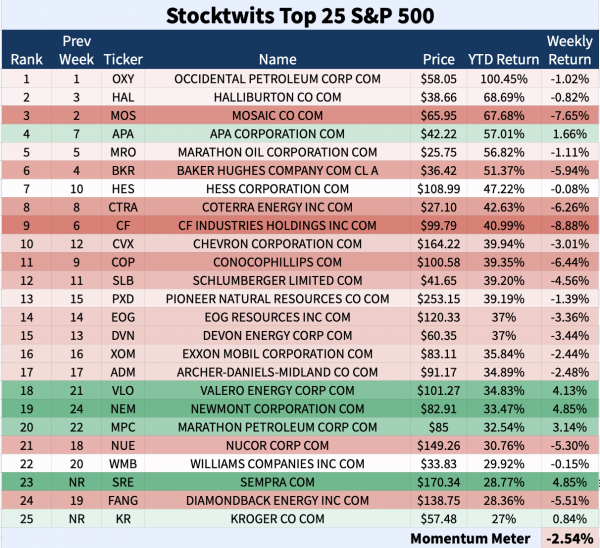

S&P 500

ST Top 25 S&P 500

The ST Top 25 S&P 500 List was full of red.

19 out of 25 stocks closed negative.

CF Industries collapsed 8.88% as the list’s biggest loser. $CF worsened its ranking from #6 to #9.

Sempra Energy had enough gas in the tank to enter the list as a freshman. You can read more below.

Two freshmen appeared on the list. The stocks are Sempra Energy and Kroger Co.

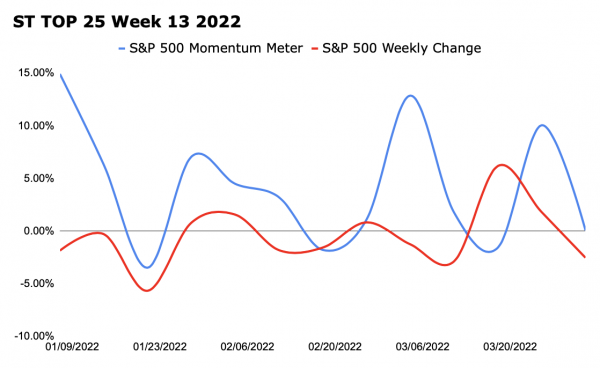

The Stocktwits Top 25 S&P 500 Momentum Meter dipped 2.54% while the S&P 500 sparked 0.06%. The 2.6% difference in favor of the full index shows there is weakness among the top stocks.

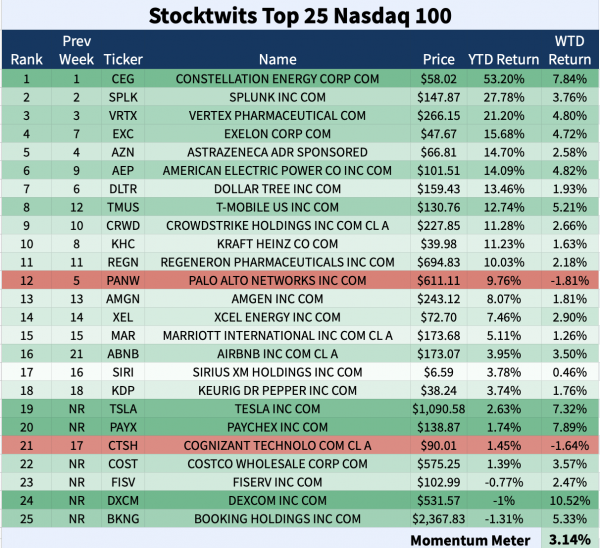

NASDAQ 100

The Big Cap Nasdaq 100

The ST Top 25 N100 List was extremely green.

23 of 25 stocks registered gains.

Constellation Energy climbed 7.84%, solidifying its top ranking ahead of Splunk.

Palo Alto Networks and Cognizant Technology Solutions were the only losers. $PANW plummeted 1.81% and $CTSH sank 1.64%.

6 new names appeared on the list. The tickers are $TSLA, $PAYX, $COST, $FISV, $DXCM, and $BKNG.

The ST Top 25 Nasdaq 100 Momentum Meter improved 3.14% and the full Nasdaq 100 fell 0.72%. The 3.86% differential proves that the top-performing stocks are outpacing the full index.

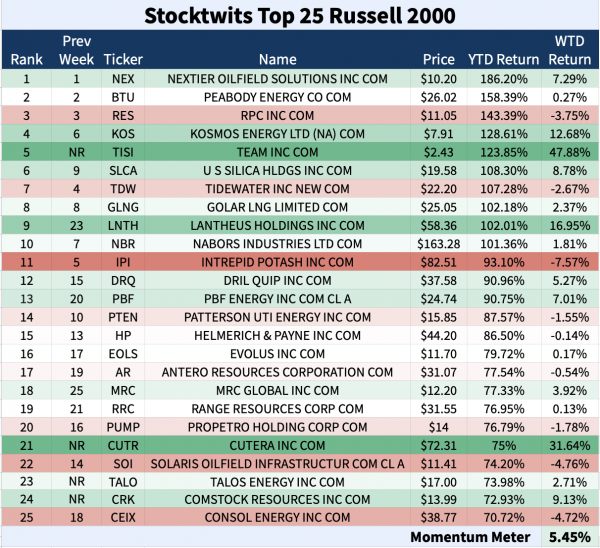

RUSSELL 2000

Small-Cap Russell 2000

The ST Top 25 R2K List was mixed in Week 13.

16 of 25 stocks closed positive.

Cutera surged 31.64% and claimed a spot on the list as a freshman. $CUTR is the Top Dawg below. 👑

Intrepid Potash tumbled 7.57% and slipped from #5 to #11. See more on this one.

The list’s Freshmen are $TISI, $CUTR, $TALO, and $CRK.

The ST Top 25 R2K Momentum Meter rampaged 5.45% while the Russell 2000 index rose 0.70%. The top stocks outperformed the whole index by 4.75%, showing a significant divergence.

🐶🐶🐶

ST Top 25 TOP DAWG OF THE WEEK 🐶

The ST Top 25 Top Dawg for Week 13, 2022 is #21 R2K – Cutera Inc.

Cutera climbed 31.64% this week and appeared on the ST Top 25 R2K List as a freshman ranked 21st.

Shares of Cutera closed green four days this week after the FDA cleared the company’s AviClear acne device. AviClear is a laser therapy for acne that is safe and does not require a prescription. Clinical research demonstrates that after the AviClear operation, future breakout episodes are shorter, less severe, and less frequent.

$CUTR is on a six-week win streak and sits at all-time highs… We’ll see if the medical device company can keep it up in Week 14.

Here’s the daily chart:

$CUTR is up 75% YTD.

📈📈📈

The Winners 📈

△ #5 R2K – Team Inc was the largest gainer on all of the lists in Week 13 with a 47.88% profit. The specialized industrial services company launched onto the ST Top 25 R2K List in the fifth ranking as a freshman.

$TISI got its week started on Tuesday, climbing 19.37% to twenty-week highs. It closed green every day after that.

Here’s the daily chart:

$TISI is up 123.85% YTD.

△ #23 S&P 500 – Sempra Energy spiked 4.85% this week and closed at record highs! The freshman on the ST Top 25 S&P 500 List is ranked twenty-third

$SRE sailed higher all five days of the trading week. The San Diego-based energy infrastructure company has registered gains for six weeks in a row, an impressive feat.

Here’s the weekly chart:

$SRE is up 28.77% YTD.

△ #20 N100 – Paychex popped off for the third straight week. The human capital services company rushed onto the ST Top 25 N100 List as a freshman in the 20th spot.

$PAYX surged 3.3% on Wednesday to all-time highs after smashing earnings and sales expectations. Here is the full data:

EPS: $1.15 (vs. $1.04 expected) | Revenue: $1.28 billion (vs. $1.21 billion expected) | Link to Report

Daily chart:

$PAYX entered positive territory for 2022, up 1.74%.

📉📉📉

The Sinners 📉

▼ #11 R2K – Intrepid Potash pooped the bed in the thirteenth week. The agricultural input company flopped 7.57% as the biggest loser on any list. $IPI decreased from #5 on the ST Top 25 R2K List to #11…

$IPI got smacked off the bat, dipping 5.5% on Monday and falling another 7.12% Tuesday. The damage had been done at that point and any hopes of a green week were erased.

Despite the poor weekly performance, $IPI is still up 93.10% in 2022.

▼ #9 S&P 500 – CF Industries Holdings tanked 8.88% and was the largest loser on the ST Top 25 S&P 500 List. The fertilizer manufacturer moved three spots lower from #6 to #9.

$CF performed in line with $IPI, trading lower during the opening two days of the week, followed by gains on the remaining three days.

On Thursday, CF Industries released its 2021 Sustainability and Annual Report. Tony Will, CEO of the company commented:

“We remain focused on realizing the promise of what CF Industries can offer the world through producing the fertilizer that helps feed the crops that feed the world.”

Here’s the daily chart:

See Y’all Next Week 🤙