Good afternoon and welcome back to Stocktwits’s Sunday tradition… The Weekend Rip!

The Russell 2000 came out on top in equities world this week, rising 0.62% in the week. Meanwhile, the large-cap heavy Dow Jones trailed the pack, closing out the week down -0.04%. The indexes posted modest moves to close out the worst quarter since Q1 2020, when the COVID-19 pandemic began (and caused a fairly insufferable market crash.)

However, the real excitement was in the world of crypto, which saw another week of gains across the board. Bitcoin (+3%) and Ethereum (+9.9%) continued to lead the market north, but they were by no means the growth-leaders this week. Instead, Solana (+32%) and Terra (+23%) were the biggest movers this week.

As always, we take every Sunday to reflect on big news from the week, weekend, and what lies ahead. That’s no different today. But before we jump in, here’s the (up/down)side from the week:

| S&P 500 | 4,545 | +0.11% |

| Nasdaq | 14,261 | +0.59% |

| Russell 2000 | 2,091 | +0.62% |

| Dow Jones | 34,818 | -0.04% |

Bullets

Bullets from the Week

🛑 Cathie doesn’t want interest rate hikes. Ark Invest founder Cathie Wood has fallen out of fervor with retail investors over the last year, in part because of the decline of growth stocks. However, the still-zeitgeisty fund manager imparted two cents on Twitter this week, saying that the Fed was “playing with fire” by raising interest rates. She cited the yield curve’s recent movement. Naturally, she would be opposed to this: higher rates are generally not great for growth companies. Read Cathie’s tweets.

📈 Another Fed official supports faster hike. St. Louis Fed President James Bullard has been a long advocate for raising interest rates faster and more aggressively. He now has some company. The San Francisco Fed President Mary Daly has indicated that support for a 50bp rate hike is now stronger saying, “The case for 50, barring any negative … [news], has grown.” Read more in Financial Times (Getting a paywall? Click here.)

🇷🇺 U.S. to levy new sanctions on Russia. As Russia has fallen back amid its invasion of Ukraine, the world has been offered a glimpse into the depth of Russia’s war crimes and atrocities. The U.S. indicated it would levy new sanctions on the country as a result. Read more in Axios.

🌉 New crypto “bridge” aims to solve pervasive bridging problems. A new crypto “bridge” called Stargate is hoping to fix the pervasive security and settlement issues incurred by sending money between blockchains. Unlike platforms like Wormhole and Multichain, Stargate only deals in “native assets” like stablecoins. That pitch has already helped it raise millions from top VCs… and just over a week into its launch, it has over $4 billion in value on its platform. Subscribe to The Litepaper to read more about Stargate and what it means for crypto in our forthcoming Monday edition.

The Short of It

Need a concise summary of what’s going on this week? Look no further. Here’s a summary of important earnings and economic data for the trading week ahead.

Economic Calendar

4/5 ISM Non-Manufacturing Index (10:00 AM ET)

4/6 EIA Crude Oil Inventories (10:30 AM ET)

4/6 FOMC Minutes (1:00 PM ET)

4/7 Initial & Continuing Claims (8:30 AM ET)

Peep the full Economic Calendar provided by Briefing for all the reports this week.

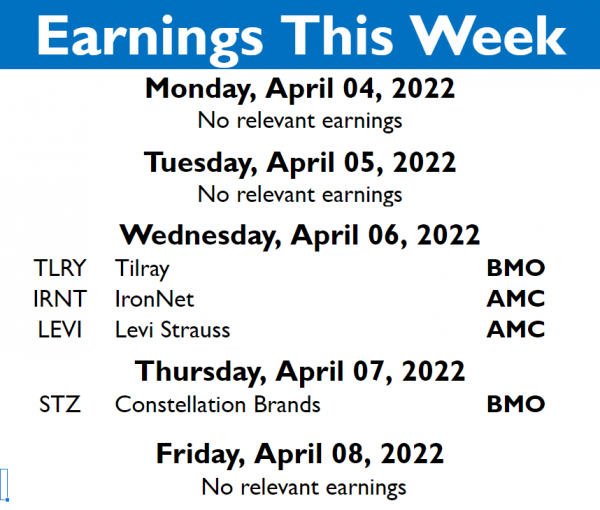

Earnings this Week

The quarter is over, so Q1 2022 earnings will soon be upon us. However, this week’s earnings are fairly light (if we’re being honest.) Here’s what to expect:

As always, you can see the full list of earnings on the Stocktwits earnings calendar.

Links

Links That Don’t Suck:

✨ Bygone Visions of Cosmic Neighbors

👀 This Website Aggregates All The Latest News in Crypto

📍 Can You Really Stalk Somebody With An Apple AirTag?

🐠 YouTuber Gave Goldfish $50,000 To Trade Stocks.

🇺🇦 Here’s Who Controls What In Ukraine Right Now

℞ A Boy Rubbed A Tube of Pain Relief Cream On His Legs. This Is What Happened To His Brain.