It’s finally Wednesday, aka two more days until our portfolios stop bleeding. 🙃

It was another red day in the stock market as investors digested April’s hotter-than-forecasted inflation data. 😭 This heat map sums up how the day went:

All of the major indexes closed red as they were dragged down by the tech sector’s heavy selling. But under the surface, some cyclical and defensive industries closed flat or positive.

Energy (+1.41%), utilities (+0.73%), and basic materials (+0.07%) were the 3/11 sectors that closed positive. 🍀

It was a slower earnings day with 194 companies reporting, but Disney and Beyond Meat were trending heavily.

Disney ($DIS) posted mixed results. Strength in the company’s Parks, Experiences, and Products revenues and streaming numbers were the main focus. Full story below. 🏰

Beyond Meat ($BYND) missed on the top and bottom lines, with investors sending it to fresh all-time lows in the after-hours session. More on that below too.

Lastly, the Lunaverse blew up in flames as Luna collapsed 90%… 🔥 the ‘stablecoin’ is now down 99.50% from its highs set in April. More on that in tonight’s Litepaper, but the spillover effects were clear as Bitcoin, Coinbase, AMC, and Rivian, among other risk assets, all resumed their aggressive multi-day declines.

Here are the closing prices:

| S&P 500 | 3,935 | -1.64% |

| Nasdaq | 11,364 | -3.18% |

| Russell 2000 | 1,719 | -2.43% |

| Dow Jones | 31,834 | -1.01% |

April’s headline inflation rate moderated slightly from March, snapping an 8-month streak of increasing inflation pressures. With that said, numbers still exceeded consensus expectations on a MoM (0.6% vs. 0.4%) and YoY (8.3% vs. 8.1%) basis.

As we dig into the numbers, energy prices waned slightly in the aggregate, down 2.7% MoM but still up 30.3%. The main culprits in April were increases in shelter, food, airline fares, and new vehicles. Good thing nobody uses any of those things. 😆

If you were looking to save money on gas by eating at home, think again. The food at home index rose 10.8% YoY, marking the largest 12-month increase since November 1980. 🌽 📈

The market’s reaction to this news was not great. 👎

As a reminder, inflation impacts interest rates, ultimately impacting what price investors are willing to pay for other assets like stocks, cryptocurrencies, real estate, etc.

That’s why we saw tech-heavy Nasdaq led to the downside, closing down over 3%, and more speculative areas of the market related to cryptocurrencies, SPACs, and recent IPOs all falling heavily. 🔻

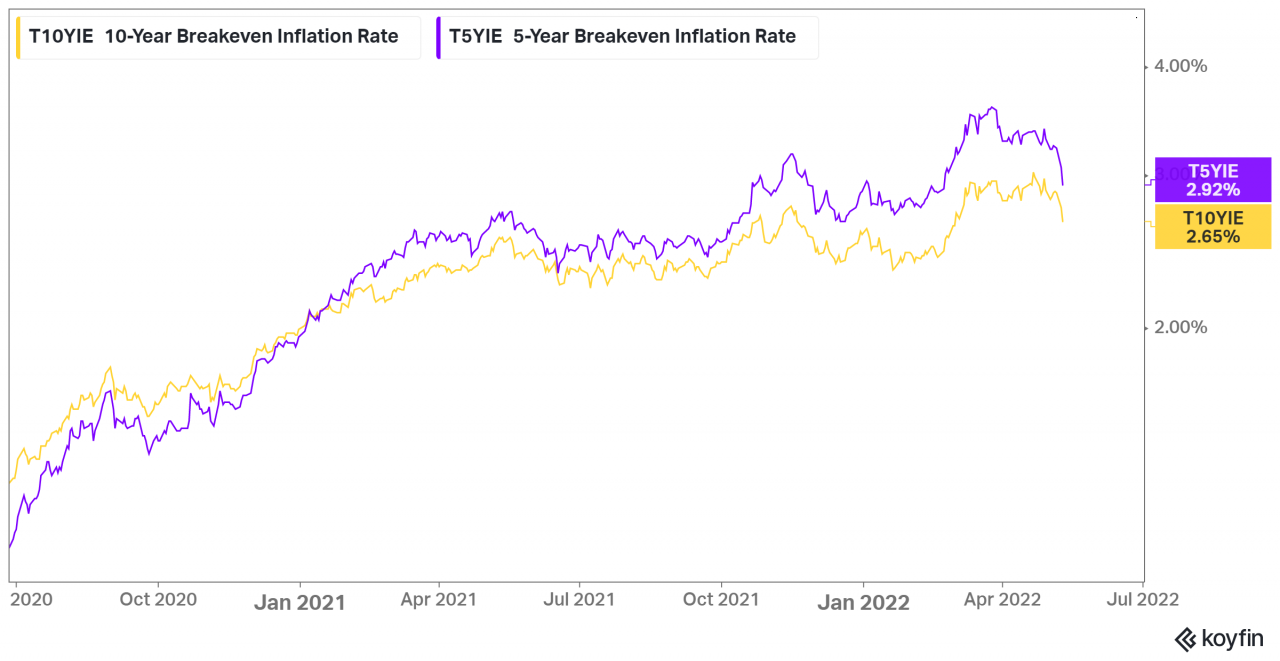

Interestingly enough, Breakeven Inflation Rates, which track the market’s expectations of inflation, peaked last month and have been falling steadily. So the expectation among bond market participants (for now) appears to be that today’s inflation cooling will continue in the months ahead.

Ultimately, the market needs to see that most inflation components cool off simultaneously. So far, it’s been a seesaw effect where some drop and others rise, keeping overall inflation levels elevated. ⚖️

While it would be great to think the recent bond market action is correct and the worst of the inflation story is behind us, today’s action shows us that the stock market isn’t buying that story just yet. 😕

Earnings

Disney (kind of?) Disappoints in Q2

Disney Misses on Top and Bottom Lines, but Still Shows Growth in Streaming and Theme Parks

Now that Disney’s business model is divided between the Disney+ streaming service and good old-fashioned theme parks, investors are left to decide for themselves whether the House of Mouse is truly recovering from the ongoing COVID-19 crisis. Could the company’s second-quarter 2022 fiscal results provide some insight? 🤔

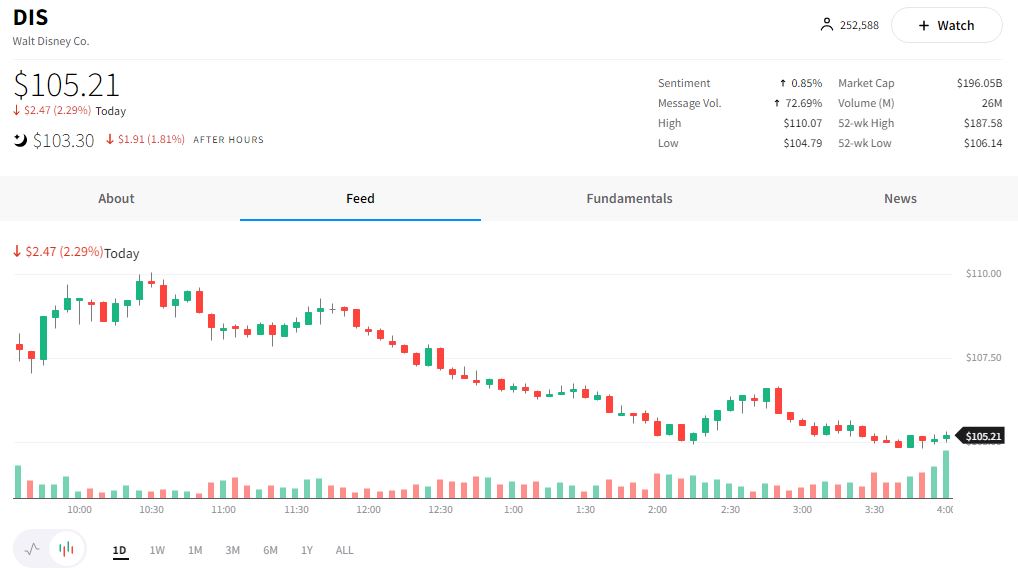

Judging by the initial price action of $DIS stock post-earnings-release, investors had mixed emotions even if the experts on Wall Street were likely disappointed. The stock jumped nearly 3% after hours, only to turn around and head south:

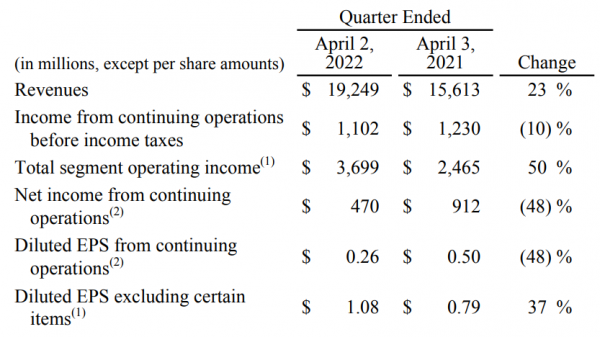

Whether Disney’s results were beats or misses depends on what you’re comparing them to. For example, in Q2 Disney generated $19.2 million in revenue, up 23% year-over-year. That’s not too shabby, considering Disney paid a $1 billion penalty for canceling a contract with a partner during the quarter.

On the other hand, Disney’s revenue fell short of the $20 billion analyst consensus estimate. That’s not a horrendous miss, though, so perhaps Disney can be forgiven for not clearing that bar. 🤷

Turing to the top line, Disney reported Q2 2022 diluted EPS (excluding certain items) of $1.08, up 37% versus the $0.79 from the prior-year quarter. The improvement is undeniable, but Disney’s EPS was still a miss compared to the analyst consensus estimate of $1.19. Wall Street’s experts sure had high hopes, didn’t they?

Still, stock traders seemed willing to accentuate the positive and, for the time being, the DIS stock bulls celebrated quarterly fiscal results that were decent, if not unassailable. CEO Bob Chapek emphasized the addition of 7.9 million Disney+ subscribers during the quarter, while also touting Disney’s “fantastic performance” at the company’s domestic parks. 🏰

How fantastic? We’ll put it this way: Disney’s Parks, Experiences, and Products revenues for the second quarter more than doubled to $6.7 billion, compared to $3.2 billion in the prior-year quarter.

It appears, then, that Disney’s back on track to something resembling normalcy, whatever that even means nowadays. As far as $DIS stock goes, though, it remains to be seen whether the investing community will choose to focus on the positive data points or continue the share dumpage.

Sponsored

Insured And Secured Access to the Blockchain for Business

It hasn’t been easy for businesses to enter the world of decentralized applications using blockchain in a secure manner. TrueNorth Quantum is changing this, breaking down the technical, security, and regulatory barriers to entry – making the new internet available to more businesses than ever.

Beyond Meat ($BYND) is falling aggressively after hours (-22.50%) after missing on its top and bottom lines. The stock was already down sharply in the regular session for a total decline of 33% since yesterday’s close. 📉

The company’s loss per share was -$1.58 adjusted vs. -$1.01 expected. Revenues came in at $109.5 million vs $112.3 million expected. (Read the full release here)

Total volume, adjusted for pricing and currency impacts, increased 12.4% in the quarter. However, net revenue per pound shrank 10% as the company offered reduced pricing to international customers as part of its promotional efforts.

Beyond Meat President and CEO Ethan Brown noted that the company’s long-term investments in growth “are having a meaningful impact on its gross margins in the short term,” but he is confident “…in the future we are building.“

Investors are not sharing his optimism, however, sending the stock to its lowest levels ever in after-hours trading. After roughly 3 years since the stock’s IPO, current investors have little to show for owning the stock… so their frustration is understandable. 💁

Bullets

Bullets from the Day

🏨 Airbnb embraces “new world of travel” with platform makeover as stock hits lowest levels since IPO. CEO Brian Chesky exclaimed “The way people travel has changed forever” as the company unveiled three major features that represent the biggest change to Airbnb in a decade. Airbnb Categories – a new way to search for the perfect place to stay; Split Stays – allows users to select multiple homes in the same location during longer stays; and AirCover – comprehensive protection for guests so they can book with confidence. The company’s press release has all the deets.

🤝🏼 Going-private deals reach 10-year highs amid sharp declines in stock-market valuations. Major declines in public securities like Twitter and Citrix Systems, combined with high cash balances among deal makers, have led to a flurry of deals. 2022 is off to a hot start with 26 deals already announced/completed through early May as more companies look to avoid the additional pains of being a public company. The WSJ breaks it all down.

😱 The party is over, or at least on hold, at high-flying tech startups. Trouble in the public equity markets has spread to the private markets, with later-stage startups having to pump the breaks during funding slowdowns. For many younger people in the tech sector, this is the first major downturn in a period of growth that’s been largely up and to the right. So far this year, there are double as many companies conducting layoffs or shut downs than there were last year, according to Layoffs.fyi. The NY Times lays out some interesting stats.

⚡ EV maker Rivian reported earnings, up over 5% after hours. The company reported narrower EPS losses than expected, but missed big on revenue. The company’s most reassuring figure, however, was its number of new vehicle reservations, up to 90,000 compared to last year’s 83,000. Rivian has manufactured just 5,000 cars since last fall. Here’s CNBC with more on Rivian.

Links

Links That Don’t Suck

🚉 The Hottest Work Day of the Week Is Now…Wednesday?”

🎁 YouTube is testing a memberships gifting feature with select creators

🏢 Office Building Owners Drown in Tide of Sublease Space

📀 Chicken Soup for the Soul Entertainment Acquires Redbox for $375m

🗑️ Stock Turmoil Spreads to Junk Bonds, Hurts deals

🤖 Google announces its first smartwatch, a new budget phone and more