April’s headline inflation rate moderated slightly from March, snapping an 8-month streak of increasing inflation pressures. With that said, numbers still exceeded consensus expectations on a MoM (0.6% vs. 0.4%) and YoY (8.3% vs. 8.1%) basis.

As we dig into the numbers, energy prices waned slightly in the aggregate, down 2.7% MoM but still up 30.3%. The main culprits in April were increases in shelter, food, airline fares, and new vehicles. Good thing nobody uses any of those things. 😆

If you were looking to save money on gas by eating at home, think again. The food at home index rose 10.8% YoY, marking the largest 12-month increase since November 1980. 🌽 📈

The market’s reaction to this news was not great. 👎

As a reminder, inflation impacts interest rates, ultimately impacting what price investors are willing to pay for other assets like stocks, cryptocurrencies, real estate, etc.

That’s why we saw tech-heavy Nasdaq led to the downside, closing down over 3%, and more speculative areas of the market related to cryptocurrencies, SPACs, and recent IPOs all falling heavily. 🔻

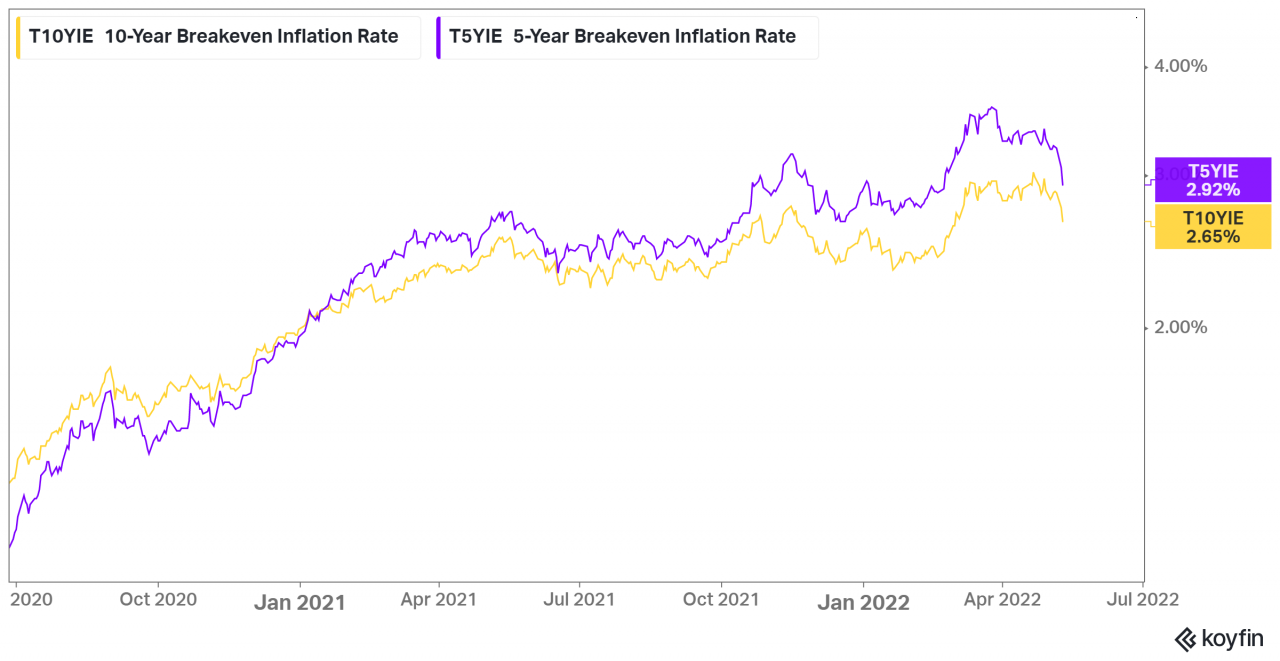

Interestingly enough, Breakeven Inflation Rates, which track the market’s expectations of inflation, peaked last month and have been falling steadily. So the expectation among bond market participants (for now) appears to be that today’s inflation cooling will continue in the months ahead.

Ultimately, the market needs to see that most inflation components cool off simultaneously. So far, it’s been a seesaw effect where some drop and others rise, keeping overall inflation levels elevated. ⚖️

While it would be great to think the recent bond market action is correct and the worst of the inflation story is behind us, today’s action shows us that the stock market isn’t buying that story just yet. 😕