Welcome to the Stocktwits Top 25 Newsletter for Week 29 of 2022!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD) and tracks their performances over time.

Here are the Stocktwits Top 25 Lists for Week 29:

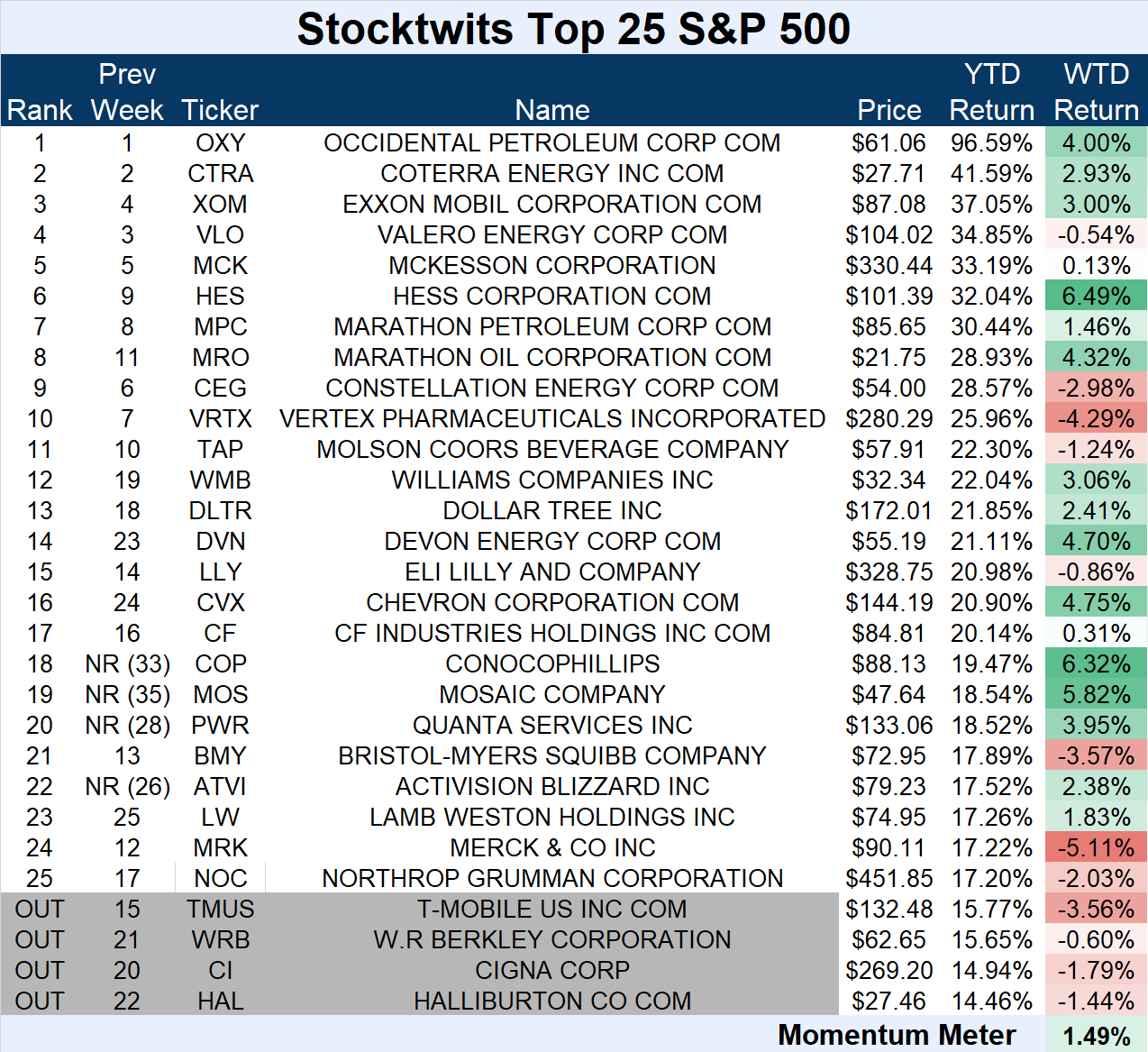

S&P 500

ST Top 25 S&P 500

The S&P 500 Top 25 list (+1.49%) underperformed the S&P 500 index (+2.55%).

There were four major changes to the list this week.

ConocoPhillips (+6.32%), Mosaic Company (+5.82%), Quanta Services (+3.95%), and Activision Blizzard (+2.38%) joined the list.

They replaced T-Mobile US (-3.56%), W.R. Berkley (-0.60%), Cigna Corp. (-1.79%), and Halliburton (-1.44%).

Energy rebounded this week, while health care stocks sold off.

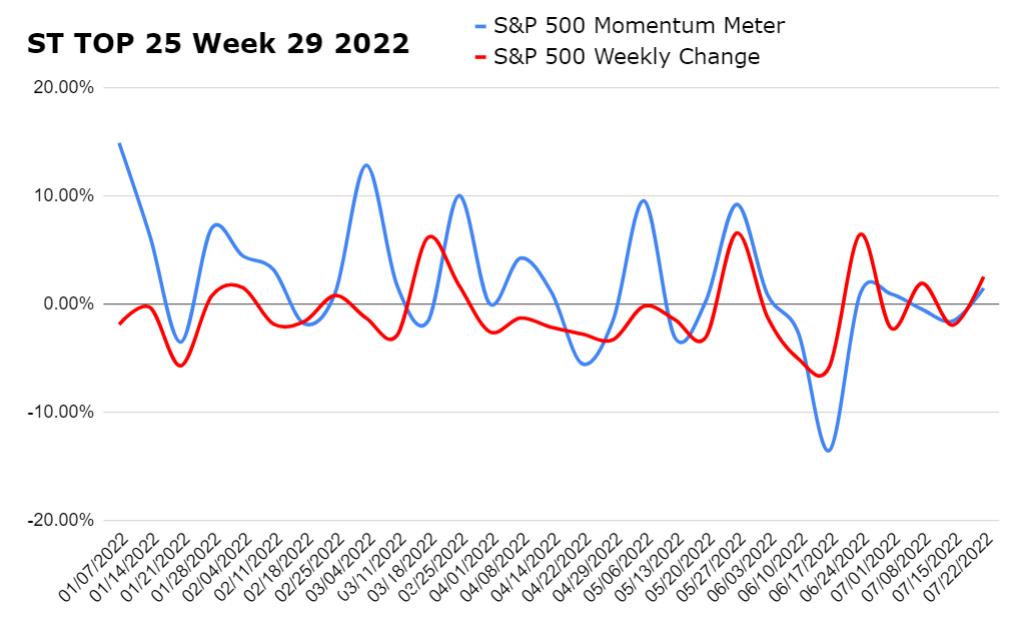

Check out how the momentum meter has performed vs. the S&P 500 index this year:

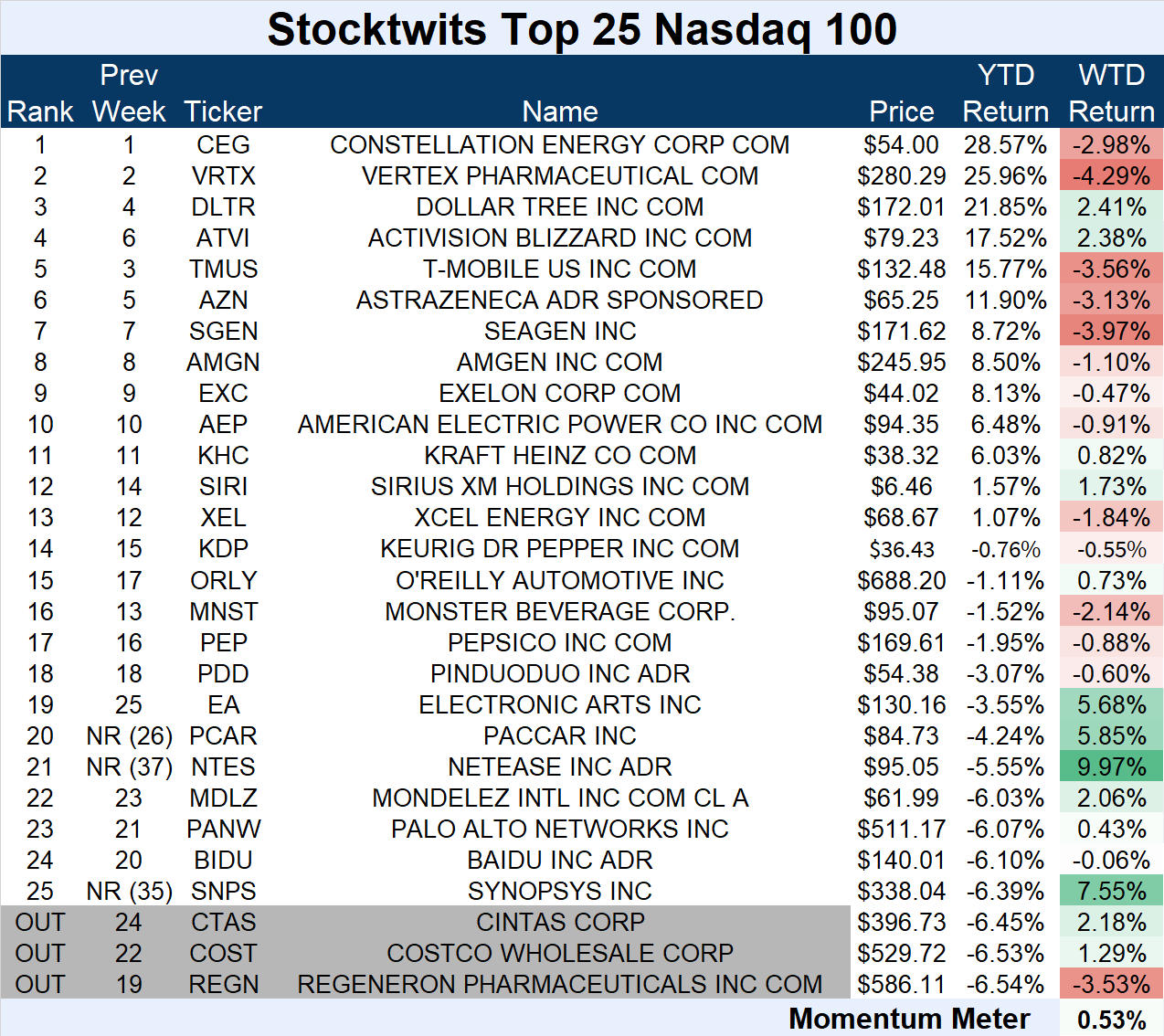

NASDAQ 100

The Large-Cap Nasdaq 100

The Nasdaq 100 Top 25 list (+0.53%) underperformed the Nasdaq 100 index (+3.45%).

There were three major changes to the list this week.

PACCAR Inc. (+5.85%), NetEase Inc. (+9.97%), and Synopsys (+7.55%) joined the list.

They replaced Cintas Corp. (+2.18%), Costco (+1.29%), and Regeneron Pharma (-3.53%).

It was a quiet week overall, with minimal intra-list movement.

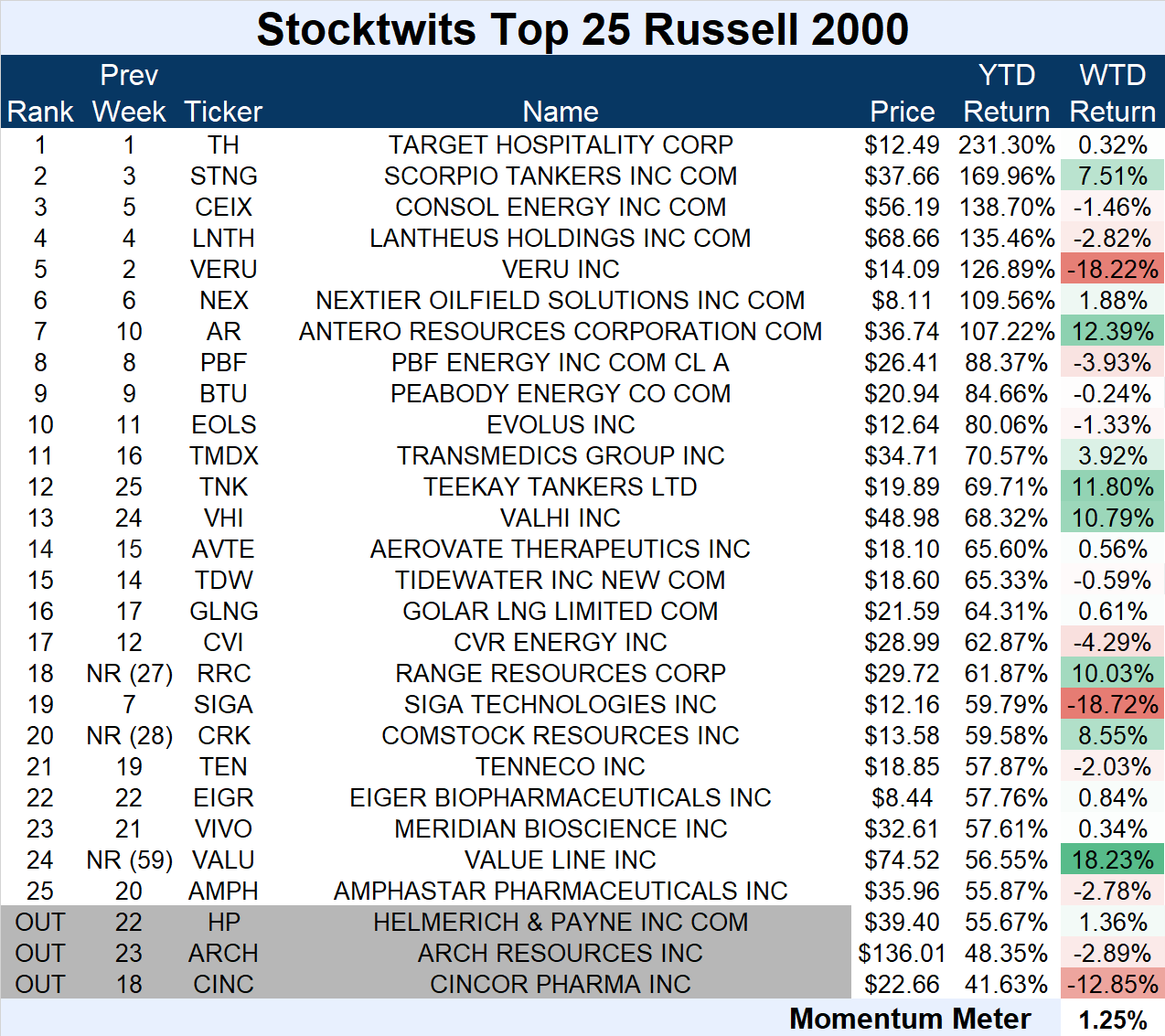

RUSSELL 2000

The Growth-Centric Russell 2000

The Russell 2000 Top 25 list (+1.25%) underperformed the Russell 2000 index (+3.58%).

There were three major changes to the list this week.

Range Resources (+10.03%), Comstock Resources (+8.55%), and Value Line (+18.23%) joined the list.

They replaced Helmerich & Payne (+1.36%), Arch Resources (-2.89%), and Cincor Pharma (-12.85%).

This list continues to host big winners and losers every week.

🐶🐶🐶

ST Top 25 TOP DAWG OF THE WEEK 🐶

The Top 25 lists’ Top Dawg was Value Line, Inc., which rallied 18.23%

There wasn’t any major news about the company, which produces and sells investment periodicals and related publications primarily in the U.S.

However, it did declare a quarterly cash dividend of $0.25 per share (a 13.6% increase), which is its 8th consecutive increase. The stock is currently trading near its highest level ever after starting the year by breaking above its mid-2000 highs.

$VALU is up 56.55% YTD.

See Y’all Next Week 🤙