We hope you’re enjoying your weekend and staying cool amid the record-high temperatures. ☀️

Let’s at least recap and look to the week ahead.

What Happened?

💚 Despite Friday’s reversal, stocks closed green for the week as the market approached its highest levels since early June.

🤩 This week’s Stocktwits Top 25 report showed continued underperformance from the top 25 list and several significant outliers in the Russell 2000.

💰 Earnings season ramped up with reports from several retail favorites. Netflix finally caught a break after a better-than-expected announcement, showing it only lost 900,000 subscribers in Q2 after initially forecasting 2 million. Tesla earnings more or less met expectations, though the report showed that the company “paper-handed” its crypto holdings, selling 75% of its Bitcoin despite Elon Musk suggesting the company would not do so. Lastly, Snapchat fell nearly 40% after a terrible earnings report. It took a lot of its peers down with it, with investors fearing that ad spending could slow across the board.

🥵 In economic news, inflation numbers worldwide continue to set records, with Euro Zone inflation reaching a new high of 8.6%, the U.K. reaching 9.3%, and Canada coming in at 8.1%. Central bankers continue to raise rates to slow growth and bring down prices, but structural issues in the energy and food markets continue to hamper progress on the inflation front.

📋 In this challenging environment, some central banks take vastly different approaches to their policy. First, we had the European Central Bank hike rates by 50 bps for the first time since 2011, bringing its policy rate to…0.00%. On the other hand, the Bank of Japan has decided to continue its easy money policy despite inflation pressures. And Russia’s central bank cut rates by 150 bps (its fifth rate cut this year) as it struggles with a strong currency and weak economic growth.

💵 The U.S. Dollar also remains in focus after hitting parity with the Euro last week. We wrote an explainer of what’s happening in the currency markets and why it matters to investors.

🧭 Additionally, Cathie Wood’s $ARKK ETF is catching the attention of some market participants. We discussed why some view it as a potential leading indicator for the stock market’s next move.

₿ Crypto prices rebounded had a great week with stocks and are continuing their rally over the weekend. In company-related news, Three Arrows Capital founders finally resurfaced, and Coinbase confirmed they had no exposure to bankruptcy crypto firms which quelled some rumors about its health.

🔥 Several names were on the Stocktwits trending tab for a good portion of the week, including $EVFM, $MULN, $PGY, $MARA, $TSLA, and $XELA.

🎉 Lastly, it was an exciting week here at Stocktwits. In case you missed this news, Stock trading is now live on Stocktwits iOS app (Web and Android coming soon)! Share your trades with your community and prove your skin in the game. Equity trading is executed via ST Invest (Member FINRA/SIPC). Full press release here!

Those are the major stories from the week. And here are the final prints:

| S&P 500 | 3,962 | +2.55% |

| Nasdaq | 11,834 | +3.33% |

| Russell 2000 | 1,807 | +3.58% |

| Dow Jones | 31,288 | +1.95% |

Bullets

Bullets From The Weekend

🏗️ China’s Evergrande gets a management shakeup amid crisis. The CEO and CFO of the troubled property developer stepped down after a preliminary probe found they were involved in diverting loans secured by its publicly listed unit to the group. The company will issue a full report on the investigation once it’s closed. It is also considering appointing an internal control consultant to review its internal control and risk management systems. Reuters has more.

👎 Yellen downplays U.S. recession fears. The U.S. Treasury Secretary said on Sunday that the economy is slowing; however, the labor market remains strong. Moreover, she noted that the recent growth slowdown is “necessary and appropriate” given its rapid pace in 2021 and record-high inflation. The comments come ahead of the Federal Reserve’s rate decision on Wednesday, and a slew of other economic data points, like a preliminary read of Q2 GDP. More from AP News.

🌾 Ukraine works to resume grain exports amid Russian strikes. The agreement between Russia and Ukraine to resume grain exports got off to a rough start this weekend, as Russian missiles struck a warship in the port of Odesa. The deal, which seeks to avoid a major global food crisis, remains in choppy waters. Reuters has more.

The Brief

Need a concise summary of what’s going on this week? Look no further. Here’s an overview of important earnings and economic data for the trading week ahead.

Economic Calendar

All eyes will be on the Federal Reserve’s interest rate decision on Wednesday, July 27th at 2 pm ET. In addition to the above, check out this week’s complete list of economic releases.

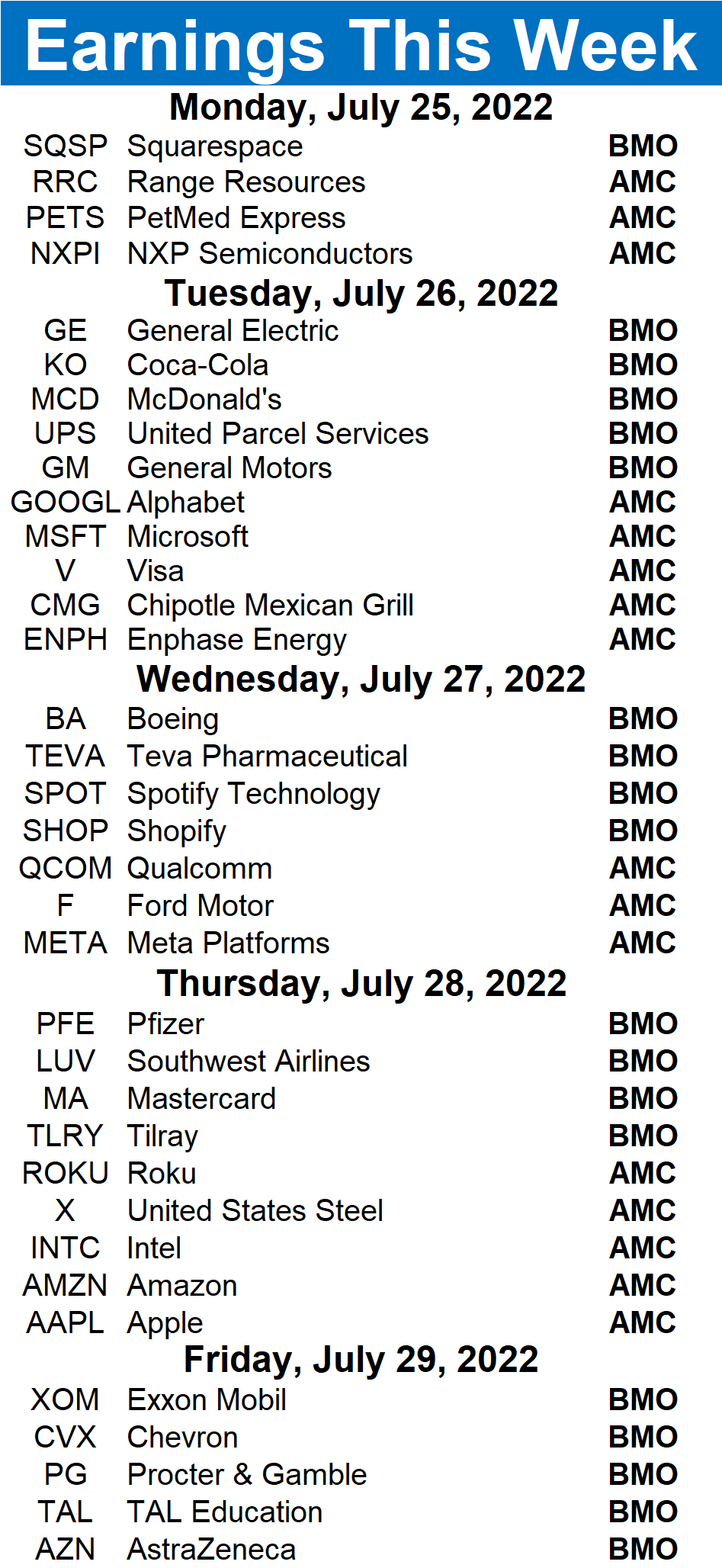

Earnings This Week

Earnings season is in full swing, with 787 companies reporting this week. Several tickers you may recognize are $AAPL, $AMZN, $GOOGL, $MSFT, $META, $MCD, $XOM, and $CMG.

Above is a quick summary. Check out the full Stocktwits earnings calendar to see the other names reporting this week.

Links

Links That Don’t Suck:

🚴♂️ Danish cyclist Jonas Vingegaard wins his first Tour de France title

💰 T-Mobile agrees to give money to customers affected by 2021 data breach

🕹️ Teens are rewriting what is possible in the world of competitive Tetris

🚗 Apple’s new car software could be a trojan horse into the automotive industry

♟️ Chess robot grabs and breaks finger of seven-year-old opponent

🍹 National Tequila Day 2022: drink in some surprising facts

🦖 A diner discovered 100 million-year-old dinosaur footprints in a restaurant

⚠️ WHO declares global health emergency over monkeypox outbreak

🔥 Wildfire near Yosemite National Park explodes in size, forces thousands of evacuations

📝 China plans three-tier data strategy to avoid US delistings

₿ Barclays participating in funding round for crypto firm Copper: Sky News