Welcome to the Stocktwits Top 25 Newsletter for Week 39 of 2022!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD) and tracks their performances over time.

Here are the Stocktwits Top 25 Lists for Week 39:

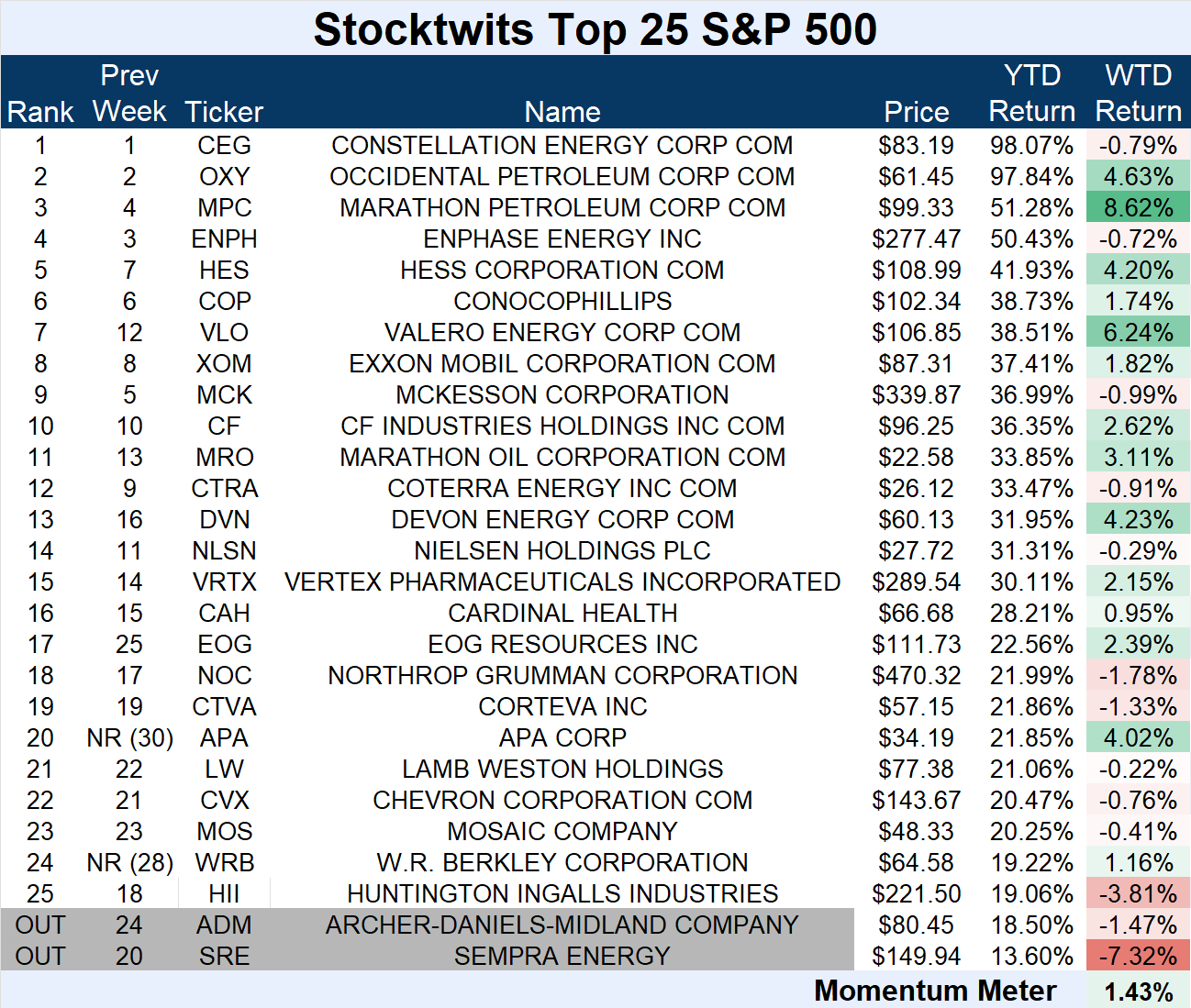

Standard and Poor's 500

ST Top 25 S&P 500

The S&P 500 Top 25 list (+1.43%) outperformed the S&P 500 index (-2.91%).

There were two major changes to the list this week.

APA Corp. (+4.02%) and W.R. Berkley (+1.16%) joined the list.

They replaced Archer-Daniels-Midland (-1.47%) and Sempra Energy (-7.32%).

Energy stocks held up best this week amidst the market’s overall volatility.

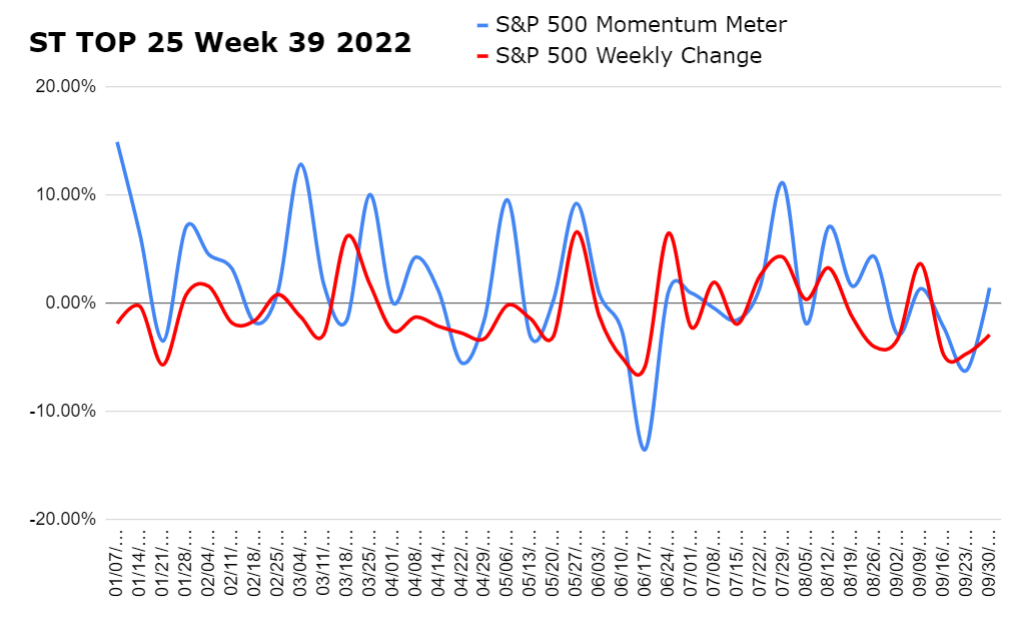

Check out how the momentum meter has performed vs. the S&P 500 index this year:

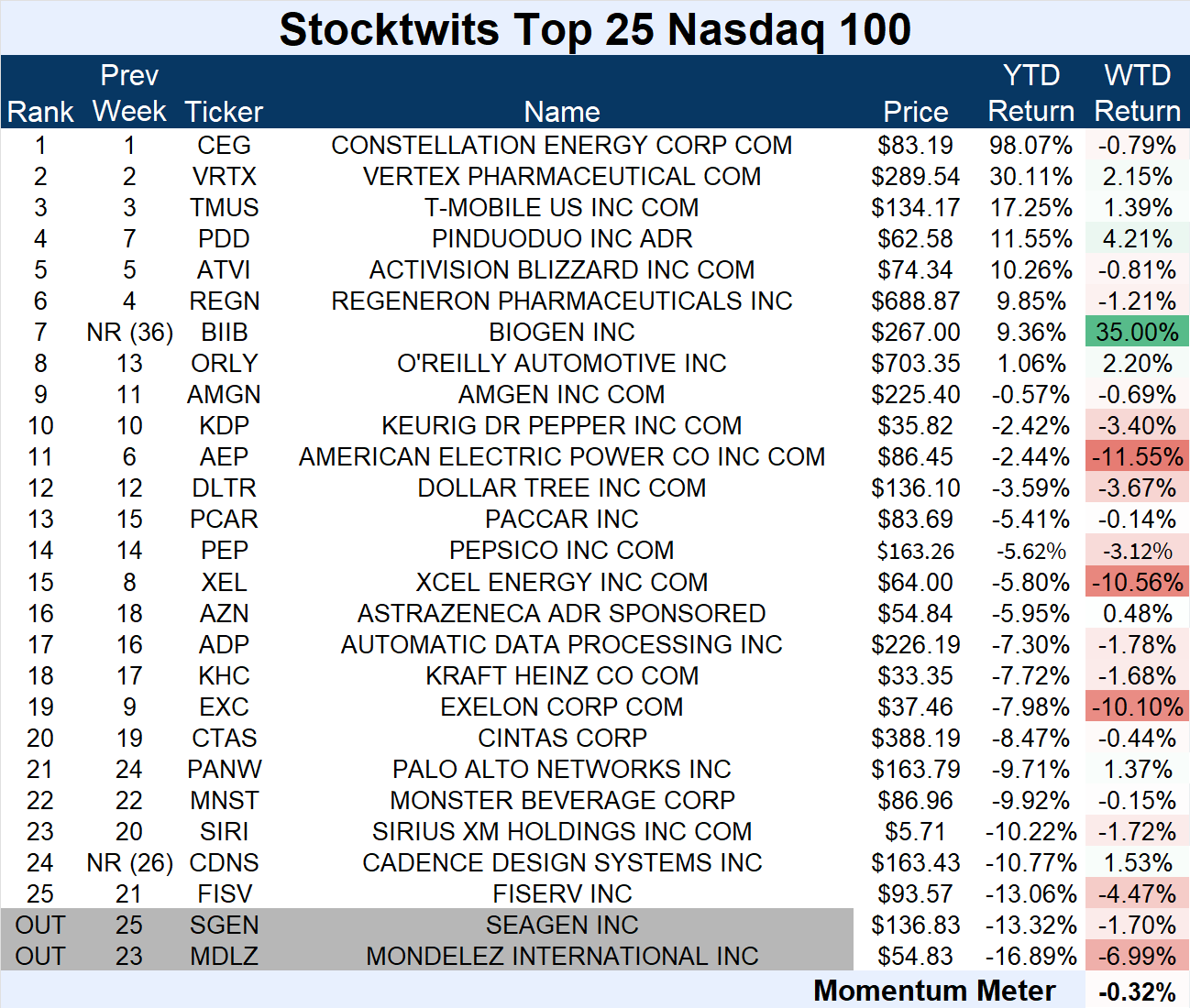

NASDAQ 100

The Large-Cap Nasdaq 100

The Nasdaq 100 Top 25 list (-0.32%) outperformed the Nasdaq 100 index (-3.01%).

There were two major changes to the list this week.

Biogen (+35.00%) and Cadence Design Systems (+1.53%) joined the list.

They replaced Seagen (-1.70%) and Mondelez International (-6.99%).

Utility stocks were hit hardest, while Biogen’s big gain helped buoy the list’s average performance.

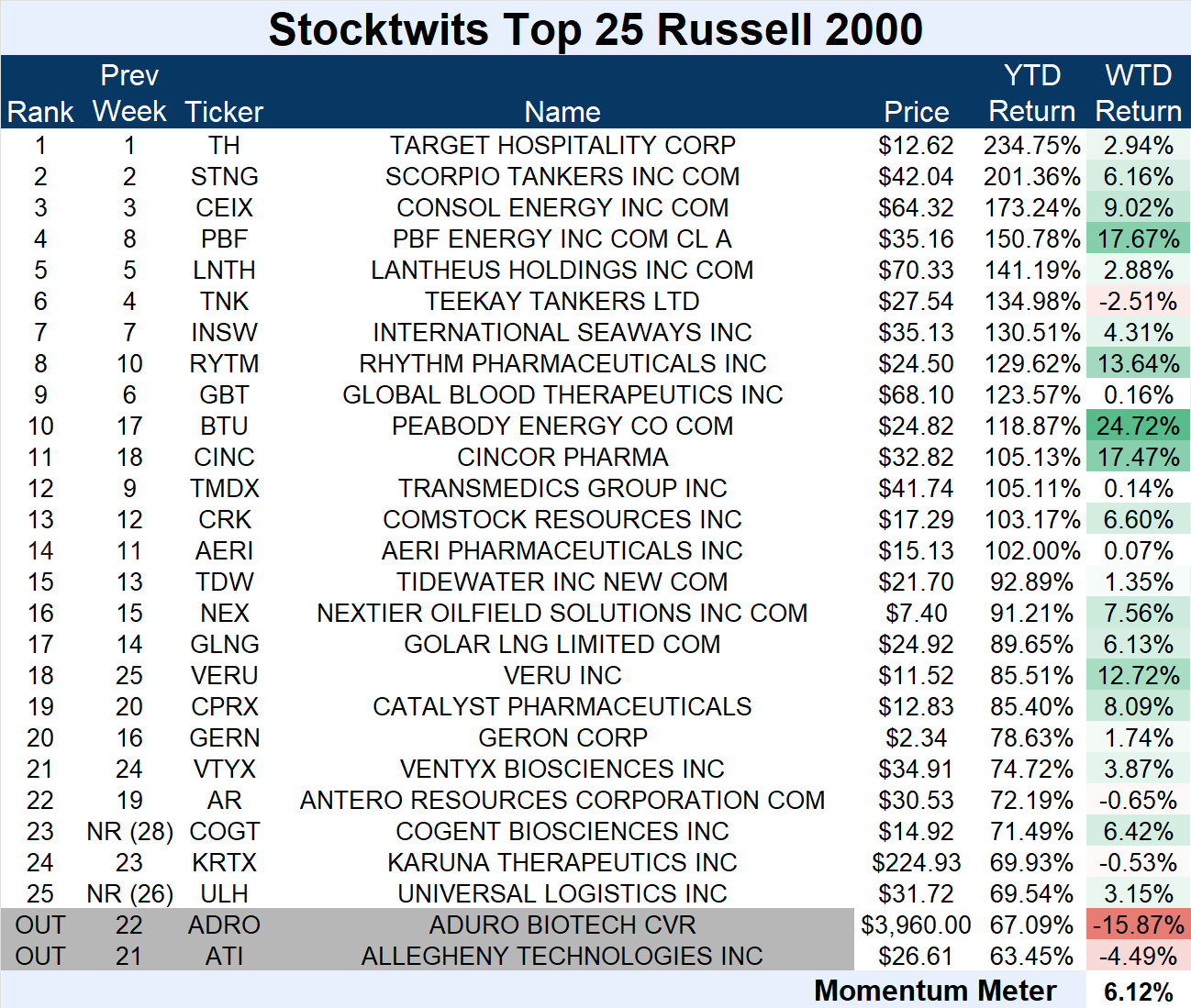

RUSSELL 2000

The Growth-Centric Russell 2000

The Russell 2000 Top 25 list (+6.12%) outperformed the Russell 2000 index (-0.86%).

There were two major changes to the list this week.

Cogent Biosciences (+6.42%) and Universal Logistics (+3.15%) joined the list.

They replaced Aduro Biotech CVR (-15.87%) and Allegheny Technologies (-4.49%).

The energy sector was the clear winner this week. Overall though, the Russell 2000 index held up best out of the three U.S. indices covered here.

🐶🐶🐶

ST Top 25 TOP DAWG OF THE WEEK 🐶

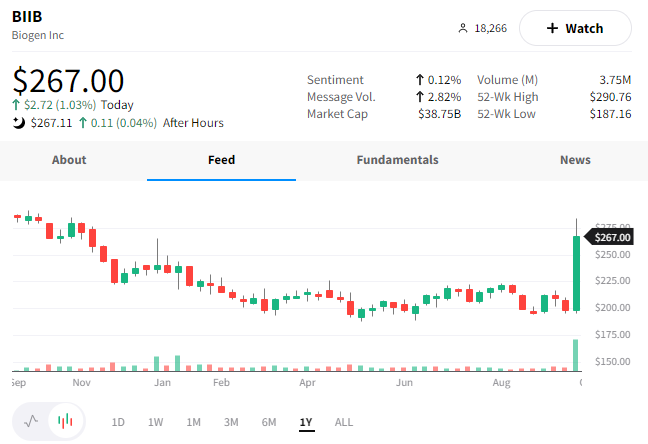

The Top 25 lists’ Top Dawg was Biogen, which rallied 35%. 📈

The large-cap Biotech company’s shares soared 40% on Wednesday after its experimental Alzheimer’s drug, made in partnership with Eisai Co. Ltd., showed positive results. 👍

The positive development pushed the stock to new year-to-date highs and also boosted the shares of other companies in the space.

$BIIB is up 9.36% YTD.

See Y’all Next Week 🤙