Welcome to the Stocktwits Top 25 Newsletter for Week 3 of 2023!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD) and tracks their performances over time.

Here are the Stocktwits Top 25 Lists for Week 3:

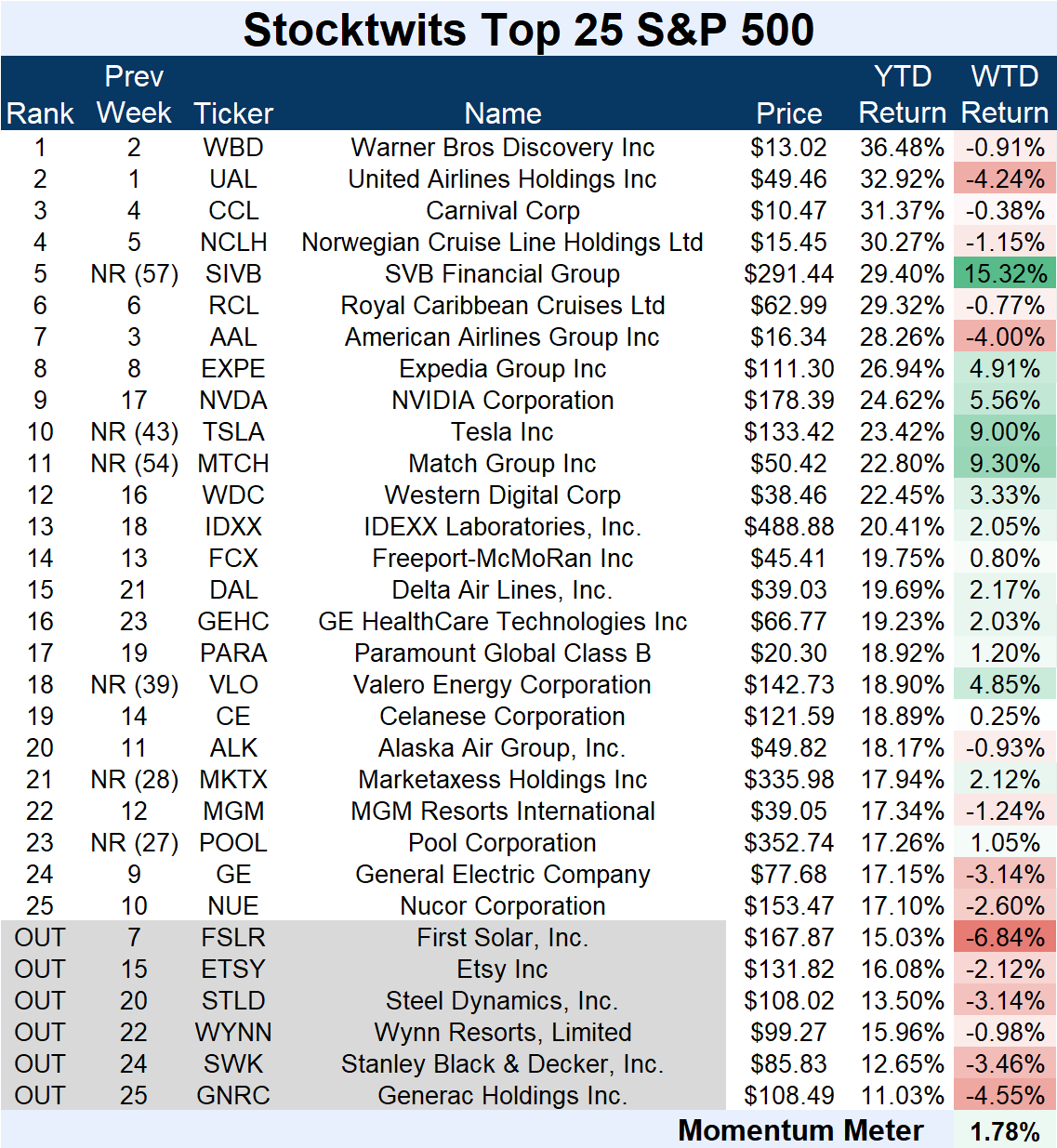

Standard and Poor's 500

ST Top 25 S&P 500

The S&P 500 Top 25 list (+1.78%) outperformed the S&P 500 index (-0.66%).

There were six major changes to the list this week.

Joining: SVB Financial (+15.32%), Tesla (+9.00%), Match Group (+9.30%), Valero (+4.85%), MarketAxess (+2.12%), and Pool Corporation (+1.05%).

Leaving: First Solar (-6.84%), Etsy (-2.12%), Steel Dynamics (-3.14%), Wynn Resorts (-0.98%), Stanley Black & Decker (-3.46%), and Generac Holdings (-4.55%).

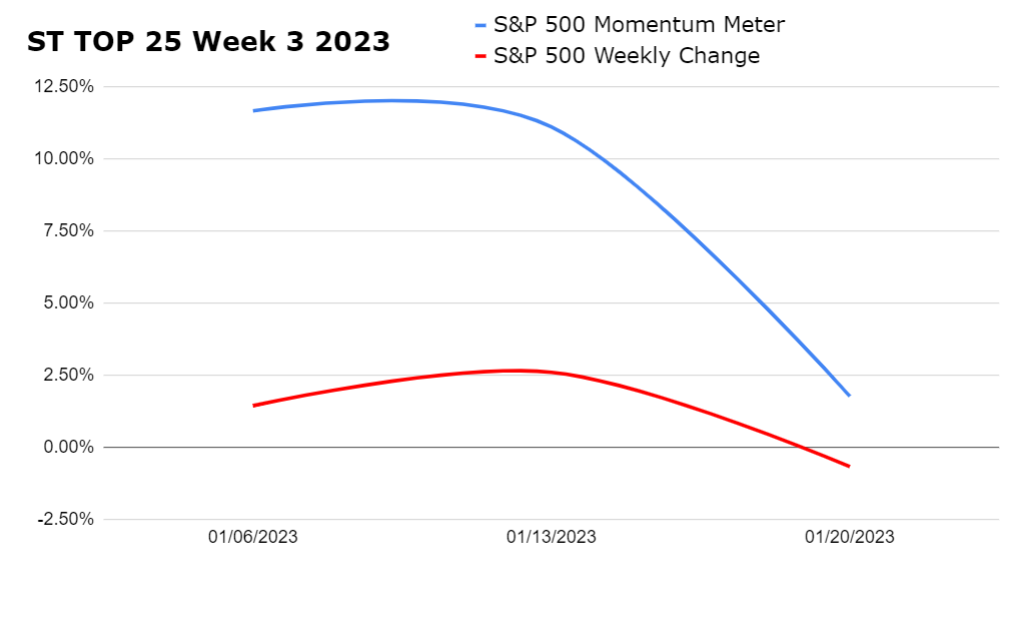

Check out how the momentum meter has performed vs. the S&P 500 index this year:

NASDAQ 100

The Large-Cap Nasdaq 100

The Nasdaq 100 Top 25 list (+1.85%) outperformed the Nasdaq 100 index (+0.67%).

There were six major changes to the list this week.

Joining: Marriott International (+3.17%), Diamondback Energy (+1.59%), Meta Platforms (+1.74%), Cadence Design Systems (+5.32%), Autodesk (+2.65%), and eBay (+0.86%).

Leaving: Pinduoduo (-4.29%), Globalfoundries (-4.55%), Marvell Technology (-2.93%), Intel (-2.96%), KLA Corp. (-1.47%), and Cognizant Technology Solutions (-2.06%).

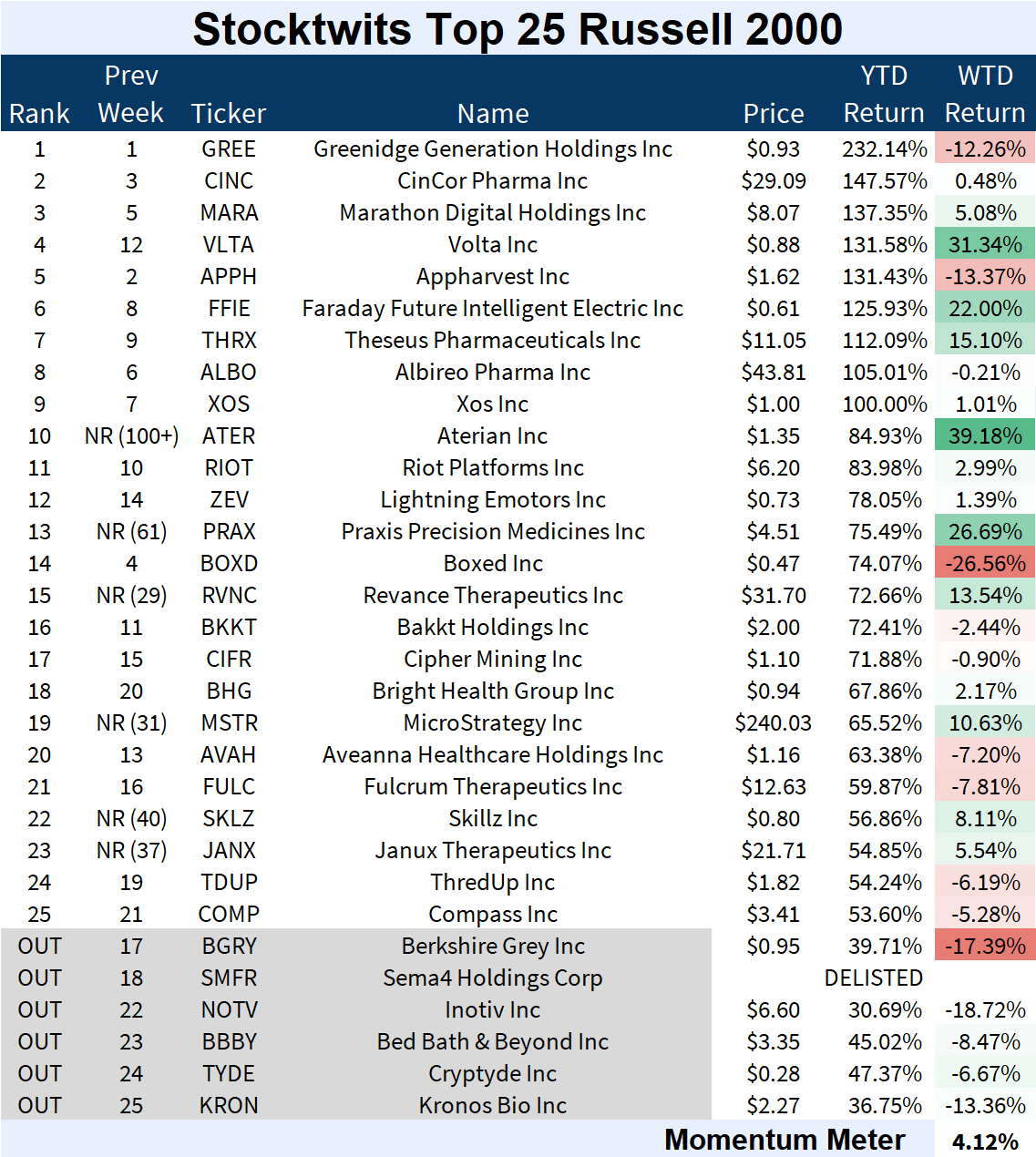

RUSSELL 2000

The Growth-Centric Russell 2000

The Russell 2000 Top 25 list (+4.12%) outperformed the Russell 2000 index (-1.04%).

There were six major changes to the list this week.

Joining: Aterian Inc.(+39.18%), Praxis Precision Medicines (+26.69%), Revance Therapeutics (+13.54%), MicroStrategy (+10.63%), Skillz Inc. (+8.11%), and Janux Therapeutics (+5.54%).

Leaving: Berkshire Grey (-17.39%), Sema4 Holdings Corp. (N/A), Inotiv Inc. (-18.72%), Bed Bath & Beyond (-8.47%), Cryptyde Inc. (-6.67%), and Kronos Bio (-13.36%).

🐶🐶🐶

ST Top 25 TOP DAWG OF THE WEEK 🐶

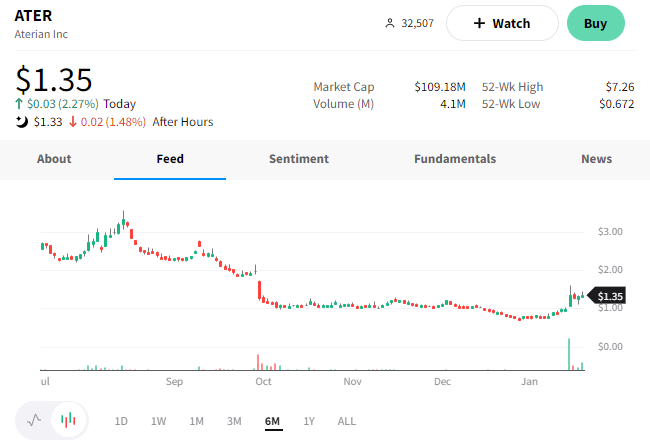

The Top 25 lists’ Top Dawg was Aterian Inc., which rallied 39.18%. 📈

The $109 million market cap technology-enabled consumer products company operates in North America and internationally. 🖥️

The stock rallied this week after announcing preliminary Q4 net revenue results of $54-$55 million, which was the top end of its previous projection. The company also noted it’s set up well for a strong 2023. And its CEO is taking 80% of his 2023 base salary in restricted Aterian common stock, which investors might view as a vote of confidence. 👍

The stock has had a tough run, falling roughly 98% from its highs near $50 in 2021. Whether or not this news is the turning point for the stock remains to be seen, but nonetheless, it was this week’s top performer. 🤷

$ATER is up 84.93% YTD.

See Y’all Next Week 🤙