Another week in the market has passed as this year’s trends begin to emerge. 👍

Let’s recap and prep you for the week ahead. 📝

What Happened?

💚 Stocks had a mixed week, with the technology-heavy Nasdaq leading and the old-school Dow Jones Industrial Average lagging. Traders continue to watch this chart as the stock market nears a decision point.

🤩 This week’s Stocktwits Top 25 report showed outperformance relative to the indexes.

🛑 The U.S. government hit its debt limit on Thursday, forcing Treasury Secretary Janet Yellen to take “extraordinary measures.”

👎 Bad news for the economy may be bad news for the market again. Weaker-than-expected economic data caused bond yields to fall further this week.

🗺️ The World Economic Forum’s annual meeting took place in Davos, with the world’s elite discussing all the topics you’d expect, including inflation, Russia’s war in Ukraine, climate change, and more.

🏦 Bank earnings continued to roll in, with Goldman falling short and Morgan Stanley clearing estimates. Meanwhile, several non-traditional banks like Ally Financial and SVB Financial Group soared on better-than-expected results and outlooks.

🎞️ Netflix’s earnings sent shares soaring after its subscriber numbers topped estimates. The streaming company also announced its co-CEO Reed Hastings is stepping down from that position and transitioning to executive chairman.

📰 There were many other earnings reports this week, which we recapped here and here.

🔥 Several names were on the Stocktwits trending tab for a good portion of the week, including $BBBY, $BTB, $MULN, $COSM, and $BBIG.

Here are the closing prices:

| S&P 500 | 3,973 | -0.67% |

| Nasdaq | 11,140 | +0.55% |

| Russell 2000 | 1,867 | -1.04% |

| Dow Jones | 33,375 | -2.70% |

Bullets

Bullets From The Weekend

🔺 Crypto execs continue to “fail upward.” Several ex-Genesis executives claim they’ve raised millions for a crypto hedge fund. The news comes just days after Genesis, which Barry Silbert’s Digital Currency Group owns, filed for bankruptcy protection. The fund is being pitched as an “alpha multi strat (delta neutral),” which means it specializes in multi-strategy, low-risk, high-return investments. The fund will also launch two other beta products. It just goes to show second chances remain a thing for those who fail big. CNBC has more.

❌ Another VR product bites the dust. Artificial intelligence and virtual reality remain the talk of the town in 2023, with investments pouring into the space. However, some companies are pulling back from the space or at least taking a more focused approach. Microsoft announced that it is sunsetting its social VR pioneer AltspaceVR on March 10th, as it directs more resources towards its mixed reality platform Microsoft Mesh. More from TechCrunch.

💽 AWS is investing $35 billion in Virginia data centers. While Amazon is cutting costs in one area, it’s continuing to invest in its Amazon Web Services business. Virginia’s governor announced this week that AWS is planning to invest $35 billion in new data centers in the state by 2040, marking the largest economic investment in the commonwealth’s history. As part of that, Amazon will receive incentives from the Mega Data Center Incentive Program and a grant of up to $140 million for workforce development site improvements and other costs. The investment is expected to create more than 1,000 jobs. Fox Business has more.

The Brief

Need a concise summary of what’s going on this week? Look no further. Here’s an overview of important earnings and economic data for the trading week ahead.

Economic Calendar

It’s another busy week on the economic data front, but investors will be focused on Friday’s Core PCE Price Index and personal income/spending data. In addition to the above, check out this week’s complete list of economic releases.

Earnings This Week

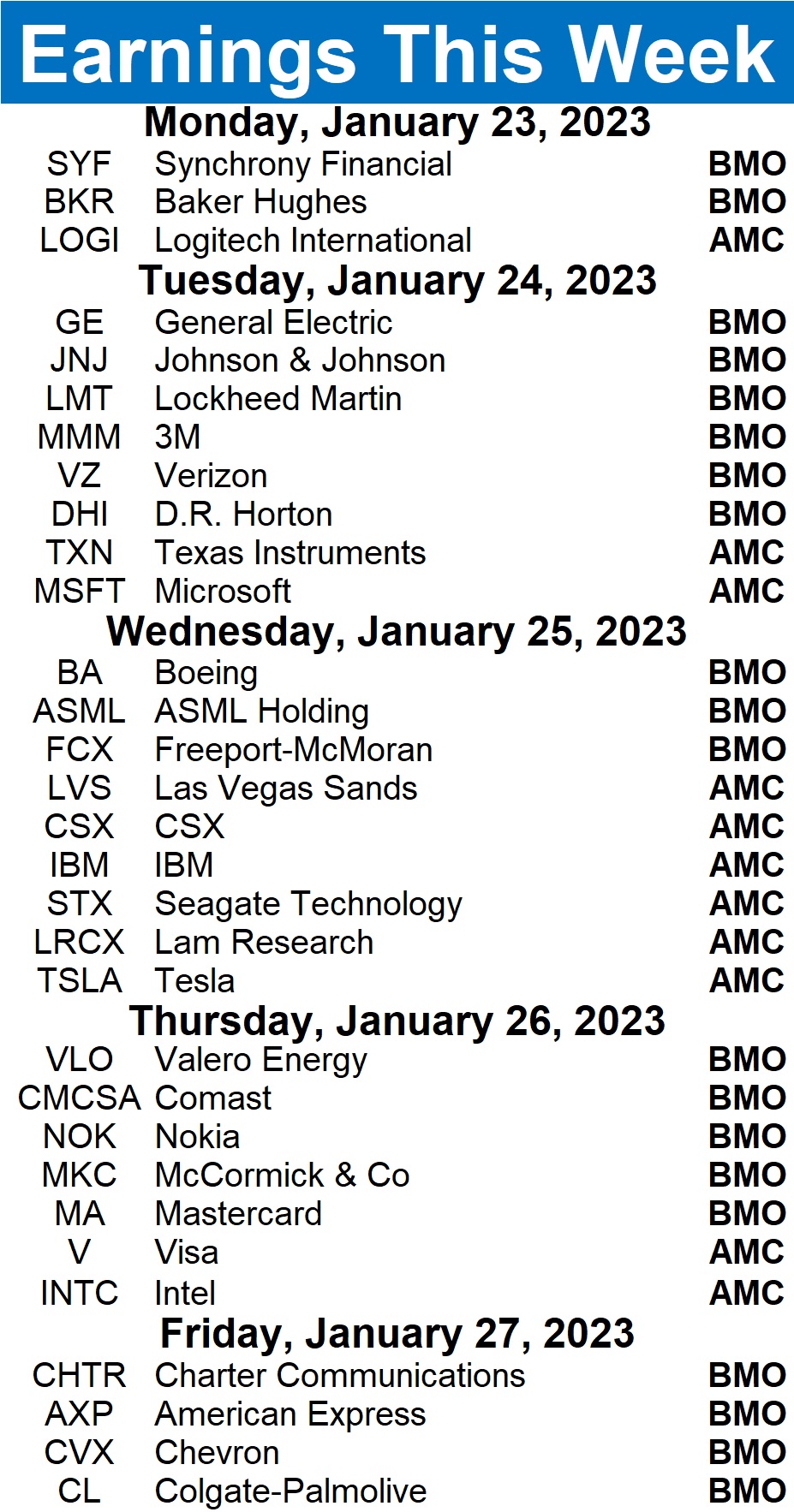

Earnings season is beginning to ramp up, with 285 companies reporting this week. Some tickers you may recognize are $MSFT, $TSLA, $MA, $V, $AXP, $CHTR, $LRCX, $ASML, $TXN, and more.

Above is a quick summary. Check out the full Stocktwits earnings calendar to see the other names reporting this week.

Links

Links That Don’t Suck:

🧑💼 What Gen Z wants to be when they grow up

🐦 Elon Musk admits Twitter has too many ads, says fix is coming

👻 Guys keep ghosting me – so I created this ‘exit survey’ to find out why

₿ U.S. home-loan banks lent billions of dollars to crypto banks: Report

🏠 Mortgage rate buydowns are on the rise as homebuyers cope with high interest rates

💩 CDC is talking to airlines about wastewater testing in planes. New reports support that strategy.

🥚 As egg prices rise, so do attempts to smuggle them from Mexico, says U.S. Customs officials

👎 FDA declines to grant accelerated approval for Eli Lilly’s experimental Alzheimer’s treatment

💰 U.S. government seizes $700 million in assets from disgraced FTX co-founder Sam Bankman-Fried