Welcome to the Stocktwits Top 25 Newsletter for Week 7 of 2023!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD) and tracks their performances over time.

Here are the Stocktwits Top 25 Lists for Week 7:

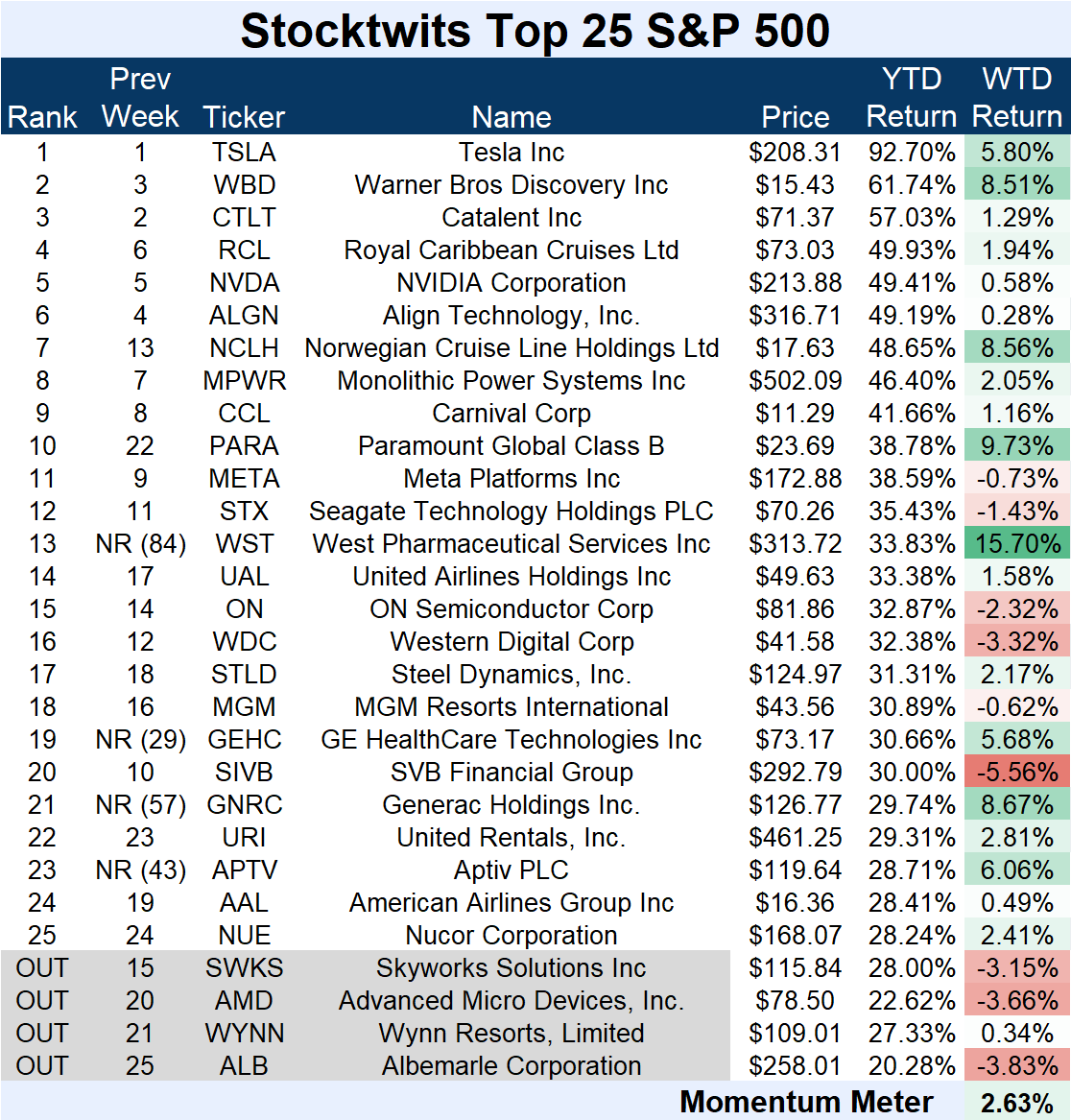

Standard and Poor's 500

ST Top 25 S&P 500

The S&P 500 Top 25 list (+2.63%) outperformed the S&P 500 index (-0.28%).

There were four major changes to the list this week.

Joining: West Pharmaceutical Services Inc (+15.70%), GE HealthCare Technologies (+5.68%), Generac Holdings (+8.67%), and Aptiv PLC (+6.06%).

Leaving: Skyworks Solution (-3.15%), Advanced Micro Devices (-3.66%), Wynn Resorts (+0.34%), and Albermarle Corporation (-3.83%).

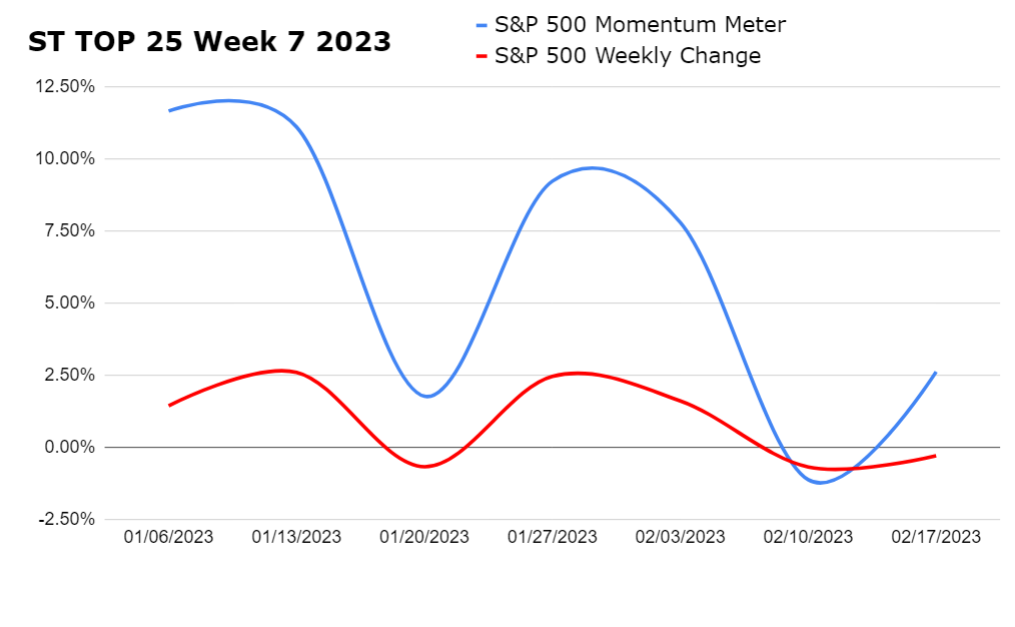

Check out how the momentum meter has performed vs. the S&P 500 index this year:

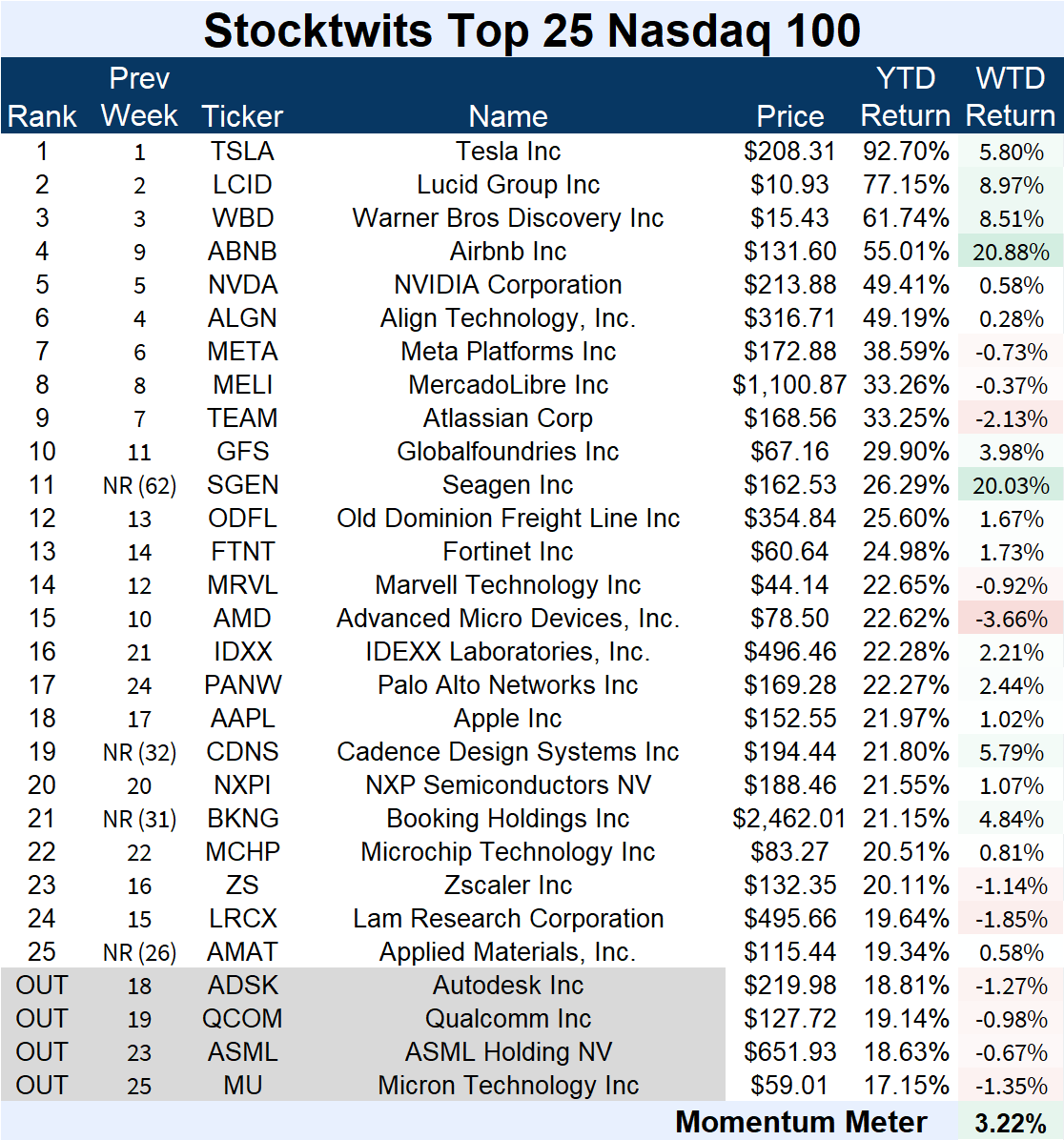

NASDAQ 100

The Large-Cap Nasdaq 100

The Nasdaq 100 Top 25 list (+3.22%) outperformed the Nasdaq 100 index (+0.59%).

There were four major changes to the list this week.

Joining: Seagen Inc (+20.03%), Cadence Design Systems (+5.79%), Booking Holdings (+4.84%), and Applied Materials (+0.58%).

Leaving: Autodesk (-1.27%), Qualcomm (-0.98%), ASML Holding (-0.67%), and Micron Technology (-1.35%).

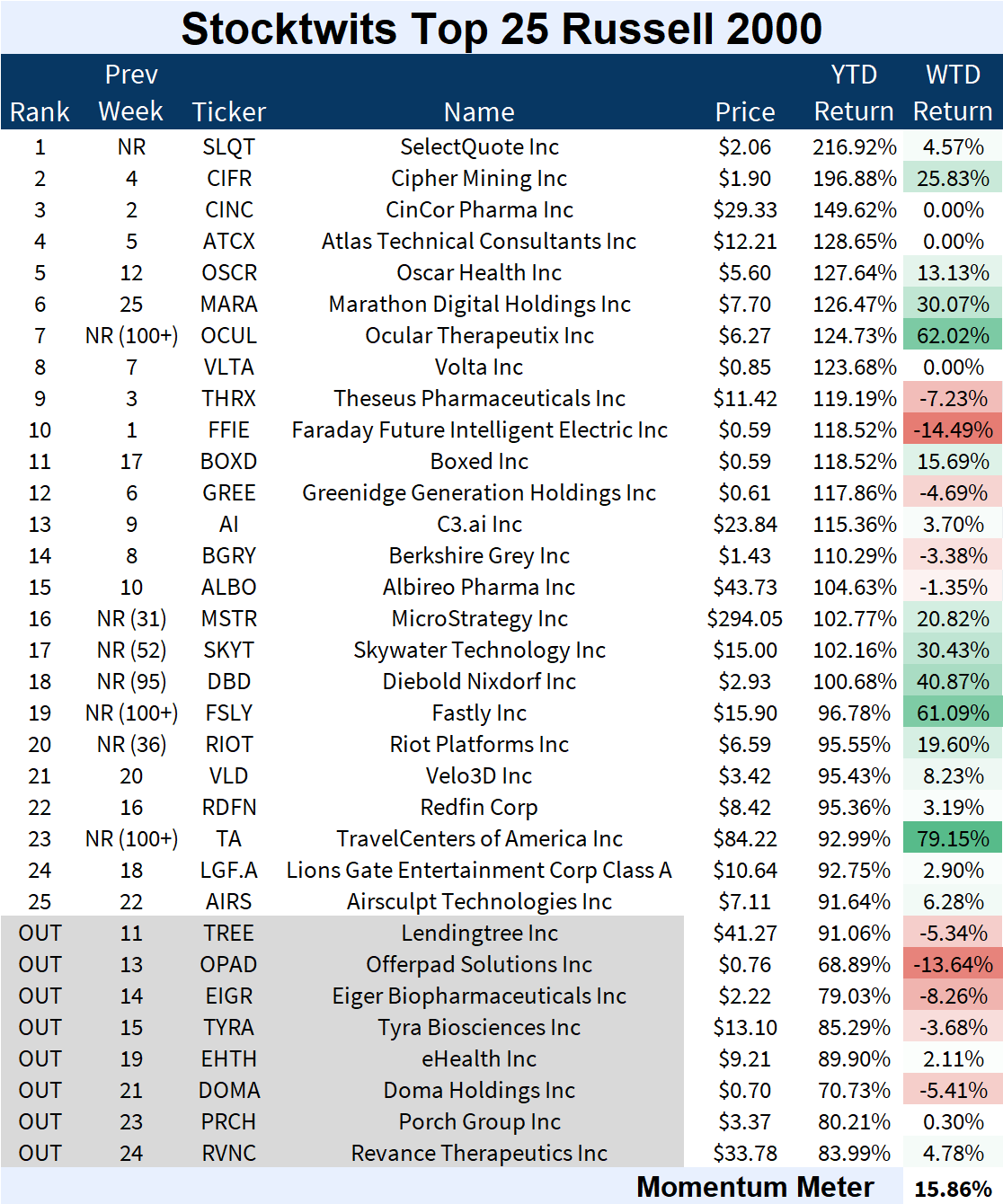

RUSSELL 2000

The Growth-Centric Russell 2000

The Russell 2000 Top 25 list (+15.86%) outperformed the Russell 2000 index (+1.44%).

There were eight major changes to the list this week.

Joining: SelectQuote Inc (+4.57%), Ocular Therapeutics (+62.02%), MicroStrategy (+20.82%), Skywater Technology (+30.43%), Diebold Nixdorf Inc (+40.87%), Fastly (+61.09%), Riot Platforms (+19.60%), and TravelCenters of America (+79.15%).

Leaving: LendingTree (-5.34%), Offerpad Solutions (-13.64%), Eiger Biopharmaceuticals (-8.26%), Tyra Biosciences (-3.68%), eHealth Inc (+2.11%), Doma Holdings (-5.41%), Porch Group (+0.30%), and Revance Therapeutics (+4.78%).

🐶🐶🐶

ST Top 25 TOP DAWG OF THE WEEK 🐶

The Top 25 lists’ Top Dawg was TravelCenters of America Inc, which rallied 79.15%. 📈

The small-cap company operates travel centers, truck service facilities, and restaurants in the U.S. and Canada. The company owns a network of about 281 highway sites across 44 states and offers services like truck maintenance, restaurants, travel stores, and parking. These non-fueling services account for roughly 70% of the business’s profit margin. ⛽

Its share price soared this week after BP made a $1.3 billion all-cash offer. 😮

BP says TravelCenters of America’s services complement its existing convenience and mobility business. The acquisition will also help expand its offers, including electric vehicle charging, biofuels, renewable natural gas (RNG), and hydrogen. As a result, BP expects the deal to offer a return on investment of over 15% in the years ahead. 💰

$TA is up 92.99% YTD.

See Y’all Next Week 🤙