A half-day followed by the 4th of July holiday equals a quiet week – maybe. 👀

Today’s issue looks at Tesla’s delivery surprise and a peek at some charts from Q2. 📰

Check out today’s heat map:

9 of 11 sectors closed green. Consumer discretionary (+1.07%) led, & healthcare (-0.82%) lagged. 🟩

In economic news, ISM manufacturing PMI for June was 46 versus the 47 estimate – the lowest in three years.

US construction spending for May was up 0.9% versus 0.6% expected. 🟩

In crypto news over the weekend, rumors were flying that SEC Chairman Gensler was reportedly resigning. While most ‘level-headed’ investors and traders were highly suspicious of the unsubstantiated claim, it nonetheless created a trending topic in crypto. The SEC has since come out to deny Chairman Gensler’s resignation. ₿

Rivian topped the trending charts and closed up more than +17% on higher-than-expected Q2 deliveries.⚡

Other symbols active on the streams included: $HOOD (+7.01%), $TGTX (-7.21%), $PRFX (+0.64%), $MULN (-5.92%), $QQQ (+0.14%), and $BTC.X (+1.62%). 🔥

Here are the closing prices:

| S&P 500 | 4,455 | +0.12% |

| Nasdaq | 13,816 | +0.21% |

| Russell 2000 | 1,896 | +0.43% |

| Dow Jones | 34,418 | +0.03% |

Company News

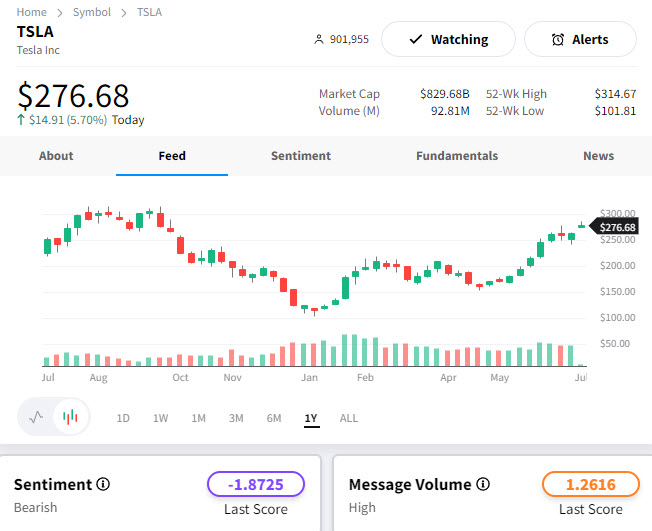

Tesla Delivery Numbers A Shock To Everyone

$TSLA unveiled its Q2 production and delivery figures, surpassing predictions significantly, courtesy of the surge in sales stemming from the company’s price cuts and the federal EV tax credits.

Tesla reported a global production of 479,700 units and 466,140 deliveries for Q2. This delivery count easily outperformed Wall Street’s consensus estimates of 448,599 units, as well as Q1’s total of 422,875. The company set new records for both production and delivery totals for Q2.

The primary focus of analysts and investors is on the delivery totals, as they offer the closest approximation to sales totals, which Tesla doesn’t divulge. Dissecting the delivery data, Tesla shipped 446,915 Model 3 and Model Ys, and 19,225 higher-priced Model S and Model X vehicles. Around 5% of the company’s sales were subject to lease accounting.

The impressive Q2 delivery performance of Tesla points towards the continued sales enhancement resulting from the company’s price cuts, both domestically and internationally.

However, there is some uncertainty about the potential impact on profits. Furthermore, Tesla enjoyed an additional push from the federal government in Q2 as every trim of the Model 3 sedan was eligible for the full $7,500 federal tax credit.

Wall Street analysts have downgraded Tesla shares after the stock’s massive surge following significant gains in the tech sector. Many analysts attribute this surge to the substantial profits made by AI-related stocks but warn that Tesla might not be the major AI player that many investors seem to think it is.

Analysts like Mark Delaney from Goldman and Adam Jonas from Morgan Stanley currently view the stock as fairly valued.

Tesla declared that it would announce the Q2 earnings results after the bell on July 19th.

Bullets

Bullets From The Day:

🌐 EU and Japan Strengthen Tech Ties. The European Union is building a stronger tech alliance with Japan, focusing on artificial intelligence (AI) and other key technologies. EU Commissioner Thierry Breton, who met with the Japanese government on Monday, stated that AI was “very high” on his agenda. The EU-Japan Digital Partnership Council will discuss quantum and high-performance computing, among other topics. This move is part of the EU’s strategy to “de-risk” from China and deepen its relationships with allied countries around technology. The EU and Japan plan to cooperate in the semiconductor area, a vital part of the tech supply chain.

🍏 $AAPL‘s performance is causing some headaches for fund managers. The 49% rally this year pushed its market capitalization over $3 trillion and its weighting in the S&P 500 to 7.6% – the largest of any single stock in the benchmark index’s history. This raises a problem for fund managers, many of whom hold smaller allocations of Apple compared to its relative weighting in indexes due to portfolio flexibility, concerns over owning too much of any one position, and rules of their own funds. If Apple’s shares continue to rally, it could negatively impact active fund managers striving to beat indexes such as the S&P 500 or Russell 1000.

🍫 Warning: Cocoa prices have reached their highest level in nearly four decades. The spike is due to strong demand, production shortfalls, and unfavorable weather forecasts in West Africa, the world’s main cocoa-growing region. So far this year, cocoa futures in London have soared over 32%, outpacing even the Nasdaq Composite. This price surge is expected to further inflate the already high costs of chocolate, with U.S. chocolate candy prices having risen more than 20% since 2021. Contributing to these price increases are higher sugar and coffee costs, nervous buyers, a projected cocoa demand exceeding production by 142,000 metric tons for the season-ending September 30, and potential impacts from the El Niño weather phenomenon.

🛢️ In an effort to maintain balance in the global market, Russia has pledged to reduce its crude oil exports by 500,000 barrels per day in August, as stated by Deputy Prime Minister Alexander Novak. This decision comes after Saudi Arabia, a significant ally of Russia in the OPEC+ group, announced it would extend its voluntary cut of 1 million barrels per day through August. This pledge to cut exports follows Russia’s earlier commitment this year to reduce its oil production by 500,000 barrels a day from a February baseline and to sustain this level through 2024.

Links That Don’t Suck:

🇺🇸 4th of July sale: Save over $50 on an IBD Digital subscription*

👩🔧 Valve reacts to reports of games getting blocked from Steam over AI issues

🥔 Idaho man takes on party popper world record for Fourth of July

🚀 U.S. considers ATACMS long-range missiles to bolster Ukraine’s fight

🤷 What if you can’t pay back your student loans when payments start again? These are your options.

🥑 Why most restaurant stocks have surprised everyone in 2023

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.