Mostly red today, with most of the day’s activity occurring after the FOMC minutes were released. 🗒️

Today’s issue covers the failed compromise between UPS and the Teamsters, record high yields from Britain, Goldman Sach’s bullish outlook on Netflix, and a quick rundown of today’s FOMC minutes. 📰

Check out today’s heat map:

4 out of 11 sectors closed in the green. Communication services (+1.21%) led, and materials (-2.47%) lagged. 🟥

US May factory orders came in at +0.3% vs. +0.8 expected. Orders are up in five of the past six months. 🏭

SNAP, Verizon, and others are getting close to, or have already achieved, new historical win streaks. 🤖

In crypto news, $COIN experienced some selling pressure following a downgrade from overweight to neutral by Piper Sandler in the crypto market. Despite this, the company has managed to retain significant gains since Monday. Traders and investors flocked to the stock after learning that prominent entities like BlackRock and Fidelity refiled their spot BTC ETF applications with the SEC, identifying their surveillance partnership(s) with Coinbase. ₿

Other symbols active on the streams included: $RIVN (+4.01%), $ALLR (+36.03%), $META (+3.48%), $MRNA (+1.96%), and $CLSK (+9.86%). 🔥

Here are the closing prices:

| S&P 500 | 4,446 | -0.20% |

| Nasdaq | 13,791 | -0.18% |

| Russell 2000 | 1,872 | -1.26% |

| Dow Jones | 34,288 | -0.38% |

In fair Taxifornia, where we lay our scene, the Montagues and Capulets of the shipping realm engaged in a dramatic contract feud. ⚔️

The Teamsters Union, waving their proverbial swords, accused United Parcel Service (UPS) of walking away from negotiations. UPS swiftly retaliated, claiming the union had halted the talks. Verily, ’twas a battle of words!

As the sun rose upon the warring factions, they unleashed their salvos in early morning statements. Their aim? To reach an agreement and avert a strike before the month’s end, when the current contract expires.

Alas, the shares of the parcel delivery company suffered a 2.3% blow in the skirmish.

Already, the workers of UPS have given their blessing for a strike if the talks crumble. ‘Tis a dire threat, for it would be the first strike since 1997, a mighty clash that lasted fifteen days. With millions of daily deliveries hanging in the balance, both sides yearn for a finalized deal. 😱

But alas! The dance of negotiation has faltered. The Teamsters claim UPS made an offer unanimously rejected and withdrew from the bargaining table. In response, UPS brandishes its historic offer and beckons the union to return. Verily, a wrong road has been chosen, cries the Teamsters’ General President, Sean O’Brien.

Memories of the past doth haunt them, for the national strike of 1997 brought chaos, cost the company a hefty sum of $850 million, and sent customers fleeing to rivals. UPS attempted to sweeten the deal, but the Teamsters deemed it insufficient, demanding greater rewards for the brave workers who risked their lives during the pandemic.

Yet, refusing to negotiate, especially when the finish line is within reach, spreads unease among employees and customers alike, threatening to disrupt the realm of the U.S. economy, UPS warned.

Alas, the feud continues, and only time shall reveal the fate of these star-crossed negotiators. 🌟

Economy

Gilty As Charged

Highest yields since 2007? 🤯

In a significant development that reflects the shifting tides of the financial market, the United Kingdom Debt Management Office recently conducted a government bond auction, resulting in the sale of £4 billion ($5.08 billion) worth of bonds. Notably, this auction offered an annual return of 5.668%, marking the highest yield seen in the gilt market since 2007.

The robust demand, at 2.77 times the volume of offer, compared favorably to the previous auction held on June 7, when it stood at 2.34 times.

To find a comparable yield level, we’d have to go back to June 2007 when a similar five-year gilt auction took place, with an average yield of 5.790% on the sale of £2.5 billion.

A prior instance of a significant yield was recorded in September 1999 when the sale of £2.7 billion in 10-year gilts garnered an average yield of 5.694%.

The Bank of England’s latest projections indicate a gradual decline to just over 5% by year-end and a subsequent drop below 2% by early 2025. Consequently, the real inflation-adjusted return for bond investors is anticipated to be considerably lower than what was observed during the late 1990s, when similar nominal yields were prevalent.

As market expectations regarding further rate hikes from the Bank of England persist, investors are demanding greater returns, as evidenced by the strong performance of this government bond auction. These developments highlight the dynamic nature of the financial landscape and the continued impact of evolving market conditions on bond yields and investor sentiment. ⏫

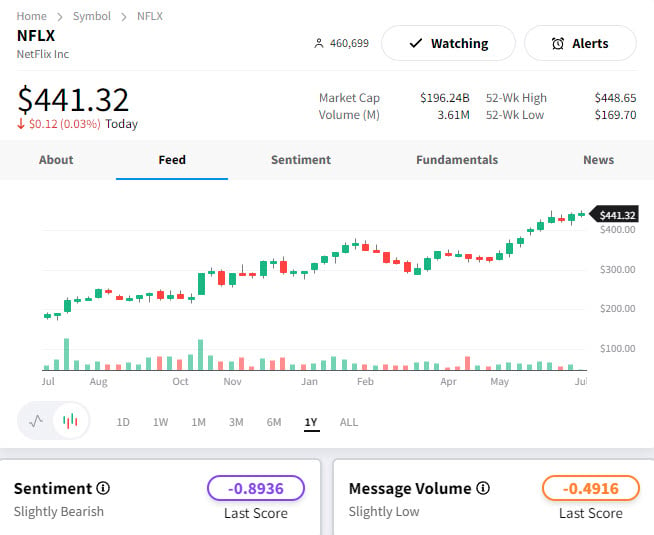

$NFLX‘s recent crackdown on password-sharing has sparked family disputes over streaming bills, but it has also generated positive effects for the company’s stock. 😆

Goldman Sachs ($GS), joining a growing list of Wall Street firms, now considers the streaming giant a more attractive buy due to its advancements in password enforcement.

In a note issued by Goldman Sachs analyst Eric Sheridan, he praised Netflix’s execution of the password-sharing initiative, the resurgence of content creation, and the reduced competition from traditional media companies. This prompted Sheridan to upgrade the stock from Sell to Neutral and raise the price target from $230 to $400.

Over the past year, Netflix has attracted 5 million monthly active users to its ad-supported tier and experiences new subscriptions in the US after implementing password-sharing restrictions. As a result, Netflix’s stock has surged, witnessing a remarkable 135% increase since Goldman Sachs issued its sell rating.

Goldman Sachs envisions a scenario where 40 million sharers become add-on members, generating $7.99 per month, while 30 million sharers transition to the ad-supported tier, yielding an average monthly revenue of $15 per user.

Goldman Sachs envisions a scenario where 40 million sharers become add-on members, generating $7.99 per month, while 30 million sharers transition to the ad-supported tier, yielding an average monthly revenue of $15 per user.

These estimations lead Goldman Sachs to project a revenue increase from $31.62 billion in 2022 to approximately $49 billion in 2025. 😱

Economy

FOMC Minute Highlights

Here’s a quick run-down of what today’s FOMC notes revealed. If you want to read the behemoth of the text yourself, you can find it here.

- Most Federal Reserve policymakers at the June meeting believed it was appropriate to maintain the benchmark interest rate unchanged due to the need to assess the impact of previous tightening measures.

- Inflation above the 2% target rate led committee members to consider maintaining a restrictive monetary policy stance going forward.

- The latest projections indicate that FOMC members expect the federal-funds rate to reach 5.6% by year-end, suggesting the possibility of two more quarter-point rate hikes this year.

- The minutes highlight uncertainty around the economic outlook and inflation levels, and there is an acknowledgment of the potential for a mild and short recession.

- Concerns exist regarding the banking sector and the potential for credit tightening due to weakness in this area.

- Future policy decisions will be made based on available information, and the possibility of consecutive rate increases has not been ruled out.

- The Federal Reserve aims to remain restrictive until inflation shows signs of easing and is on a path to 2%, emphasizing the current distance from that scenario.

Bullets

Bullets From The Day:

💰 If you don’t have it, it’s not yours. A recent court ruling mandated two precious metals companies, Argent Asset Group, and First State Depository Company, to pay a substantial sum of nearly $146 million as restitution and penalties. The court found the companies, owned by Robert Higgins, guilty of engaging in a fraudulent and deceptive scheme related to the storage of over 500,000 American Silver Eagle coins. These companies allegedly promised to safeguard the coins on behalf of customers but failed to produce them when investigators inspected the supposed storage vaults. The US financial watchdog, the Commodity Futures Trading Commission (CFTC), accused Higgins’ companies of operating fraudulent silver leasing programs, namely the Maximus Program and the Silver Lease Program, from 2014 to 2022. According to the CFTC, the companies misappropriated funds and silver worth at least $7 million from approximately 200 customers.

🗣️ $SNAP experienced a 1.1% surge during Wednesday’s afternoon trading session, indicating a potential record-setting win streak. The stock has enjoyed an 18.8% increase throughout nine consecutive sessions, surpassing the previous record of eight sessions set in June 2020 and matched earlier this week. This winning streak is also on track to become Snap’s most impressive nine-day stretch of gains since March 6, 2023, when it rose by 18.9%. The surge in Snap’s stock coincides with the upcoming launch of $META‘s new social media app, Threads, which some anticipate could rival Twitter.

🛢️ Kuwait will be pumping more oil. Kuwait’s Minister of Oil has revealed that the country is poised to achieve an oil production capacity of 3.2 million barrels per day (BPD) by the end of 2024 while emphasizing that Kuwait has no intentions of seeking an increase in its OPEC quota. This announcement aligns with the earlier statement by the CEO of Kuwait’s state oil company, who projected that the current production capacity, which already exceeds 2.8 million BPD, will rise to 3 million BPD by 2025. Despite these optimistic projections, Kuwait remains committed to complying with OPEC’s decisions.

✈️ Treasury Secretary Janet Yellen is embarking on a visit to Beijing. The purpose is to engage in talks with her Chinese counterparts amid escalating tensions between the two countries. While no breakthroughs are expected, Yellen aims to establish better communication with China’s new economic leaders to prevent further deterioration of relations between the world’s largest economies. The visit follows Secretary of State Antony Blinken’s recent trip to Beijing. The strained relationship between the two nations has been exacerbated by trade restrictions, strategic frictions regarding Taiwan and the South China Sea, and recent export limits imposed by both sides.

Links

Links That Don’t Suck:

🎮 Generative AI in games will create a copyright crisis

💵 Biden administration gives student loan borrowers some leeway when payments restart

🎢 Stalled ride strands passengers upside down for more than four hours

🤖 New York employers must now tell applicants when they encounter AI