Stocks continue to make upward progress as money rotates throughout sectors and industry groups. Notably, the small-cap Russell 2000 closed at nearly one-year highs. Let’s see what else you missed. 👀

Today’s issue covers SoFi’s earnings surprise, automation stock Symbotic’s revenue beat, and a look at Yum! Brands ahead of its quarterly results. 📰

Check out today’s heat map:

8 of 11 sectors closed green. Energy (+1.90%) led, and healthcare (-0.77%) lagged. 💚

Oil and other energy commodities continue to rally, with OPEC output impacted by Saudi Arabia’s 860,000 bpd production cut and Nigeria’s outage. Meanwhile, ExxonMobil is reportedly “actively exploring” entering lithium production and processing as electric vehicle production grows. 🛢️

Despite a continued contraction in China’s factory activity and weak overall economic activity, its stocks quietly continue to rebound on hopes of more government stimulus. In the U.S., July’s manufacturing activity remained subdued, with many measures stuck in contraction territory. 🔺

Cannabis stocks continue to catch a short-term bid as speculation spreads. But in industry news, producers Cresco Labs and Columbia Care mutually terminated their $2 billion merger as the U.S. pot industry boom remains weaker than many anticipated. 😶🌫️

Disney shares popped 3% after tapping the company’s former executives, Kevin Mayer and Tom Staggs, as consultants to strategize its ESPN plans. 📺

New Relic jumped 13% on news that Francisco Partners & TPG will take the company private in a $6 billion all-cash deal. 💰

Johnson & Johnson shares fell 4% after a judge rejected its second attempt to limit talc-related suits through bankruptcy. ❌

And Archer Aviation soared 41% after securing an eVTOL purchase contract worth up to $142 million from the U.S. Air Force. 📈

Other symbols active on the streams included: $AFRM (+12.28%), $PLTR (+11.40%), $BB (+7.37%), $PLUG (+10.62%), $TUP (+38.64%), $YELL (+148.97%), $APLS (-19.58%), and $ANET (+13.65%). 🔥

Here are the closing prices:

| S&P 500 | 4,589 | +0.15% |

| Nasdaq | 14,346 | +0.21% |

| Russell 2000 | 2,003 | +1.09% |

| Dow Jones | 35,560 | +0.28% |

Earnings

SoFi’s Rebound Continues

Neobank SoFi Technologies has become extremely popular among retail traders and experienced a massive run so far this year. That strength continued today as the company reported better-than-expected results. Let’s take a look. 👇

Looking at the headline numbers, a $0.06 per share loss on adjusted net revenue of $488.8 million topped the expected ($0.07)and $474 million. New member additions grew by 584,000 to roughly 6,240,000. And new product additions of 847,000 brought the total to 9,401,000. 🏦

The company also highlighted several “financial inflection points” in its consolidated results.

- Adjusted EBITDA exceeded share-based compensation expenses for the second consecutive quarter.

- Financial Services segment contribution loss improved from $24 to $4 million QoQ.

- GAAP net loss was cut in half YoY from $95.8 million to $47.5 million.

SoFi’s CEO Anthony Noto told Barron’s that “…all the pieces have come together in financial results…” during the quarter. Additionally, his tweet below references another major milestone for the company, with more than 50% of revenue growth coming from non-lending segments. 🤩

Interesting $SOFI earnings day fact: Q2'23 marks the first time 50% of our growth in revenue dollars year-over-year was attributable to Technology Platform and Financial Services business segments (our **non-lending** segments).

— Anthony Noto (@anthonynoto) July 31, 2023

Ultimately, the company says it’s on track to achieve positive contribution profit in all three business segments (lending, technology platform, and financial services) by the end of the year. Additionally, it previously guided for 2023 adjusted net revenue of $1.96 billion to $2.02 billion but raised both ends of that range by a marginal $0.01 billion. Analysts expected $1.991 billion. 🔺

Overall, the student loan repayment process restarting and strength in its personal loan business continue to provide a tailwind for the business. Although significant uncertainty remains about the student loan forgiveness program, the company will benefit from payments beginning again and consumers potentially looking to refinance their loans.

Including today’s 20% rally, $SOFI shares are back above their IPO level and nearly 170% off their December lows. With prices now towards the middle of their long-term range, investors will reassess how closely the business’ fundamentals reflect the current stock price. 🕵️

After this earnings report, the stock already received some upgrades from Wall Street. With nine hold and three sell ratings, we’ll see if the squeeze continues in the coming days. 😬

Company News

Customers Bummed As Yum Soared

Yum! Brands is making another attempt at breaking through its 2022 highs after eighteen months of consolidation. And traders are wondering whether its earnings report before the bell on Wednesday will be a catalyst for the bulls. 🤔

Competitors like McDonald’s and Restaurant Brands International are also sitting near all-time highs, with the former already reporting and the latter expected on August 8th. As a result, these stocks are on traders’ and investors’ radars. 🧭

Meanwhile, one of the company’s main brands is currently under fire from consumers who feel its advertising has deceived them. H/T to Rob Freund on Twitter for bringing this false advertising class action lawsuit against the company to our attention. 👀

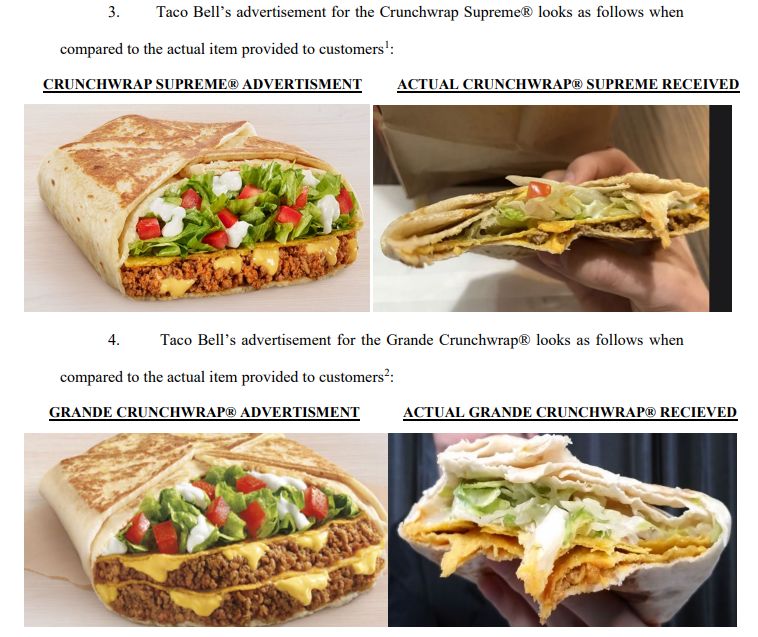

The entire lawsuit is available here but references pictures of the product advertised vs. what a typical customer allegedly receives. Specifically, part of the lawsuit states that “Taco Bell materially overstates the amount of beef and/or ingredients contained in its advertisements for the Overstated Menu Items by at least double the amount.”

The class action lawsuit is more of a funny aside than a major business catalyst. But overall, the market will be watching Wednesday’s earnings to see if this chart can ultimately break out to new all-time highs. If it does, the next round of tacos is on the bulls! 🌮

Earnings

Symbotic Soars On Revenue Beat

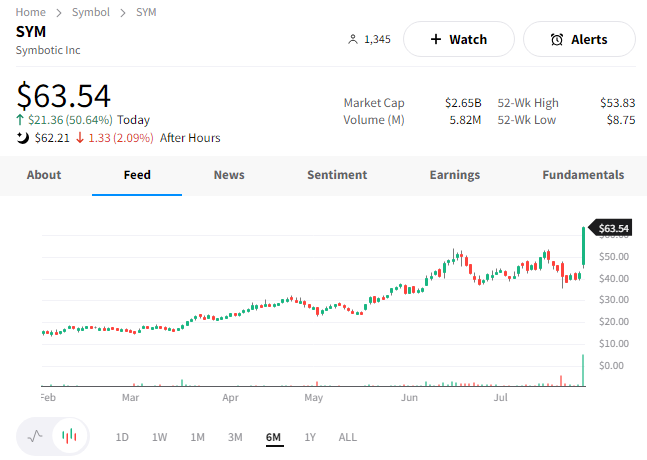

The robotics warehouse automation company Symbotic soared over 50% after reporting better-than-expected results. 💪

The supply-chain robotics supplier lost $0.07 per share, more than double its $0.03 loss a year earlier. However, that was better than the $0.08 per share loss anticipated by analysts.

What really got the stock going was its revenues of $311.8 million, which smashed its own guidance and the $261 million consensus estimate. 🤩

The company expects $290 to $310 million in fourth-quarter revenue and adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) from $0 to $3 million.

The artificial intelligence (AI) and robotics bull market continues. Traders will be watching $SYM in the coming days as the market digests this quarter. 👀

Bullets

Bullets From The Day:

📦 Amazon achieves its fastest Prime delivery speeds ever. Ahead of this week’s quarterly earnings, the company said it’s progressing towards making same-day and one-day delivery the standard in the U.S. Its fulfillment and transportation network investments continue to pay off, with Amazon planning to double its same-day delivery sites within the next two years. It hopes that speed and convenience will continue to make customers choose it over local stores or big-box retailers. CNBC has more.

🏭 Foxconn investing $194 million in new India plant. The Taiwanese manufacturer has signed a deal with Tamil Nadu to invest 16 billion rupees in a new electronic components manufacturing facility that will create 6,000 jobs in the southern state of India. It plans to quadrupole the workforce at its Tamil Nadu iPhone factory by late 2024 as it diversifies beyond China. More from Yahoo Finance.

🎰 Fox is shutting down its gambling business. Just four years after becoming the first major media company to launch its own branded betting offering, Fox is pulling the plug on its partnership with Fanduel owner Flutter Entertainment. It will take place in phases and complete by the end of August, with Flutter keeping Fox Bet’s customer database and licenses and Fox retaining the brands. The Hollywood Reporter has more.

🛒 Walmart buys out Tiger Global’s stake in India’s Flipkart for $1.4 billion. The big box retailer has increased its control over Indian e-commerce firm Flipkart by buying out hedge fund Tiger Global and venture capital firm Accel’s remaining stakes. The transaction occurred at a $35 billion valuation, down from the peak $38 billion valuation the firm attained in 2021. Executives say it will be crucial to meeting Walmart’s target of doubling the gross merchandise volume it sells in foreign markets to $200 billion over the next five years. More from Reuters.

☢️ The first U.S. nuclear reactor built from scratch enters operation. Unit 3 at Plant Vogtle has completed testing and become commercially operable, about seven years late, and $17 billion over budget. While its full output of 1,100 megawatts of electricity can power 500,000 homes and businesses, the high cost makes it an expensive solution in the country’s attempt to achieve a carbon-free future. AP News has more.

Links

Links That Don’t Suck:

🗳️ Banks vote to limit accounting of emissions in bond and stock sales

🤑 Mega Millions jackpot soars over $1 billion: when is the next drawing?

🏢 Musk says X won’t leave San Francisco despite city facing ‘doom spiral’

🤦 Elon Musk’s X Corp. seen taking down giant glowing sign in San Francisco

🥴 The death of hobbies: how side hustles turned everyone’s leisure activities into work

💵 Biden administration launches new SAVE student loan repayment plan. Here’s how to apply