Welcome to the Stocktwits Top 25 Newsletter for Week 45 of 2023!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD) and tracks their performances over time.

Here are the Stocktwits Top 25 Lists for Week 45:

P.S. To help you understand this data further, check out our FAQ page, and feel free to reach out if you have questions!

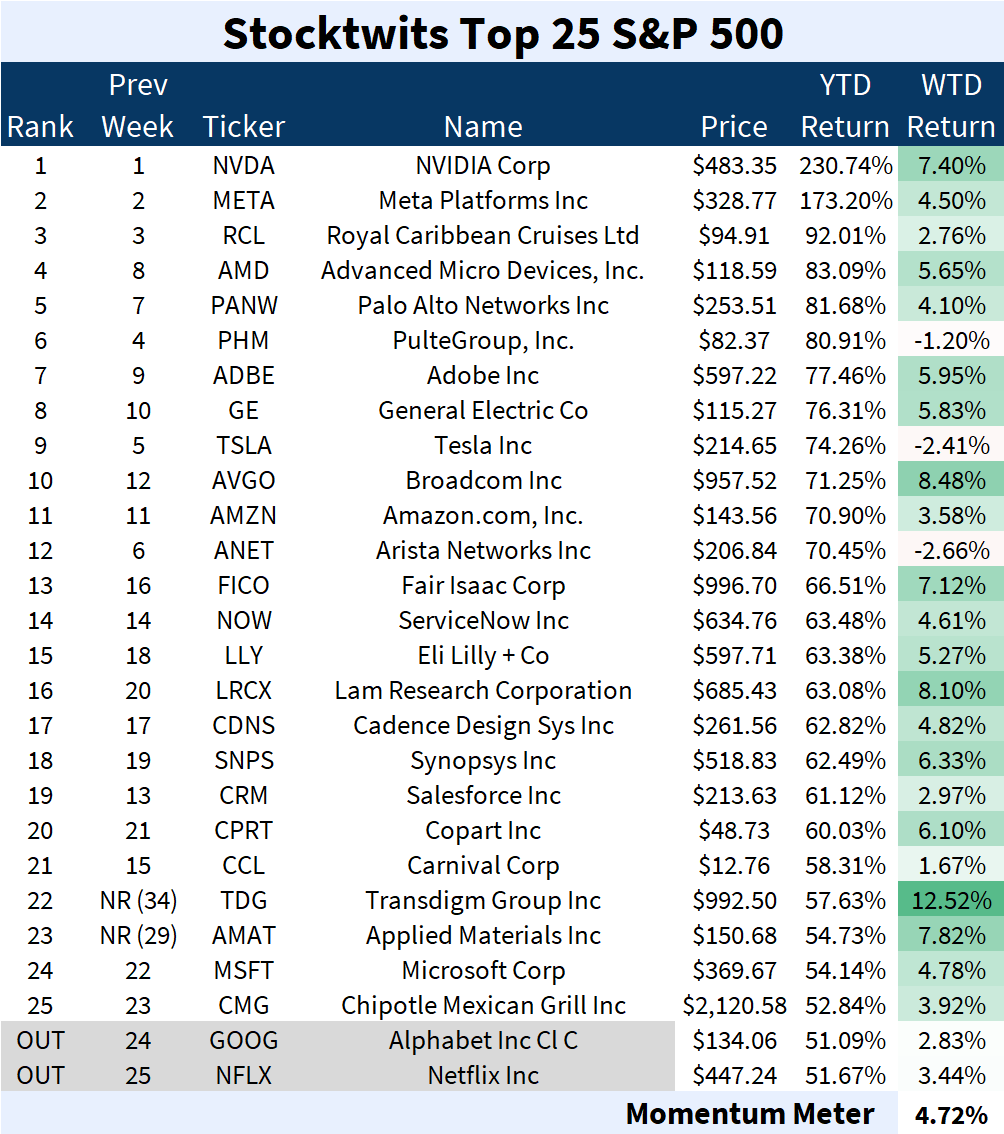

Standard and Poor's 500

ST Top 25 S&P 500

The S&P 500 Top 25 list (+4.72%) outperformed the S&P 500 index (+1.31%).

There were two major changes to the list this week.

Joining: Transdigm Group (+12.52%) and Applied Materials (+7.82%).

Leaving: Alphabet Inc Class C (+2.83%) and Netflix (+3.44%).

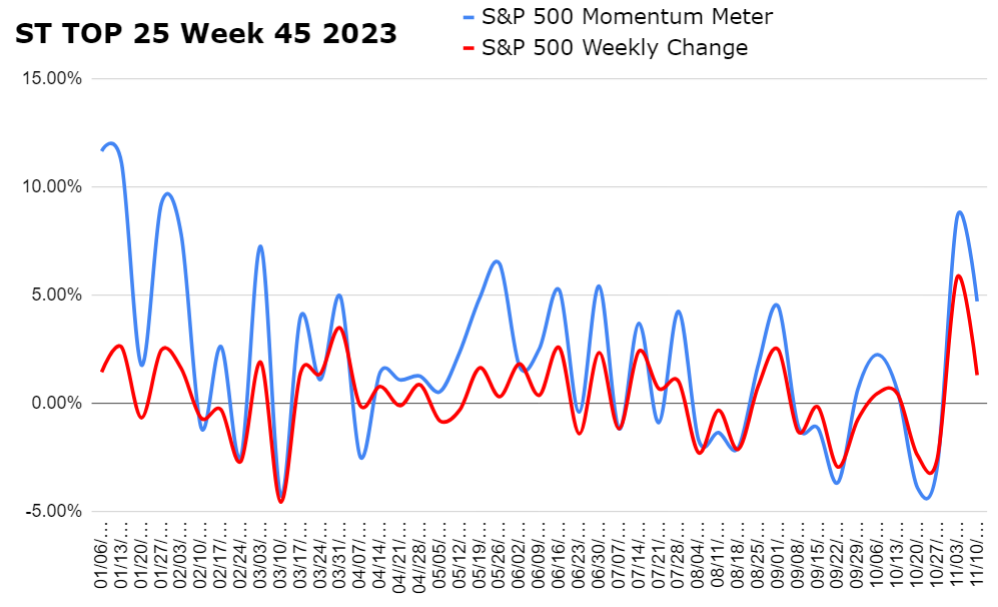

Check out how the momentum meter has performed vs. the S&P 500 index this year:

NASDAQ 100

The Large-Cap Nasdaq 100

The Nasdaq 100 Top 25 list (+4.52%) outperformed the Nasdaq 100 index (+2.85%).

There were two major changes to the list this week.

Joining: Booking Holdings (+7.54%) and Marvell Technology (+6.35%).

Leaving: The Trade Desk (-19.06%) and Airbnb (-3.66%).

RUSSELL 2000

The Growth-Centric Russell 2000

The Russell 2000 Top 25 list (+4.01%) outperformed the Russell 2000 index (-3.15%).

There were four major changes to the list this week.

Joining: Duolingo (+32.76%), Bluegreen Vacations Holdings (+107.18%), Oscar Health (+24.08%), and Dream Finders Homes (+2.35%).

Leaving: Applied Digital Corp (-14.10%), ThredUp Inc (-46.22%), Skywest Inc (-3.98%), and Arlo Technologies (-10.75%).

🐶🐶🐶

ST Top 25 TOP DAWG OF THE WEEK 🐶

The Top 25 lists’ Top Dawg was Bluegreen Vacations Holdings, which rallied 107.18%. 📈

The small-cap vacation property operator doubled this week on news that Hilton Grand Vacations will buy the company in a $1.5 billion deal, including debt. Shareholders of Bluegreen Vacations will receive $75 in cash per share, valuing the company at $1.28 billion. That’s more than double where the stock closed the previous trading day. 🏨

Hilton is making the acquisition to attract younger customers for its timeshare properties and expand its offerings. The deal is expected to close during the first half of 2024, increasing Hilton Grand’s membership by 41% and portfolio of properties by 33%. 🔺

$BVH is up 182.44% YTD.

See Y’all Next Week 🤙