Individual stocks remain in focus as the major stock market indexes pause and look to close out one of their best months in decades. Let’s see what you missed. 👀

Today’s issue covers GM throwing a bone to shareholders, Foot Locker taking a step forward, and why Petco’s turnaround seems Farfetch(ed). 📰

Here’s today’s heat map:

6 of 11 sectors closed green. Real estate (+0.76%) led, & consumer staples (-0.81%) lagged. 💚

The U.S. economy grew at a stronger pace than expected in the third quarter, rising to a 5.2% annualized pace. Strong business investment and government spending pushed it above estimates of 5%. Wholesale inventories fell 0.2% MoM in October, while retail inventories were flat. 💪

Technology stocks were in focus after earnings, with CrowdStrike, Workday, NetApp, Salesforce, Snowflake, and Hewlett Packard Enterprise all rising sharply. 👀

Dollar Tree shares rose despite earnings and sales missing expectations, driven by weak demand. With that said, its current quarter outlook matched estimates as Wall Street gets used to the same old “cautious consumer” narrative. 💵

Energy giant Phillips 66 jumped 4% after Elliott Investment Management revealed a roughly $1 billion stake and pushed for the appointment of two directors. Meanwhile, Fluence Energy soared 24% after its fourth-quarter results topped expectations. 🛢️

Vivos Therapeutics soared over 800% after it received the first-ever FDA 510(k) clearance for oral device treatment of severe obstructive sleep apnea. In other healthcare news, Cigna and Humana shares both dropped on reports that they’re in talks to merge. 🧑⚕️

Crypto’s rally remains intact, but traditional brokerages continue to back away from the space. SoFi is the latest fintech to shutter its crypto service. However, it’s the first following the introduction of the Fed’s “novel activities supervision program” that imposes stringent requirements on how banks interact with emerging financial technologies like crypto. ₿

Other symbols active on the streams: $GME (+20.46%), $QS (+10.12%), $PSTG (-8.76%), $NTNX (+9.52%), $MULN (-3.60%), $CDT (+72.88%), $PACI (+148.32%), & $BITF (+11.94%). 🔥

Here are the closing prices:

| S&P 500 | 4,551 | -0.10% |

| Nasdaq | 14,258 | -0.16% |

| Russell 2000 | 1,804 | +0.61% |

| Dow Jones | 35,430 | +0.04% |

Earnings

Foot Locker Takes A Step Forward

The last two times we spoke about Foot Locker, the stock wasn’t faring well. Inventory and other costs weighed on earnings while the company struggled to spur demand in a weaker consumer environment. And shares were plummeting. 😬

Well, the stock is back in the news today, but for a good reason. Its adjusted earnings per share of $0.30 on revenues of $1.99 billion topped expectations of $0.21 and $1.96 billion.

Same-store sales fell 8% YoY, reflecting ongoing consumer softness, a changing mix of vendors, and a 3% impact due to closing some Champs stores. Despite all that, the metric came in better than the 9.7% decline analysts expected. Digital sales fell 5.6% YoY, though excluding Eastbay, which wound down last year, digital sales were actually up 0.4%. 🔺

Inventory remains an issue for the company, with it rising 10.5% YoY, though executives said about half that was strategic as it stocks up for the holiday season. Gross margins remained under pressure due to higher promotional activity and shrink. To spur demand, it signed a multiyear deal with the NBA to gain on-court and social media exposure and will expand to India next year. 👀

Overall, many of the company’s headwinds remain in place, but it’s having slightly more success in addressing them. “Not as bad” results were enough to get the beaten-down stock going, with $FL shares rising 16% on the day to 6-month highs. 👍

Stocktwits’ Trading Competition lets you compete with traders from across the country. Watch as you rise in the ranks towards the top spot on the leaderboard! Do you have what it takes to be #1?

Earnings

$WOOF Turnaround Seems Farfetch(ed)

The title of this post combines two popular retail stocks that continue to make investors say “woof.” Those are Petco and Farfetch. Let’s see why they’re back in focus. 👀

First is pet food retailer Petco Health & Wellness, which cut its full-year guidance after posting a third-quarter loss. ✂️

Executives said they now expect full-year adjusted earnings per share of $0.08, down significantly from their summer guidance of $0.24 to $0.30 per share. Their EBITDA forecast also fell about 20% from a $460-$480 million range to $400 million. That’s despite the company expecting the same $6.15-$6.28 billion in revenues. 📊

CEO Ron Coughlin said the company is still navigating a challenging consumer environment. However, investors are running short on patience as the company’s turnaround looks less and less likely. Many are arguing that if it was unable to run a profitable, growing business when the environment was good, it’s unlikely they’ll be able to do so in a much more difficult one.

$WOOF shares fell 29% to new all-time lows on this news. 👎

Petco, Chewy, and other pet-related retailers have struggled in a post-pandemic world. And many investors are looking elsewhere for opportunity. Even the online marketplace for pet care services, Rover Group, delivered paltry returns after being acquired by Blackstone for $2.3 billion. 💰

$ROVR shares rose 29% on the day, but its total return chart shows that it’s effectively returned nothing to investors who held on since its SPAC was established. Rough. 🙃

Nevertheless, we move on to luxury fashion and beauty product e-commerce company Farfetch, which is the second part of our title. 👜

The business and stock has struggled mightily since the pandemic, with investors hoping it would receive a lifeline soon. However, that hope was pulled away today after Cartier-owner Richemont said it does not see itself lending to or investing in the company further. It’s currently Farfetch’s top shareholder and was reportedly part of talks to help the company go private.

Additionally, the company surprised investors yesterday by saying it would not report third-quarter earnings as planned. Executives did not provide the market with a new date for investors to expect the report to be issued. 🤷

The combination of these announcements sent $FTCH shares plummeting another 54% to new all-time lows, as investors doubt its ability to turn the business around. 📉

Company News

GM Throws A Bone To Shareholders

Just weeks after securing a deal with the United Auto Workers (UAW) union that brought its employees back to work, General Motors is making a big move to appease investors.

The automaker announced today that it’s initiating a $10 billion buyback, increasing its dividend by 33%, and reinstating its full-year guidance. That’s despite a roughly $1.1 billion in EBITDA-related impact from the six weeks of labor strikes. 💰

Executives said the company is finalizing a 2024 budget that will “fully offset the incremental costs of our new labor agreements.” That effectively means that GM is looking to make significant cost cuts by improving operational efficiency. It also means it’ll cut back on some of its investment in electric vehicles and projects like its self-driving subsidiary Cruise.

CEO Mary Barra told investors that the stock price is “disappointing to everyone.” However, combining these short-term and long-term plans shows the company’s commitment to delivering shareholder value. 😓

Its accelerated buyback program is expected to be completed by the end of the fourth quarter, with the company having $1.4 billion of additional capacity for opportunistic share repurchases throughout 2024. Its quarterly dividend payment will be $0.12 per share. And its planned cost cuts and strong operational free cash flow will keep its liquidity and credit ratings safe.

Essentially, today’s move was GM’s attempt at appeasing investors and buying itself more time to figure out its electric vehicle transition. The company’s internal combustion engine (ICE) business remains strong, but it’s still unclear how it will compete in the electric vehicle space while balancing these priorities. ⏳

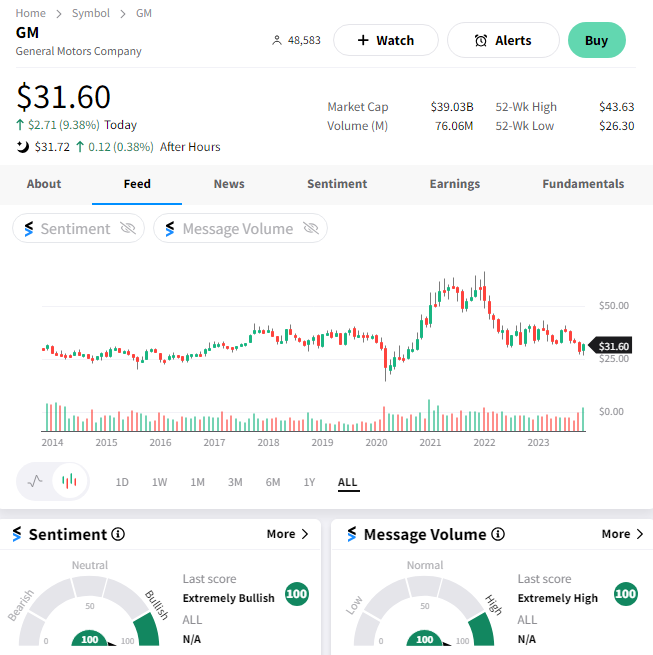

$GM shares rose nearly 10% today but fell roughly 60% from their 2022 peak through the end of last month. Its historical performance makes it clear that financial engineering can only do so much for the stock. Eventually, it needs to tackle these broader business concerns. 😬

Meanwhile, the electric vehicle industry news remains robust. Here are some stories from today. 📰

- China’s Huawei is pushing its tech into the space with new car and automaker partnerships.

- Toyota Motors plans to sell $2 billion worth of its stake in auto-parts supplier Denso to further its investment in EVs.

- The Biden Administration may limit China’s role in the U.S. EV market by disqualifying some vehicles from the $7,500 consumer subsidy.

- The UAW launched union campaigns at Tesla and twelve other U.S. automakers.

Bullets

Bullets From The Day:

💳 Apple plans to nix its Goldman Sachs credit card partnership. The consumer tech giant has given the bank a proposal to end its credit and savings account partnership within the next 12 to 15 months, in a move that would effectively end one of the highest-profile partnerships in consumer banking. Apple, which currently offers a credit card and savings account through the wallet app on iPhones, would need to find a new banking partner to run the products’ back end. CNBC has more.

🏚️ European property giant declared insolvent after failing to secure fresh funding. The property and retail giant is the biggest casualty so far of Europe’s property crash. Controlled by Austrian magnate Rene Benko, the group is an owner of New York’s Chrysler Building as well as several high-profile projects and department stores across Germany, Austria, and Switzerland. It currently owes roughly 5 billion euros, with analysts worried about the impact to investors and lenders, as well as property sales triggering a wider drop in industry prices. More from Reuters.

🎮 Netflix leans into gaming with a trio of Grand Theft Auto games. The streaming giant is boosting its gaming strategy with the help of one of the best-selling video game franchises of all time. The three classic titles in the Grand Theft Auto series will be available to Netflix customers on mobile platforms at no additional cost beginning on December 14. The news comes a day after YouTube rolled out thirty playable mini-games for its premium users. Meanwhile, ByteDance is pulling back from gaming as it refocuses resources on its core businesses. Variety has more.

🚕 Uber will now list London’s famed black cabs. The transportation company has won another battle in its effort to win over the taxi industry, with all 15,000 of London’s cab drivers having the opportunity to sign up for Uber trip referrals. It adds to a growing list of taxi fleet owners in New York City, Paris, Rome, and Los Angeles that the company has successfully courted. However, some organizations like the Licensed Taxi Drivers’ Association (LTDA) have doubts that cab drivers will want to sign up for the service due to Uber’s mixed reputation and service record. More from The Verge.

🏀 Mark Cuban working to sell a majority stake in the NBA’s Dallas Mavericks. The billionaire entrepreneur bought the team for roughly $285 million in 2000 and is set to sell a majority stake in the franchise to the family that runs the Las Vegas Sands casino company at a $3.5 billion valuation. The parties are looking to close the transaction by year-end, with Miriam Adelson selling $2 billion of her shares in Las Vegas Sands to help fund the purchase, leaving her with a 51.3% stake in the casino. Cuban will retain control of basketball operations and has denied rumors that he is selling the team to run for President in 2024. AP News has more.

Links

Links That Don’t Suck:

👿 The real villians of today’s housing market

🔬 FDA investigates a cutting-edge cancer treatment that may cause cancer

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.