Just weeks after securing a deal with the United Auto Workers (UAW) union that brought its employees back to work, General Motors is making a big move to appease investors.

The automaker announced today that it’s initiating a $10 billion buyback, increasing its dividend by 33%, and reinstating its full-year guidance. That’s despite a roughly $1.1 billion in EBITDA-related impact from the six weeks of labor strikes. 💰

Executives said the company is finalizing a 2024 budget that will “fully offset the incremental costs of our new labor agreements.” That effectively means that GM is looking to make significant cost cuts by improving operational efficiency. It also means it’ll cut back on some of its investment in electric vehicles and projects like its self-driving subsidiary Cruise.

CEO Mary Barra told investors that the stock price is “disappointing to everyone.” However, combining these short-term and long-term plans shows the company’s commitment to delivering shareholder value. 😓

Its accelerated buyback program is expected to be completed by the end of the fourth quarter, with the company having $1.4 billion of additional capacity for opportunistic share repurchases throughout 2024. Its quarterly dividend payment will be $0.12 per share. And its planned cost cuts and strong operational free cash flow will keep its liquidity and credit ratings safe.

Essentially, today’s move was GM’s attempt at appeasing investors and buying itself more time to figure out its electric vehicle transition. The company’s internal combustion engine (ICE) business remains strong, but it’s still unclear how it will compete in the electric vehicle space while balancing these priorities. ⏳

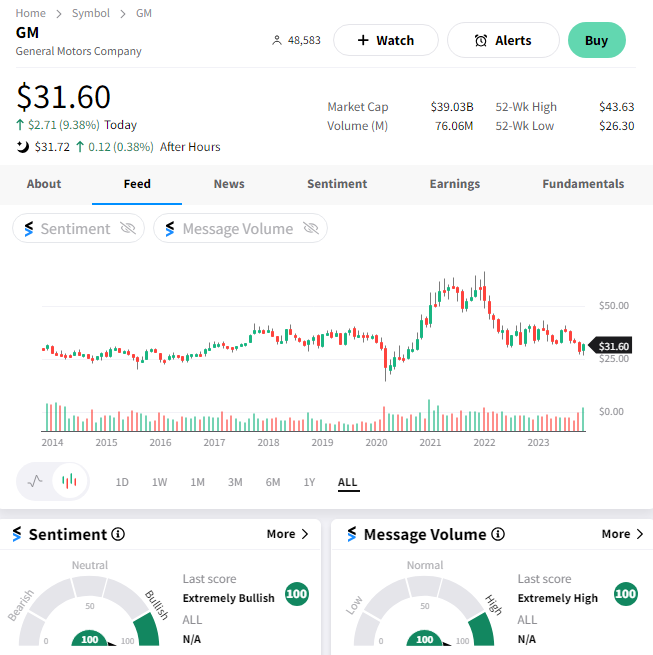

$GM shares rose nearly 10% today but fell roughly 60% from their 2022 peak through the end of last month. Its historical performance makes it clear that financial engineering can only do so much for the stock. Eventually, it needs to tackle these broader business concerns. 😬

Meanwhile, the electric vehicle industry news remains robust. Here are some stories from today. 📰

- China’s Huawei is pushing its tech into the space with new car and automaker partnerships.

- Toyota Motors plans to sell $2 billion worth of its stake in auto-parts supplier Denso to further its investment in EVs.

- The Biden Administration may limit China’s role in the U.S. EV market by disqualifying some vehicles from the $7,500 consumer subsidy.

- The UAW launched union campaigns at Tesla and twelve other U.S. automakers.