Happy Friday, ladies and gentlemen! The week ended on a strong note, showing that the crypto industry will only grow larger over time. After getting hit by the waves of sanctions across the world, Russia is looking into accepting Bitcoin as a payment method. In response to this news, the crypto market cap reached over $2 trillion — read more below.

Bitcoin ($BTC.X) rose 2%, trading around $45,000. Ether ($ETH.X) crossed the $3,100 mark with a slight jump. All other major cryptocurrencies surged until falling in the afternoon.

Today’s stories:

- Ethereum loses its dominance in one key metric

- Russia mulls Bitcoin for oil payments

- Coinbase’s support for Cardano causes the token to rise

Here’s how the crypto market is looking:

| Bitcoin (BTC) |

$44,390.01

|

+0.95% |

| Ether (ETH) |

$3,107.76

|

+0.12% |

| Binance Coin (BNB) |

$411.36

|

-0.73% |

| XRP (XRP) |

$0.8268

|

-2.32% |

| Cardano (ADA) |

$1.10

|

-4.52% |

| Terra (LUNA) |

$90.80

|

-2.54% |

| Solana (SOL) |

$98.37

|

-4.01% |

| Avalanche (AVAX) |

$83.53

|

-4.30% |

| Polkadot (DOT) |

$20.61

|

-2.85% |

| Dogecoin (DOGE) |

$0.1311

|

-4.48% |

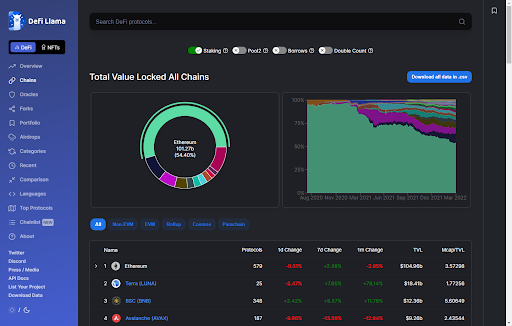

Bitcoin, the world’s largest and most expensive cryptocurrency, is sitting large-and-in-charge at a market capitalization of $833 billion. However, when it comes to new chains like Ethereum, Terra, Solana, and others, seasoned crypto investors are increasingly looking away from this tried-and-true figure in favor of a metric which more closely reflects usability, trust, and value circulating on a blockchain. It’s called Total Value Locked (TVL).

TVL is a metric which measures the total amount of money sitting in DeFi protocols on a blockchain. Increasingly, TVL is measured against market capitalization to rationalize or substantiate the market capitalization of a chain – it’s one of hundreds of ways that crypto maximalists have thought up to “value” a chain, find up-and-comers, and decide how to invest. However, if you’re lost and just YOLOing into coins – we’re pretty sure that’s okay too (nobody said this had to be a science.)

However, maybe these mathy crypto bros have a case: TVL was first used specifically on Ethereum, the chain which took blockchain from “mere payment network” to a multi-faceted foundation for systems. In the early days of Ethereum DeFi, the TVL of protocols spoke – on some level – to the trust, confidence, and outlook that investors saw in it.

For years, Ethereum was the only game in town. But now, since we live in a world of many “Ethereum Killers”, investors have started tracking TVL of other, competing chains.

In January 2021, Ethereum’s TVL was just $22.57 billion – and it represented 97% of all value locked on chains tracked at the time, according to DeFi Llama. As the proverbial crypto pie has grown, Ethereum’s TVL has risen to over $100 billion. However, its TVL dominance has fallen. In fairness, that’s to be expected – more chains = more competition. At the peak of Ethereum’s dominance, it had to share the pie with just seven other chains. Today, it shares that pie with 85 tracked chains on DeFi Llama.

However, in fairness to the competition, they’ve never looked so good. In just over 15 months, emergent chains such as Terra, Binance Smart Chain, Avalanche, Fantom, Solana, and Polygon have taken Ethereum’s share of the pie down to just 53.1%, an all-time low notched to little coverage last week. And most of their emergence can be credited to a healthy bout of FOMO, but also an interest among DeFi tinkerers looking for greater yield and lower fees.

Take Terra, for example, which has seen its TVL rise by +77% in the last month: it can credit most of its growth to its high-interest “savings” protocol Anchor, which offers investors 19.5% APY on its $UST algorithmic stablecoin. Terra sits behind Ethereum in TVL dominance, but far below it – at just $18.58 billion in TVL. Other chains such as Polygon and Avalanche can credit a large portion of their growth to trusted Ethereum apps – such as Aave and Curve – extending support to their chain (among others.)

As you might glean from our short, but defiant summary, of the TVL situation: the story of TVL dominance isn’t so much a story of a single chain making a move to “dethrone Ethereum” or solidify itself as the Ethereum killer. Instead, the story of TVL dominance is the story of increased interest in emergent “up-and-coming” chains, the rise of crypto bridges (which help move assets between chains), and a turn away from Ethereum – which could be related to any number of factors.

Nonetheless, Ethereum is squarely in the lead in this niche (but important) blockchain-related race. And if they have anything to say about it, the launch of Eth2 could be a significant catalyst which shifts interest back to the chain that started it all.

After a slew of sanctions, Russia is reportedly considering accepting digital currencies to pay for oil and gas. Yesterday, Pavel Zavalny, the head of the Russia Duma Committee, suggested that Bitcoin could be accepted as payment for the nation’s oil and other resource exports. He said that the government would be open to considering a variety of options for paying for its oil and gas from “friendly” countries.

“We’ve been offering China to switch to transacting in national currencies, such as the Ruble and the Renminbi, for a while now,” he said, according to a translated report of his comments. “With Turkey, that would be the Lira and Ruble. Currency sets can be different; it’s a common practice. You can also trade bitcoins.”

Following the news, cryptocurrency markets jumped, with the global crypto market cap reaching over $2 trillion. Bitcoin crossed the $45,000 mark, while Ether stayed strong at $3,100 after many weeks. Popular altcoins like Cardano, Solana rallied today before a sell-off.

Russia has been slapped with a wave of sanctions since it invaded Ukraine. As the conflict has advanced, Russia has had trouble finding buyers for its crude oil, although China and India had been buying it at a cheaper rate. Russia largely relies on natural resource sales to fuel their economy, which is one reason why the country’s economic regime has struggled.

In the midst of this murky situation, crypto as a payment option may seem appealing. However, analysts believe that it may be more difficult than it seems to use crypto as a payment method.

Let’s take China as an example. It’s no secret that China doesn’t like cryptocurrencies, and that’s why it issued a blanket ban in the country. Similar to that, trading in crypto in India is not cheaper due to heavy government taxes. Now even if Russia mulls trading oil with these “friendly nations” using crypto, it won’t be easy for these countries to switch to digital currencies.

With that said, Russia’s interest in using crypto might not make for the greatest optics – but crypto has remained an impartial player in the Ukrainian-Russian conflict, namely in the way that it has helped people escape the economic turbulence of their countries.

The largest U.S. cryptocurrency exchange, Coinbase, launched Cardano ($ADA.X) staking on its platform this week.

Staking is a way to earn rewards on your crypto. As a proof-of-stake cryptocurrency, Cardano’s network is not secured by mining, but rather by people contributing a portion of their $ADA.X holdings to the network. As a reward, they receive a share of the newly minted ($ADA.X).

Staking can be a lucrative way to “go long” on crypto assets – with investors able to pare the upside and downside of a token while accruing interest on it. Exchanges such as Coinbase offer staking options to allow investors who want to stake their coins to earn these rewards, lesser a fee they take.

Cardano joins Ethereum ($ETH.X), DAI ($DAI.X), Tezos ($XTZ.X), and Cosmos ($ATOM.X) on Coinbase’s yield-earning crypto list. Coinbase says it estimates users who stake Cardano will receive an APY of 3.75% on their assets, which will be paid every five to seven days.

Following the announcement, $ADA.X rose by 13%. This morning, however, the token fell again, trading for $1.09.

Coinbase’s support has helped $ADA.X’s near-term price action, but Cardano’s graphs have looked – like many other cryptos – down and to the left in recent months. Its falling price isn’t just related to changing sentiments in the broader market, either: the network has been criticized on occasion for its structural issues. Namely, when network faced major congestion after adding smart contract to its network last year. It also faced problems when decentralized exchange SundaeSwap brought the network to a standstill after its launch,causing confusion and frustration among users trying to perform swaps and invest in the protocol’s token, $SUNDAE.

In spite of Cardano’s enormous promise, the network places #21 in chains ranked by TVL, with only $412 million circulating around its DeFi ecosystem on just seven protocols. At that rate, Cardano is one of the most overvalued chains – at a 85.65x mktcap/TVL ratio. So while Coinbase’s support might induce investor confidence, Cardano still has to deliver in order to sustain itself as a chain justified in having a top 10 spot.

Tl; DR

Bullets For The Day

⚖️ India passes controversial crypto tax proposal: A controversial tax proposal approved by the Indian Parliament today will see the country’s crypto industry hit with a 30% tax on crypto transactions. Several crypto community members have raised concerns over this decision. Read more in Cointelegraph.

🏭 Bitcoin mining with natural gas: ExxonMobil, the multinational oil and gas company, is operating a cryptocurrency mining program in North Dakota using excess natural gas. According to reports, the company has reached an agreement with Crusoe Energy Systems Inc. to take gas from an oil well site to power crypto mining hardware on-site. Read more in Bloomberg.

🚫 A fake ApeCoin airdrop steals $1 million: In a Twitter phishing scam, Bored Ape Yacht Club (BAYC) profile pictures were hacked, leading to the theft of $1 million through a fake ApeCoin airdrop. Earlier this week, ApeCoin was launched for holders of the BAYC and the Mutant Ape Yacht Club. Read more in Decrypt.