If today’s price action were a sport, the game would be ping pong. 🏓

The market has been all over the place today, down -2.88% this afternoon after trading higher by +2.20%.

In today’s Litepaper, we’ll look at why Bitcoin Ordinals might be on the chopping block, Roblox’s crazy numbers, and a new blockchain network put out by some big, big-name companies (Microsoft, Goldman, and more).

I wanted to throw in a Technically Speaking article today, but we’ll do that on Friday because the action today is quite literally all over the place.

Here’s how the market looked at the end of the trading day:

| TRON (TRX) | $0.069 | 0.20% |

| Monero (XMR) | $155.19 | -0.28% |

| Cosmos (ATOM) | $11.03 | -0.60% |

| Ethereum (ETH) |

$1,858

|

-2.86% |

| BNB (BNB) |

$316.23

|

-3.19% |

| Stellar (XLM) | $0.089 | -3.40% |

| Bitcoin (BTC) | $27,889 | -4.38% |

| Ethereum Classic (ETC) | $18.98 | -4.44% |

| Quant Network (QUANT) | $106.95 | -4.50% |

| Solana (SOL) |

$21.20

|

-4.97% |

| Altcoin Market Cap |

$580 Billion

|

-0.21% |

| Total Market Cap | $1.12 Trillion | -0.33% |

Luke Dashjr, a well-known Bitcoin developer, is on a mission, and he’s not pulling any punches. 👊

He wants to eradicate block ordinals and BRC-20 tokens from the $BTC network.

Bitcoin devs are trying to cancel ordinals pic.twitter.com/FOYCIKTcIS

— Frank (@frankdegods) May 9, 2023

In his scathing proposal, Dashjr lambasts block ordinals and BRC-20 tokens as the main culprits behind the “spam transactions” plaguing the network.

He argues that the NFTs must be annihilated to improve transaction quality and allow the Bitcoin network to function at its best.

But Dashjr won’t stop there. He’s also devising a spam filter that specifically targets ordinals and BRC-20 tokens.

This filter would help obliterate what he considers spammy transactions.

We’ll update you as this story develops. 🗞️

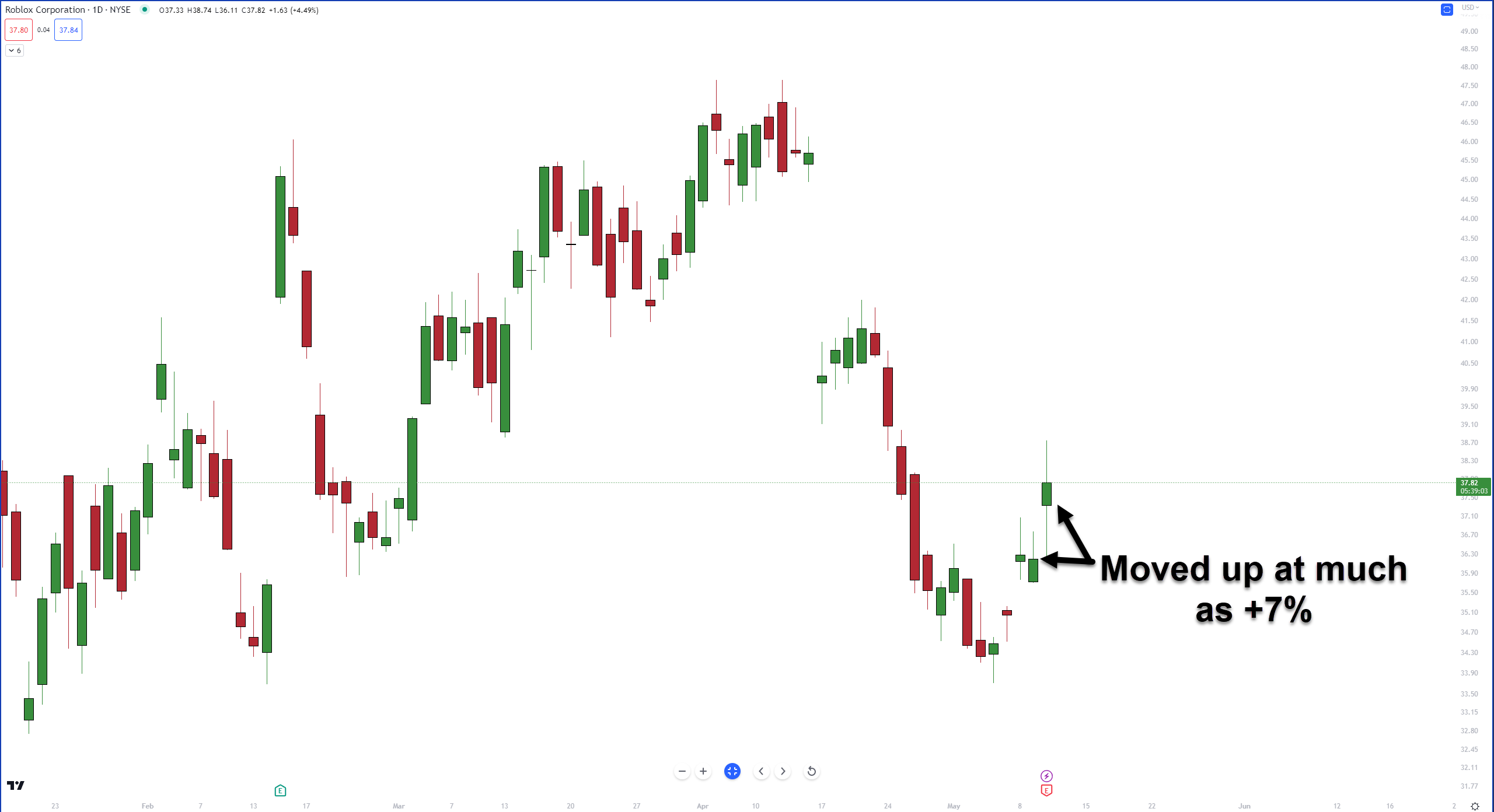

The virtual gaming universe of Roblox keeps growing like an unstoppable beast, reaching new heights with its daily users and in-game digital currency, “Robux.” 💸

During Q1, the company reported a whopping $774 million in “bookings” – a jaw-dropping 23% increase compared to last year.

$RBLX‘s bookings represent the revenue generated from users purchasing “Robux,” allowing them to customize their in-game avatars.

Daily active users surged to an astonishing 66.1 million, a 22% increase compared to the same period in 2022.

Roblox CEO, David Baszucki revealed the number of users is at an “all-time high” and aims for the ambitious goal of 1 billion daily active users. 🎯

Baszucki credits the success of their creator community, as their innovative creations attract an ever-growing global user base of all ages.

Despite the impressive numbers, Roblox reported a wider-than-expected loss per share of 44 cents, but their engagement hours and daily active users (DAUs) both saw double-digit percentage growth year-over-year.

The company’s international and 13-and-older segments experienced the most significant growth. 💥

If you were wondering when ‘Big Players’ would step in and make their own blockchain network, it looks like that time is now. 🟩

Big names like $MSFT, $IBM, and $GS came out yesterday with a presser announcing the Canton Network.

Canton Network is a privacy-enabled blockchain network for institutions. This network of networks aims to revolutionize financial market interoperability “… by connecting previously siloed systems, enabling a safer, reconciliation-free environment where assets, data, and cash can synchronize seamlessly across applications.”

The Canton Network sets itself apart by overcoming “the obstacles of privacy, control, and interoperability that have hindered other smart contract blockchain networks.” It enables participants to safeguard permissions and interactions to comply with security, regulatory, and legal requirements. 🔐

Starting in July, Canton Network participants will begin testing interoperability capabilities across various applications and use cases. This pioneering network holds the potential to unlock new efficiencies and power innovation within the financial industry.

Other participants include 3Homes, $ASX, $BNPQY, Broadridge, Capgemini, $CBOE, $CPIX, Deloitte, The Digital Dollar Project, DRW, Eleox, EquiLend, FinClear, Gambyl, IntellectEU, Liberty City Ventures, $MCO, Paxos, Right Pedal LendOS, S&P Global, SBI Digital Asset Holdings, Umbrage, Versana, VERT Capital, Xpansiv, and Zinnia. 🏦

Bullets

Bullets From The Day:

💂 The UK’s HM Revenue and Customs (HMRC) is considering new regulations that would grant it the authority to seize cryptocurrencies from companies that evade crypto taxes. As part of a strategy to modernize tax collection in the digital age, the UK government may enable the tax agency to access online wallets, including those on centralized exchanges like Coinbase, Binance, and Kraken. Law enforcement authorities can currently confiscate cryptocurrency from these exchanges when evidence of illegal activity is found.

💸 Chinese provinces are pushing digital yuan adoption in the education and public transport sectors. Jiangsu Province plans to launch a platform allowing citizens to pay education and exam fees with the central bank digital currency (CBDC) by year-end while enabling scholarship grants to be paid out in the digital yuan. By the end of 2025, the entire education sector in Jiangsu will accept digital yuan payments. Meanwhile, Jiangmen City in Guangdong Province announced its entire bus network, including public buses, school buses, and park transport systems, will accept digital yuan payments, offering “full digital yuan coverage” for fare payments.

📰 $CBOE is making its third attempt to get its Bitcoin ETF approved by the SEC. Despite facing two rejections due to concerns about investor protection and the ability to prevent fraudulent and manipulative practices, CBOE remains undeterred. The SEC has been extremely hesitant to approve spot Bitcoin ETFs, and it seems that significant changes in the crypto market will be necessary for the SEC to change its stance. This cautious approach has led to the rejection of several spot Bitcoin ETF applications from other companies, such as Grayscale, VanEck, WisdomTree, New York Digital Investment Group, and Global X.

🙂 Do ‘Con’ Kwon got some more bad news. A South Korean court has approved the freezing of domestic assets and properties worth 233.3 billion Korean won (US$176 million) belonging to the former Terraform Labs CEO. The frozen assets include private residences, real estate, imported cars, securities, bank deposits, and cryptocurrencies. The decision prevents Kwon from moving or selling these assets, which prosecutors believe represent his illegal profits. Kwon is wanted in South Korea and the US for allegedly designing the Terra-Luna project and related decentralized finance services to defraud investors and servicing unregistered financial securities. If convicted, he could face over 40 years in prison.

Here is some of what’s inside today’s curated NFT news collection:

Binance supporting BTC Ordinals, Penguins, gaming NFTs, and the surge in NFT volume from Q1.

Links

Links That Don’t Suck:

🫣 Crypto Analyst Says ‘Ultimate crypto power play’ involves Bitcoin and Cardano

🐸 Pepe the Frog meme creator unaware of PEPE coin, prefers DOGE

😱 MEV bot rakes in $34 million in three months

💱 QuadrigaCX, bankrupt crypto exchange, will resume interim fund distribution

🚨 Twitter scammer pleads guilty to $794,000 celeb crypto theft

🫣 Grayscale is worried the SEC may ban it from using Coinbase