Investors’ game of “whack a mole” continues as banking sector fears continue. As one bank’s crisis is seemingly avoided, the market moves on to its next potential victim.

Today that victim was Deutsche Bank. The German lender’s shares extended their decline after a sudden spike in the bank’s Credit Default Swaps (CDS). This asset is essentially an insurance policy against the bank’s failure, so a jump in price means the market is pricing in a rising risk of failure.

Some came to the bank’s defense, saying it’s reported ten straight quarters of profit and has stronger liquidity measures than the recently failed banks. Even Jim Cramer used a similar argument to defend Deutsche Bank, though some suggested that’s exactly why they should be concerned. 😅

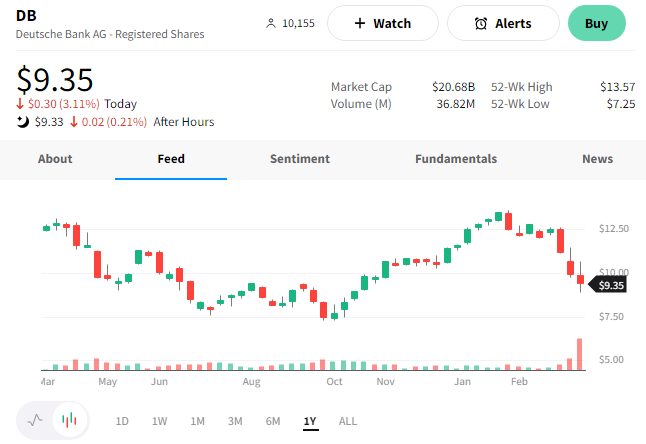

Shares of $DB closed down 3%, marking their third straight weekly decline. 📉

As the banking fears continue, global officials are working overtime to restore the market’s confidence. ⌚

Treasury Secretary Janet Yellen called an impromptu, closed-door U.S. Financial Stability Oversight Council (FSOC) meeting on today. The multi-regulator participants received a briefing on market developments from Federal Reserve Bank of New York staff. 📝

Following the briefing, FSOC released a statement, essentially saying that the U.S. banking system “is fine.” The post-meeting readout stated, “The Council discussed current conditions in the banking sector and noted that while some institutions have come under stress, the U.S. banking system remains sound and resilient.”

Three Federal Reserve bank presidents also chimed in today. Their separate remarks indicated that “there was no indication that financial stress was worsening this week,” allowing the Fed to continue tightening by 25 bp. 💬

Ultimately where we stand is that the government will only backstop depositors at banks who pose a risk of contagion. They will not bail out shareholders, bondholders, or other stakeholders. Protecting depositors and confidence in the overall banking system remains their primary goal.

For now, they will sit back and see how it all plays out, acting only as needed. 🤷