Yesterday, we heard from Target, which soared after getting its earnings back on track despite declining sales. Today, we heard from Walmart, which plunged after growing sales and beating on earnings. Let’s talk about why that happened. 👇

Today’s earnings in Walmart contrasted Target’s, but the underlying cautious tone about the U.S. consumer remained. The big-box retailer reported adjusted earnings per share of $1.53 on $168.80 in revenues, topping the $1.52 and $159.72 billion expected by analysts.

Walmart’s net sales rose 4.9% YoY, while Target’s declined a similar amount, as its reputation for low prices and a wider selection of groceries and necessities enticed shoppers. The nation’s largest grocer saw transaction volumes rise 3.4% and average ticket size jump 1.5%. Meanwhile, Target saw both figures decline, as more of its sales are derived from clothing, home goods, and other discretionary items. 🛒

Like Target, Home Depot, and other retailers, Walmart’s CFO said consumers are “leaning heavily” into major promotions. He explained, “Our events have been strong … But in the last couple of weeks of October, there were certainly some trends in the business that made us pause and kind of rethink the health of the consumer.”

Hence, the overall cautious tone we’re seeing across the board. ⚠️

Investors were also happy to see that its advertising business and Walmart+ subscription business continue to grow. Even if those businesses are relatively small, they have much higher margins, so they can still have a material impact on their results.

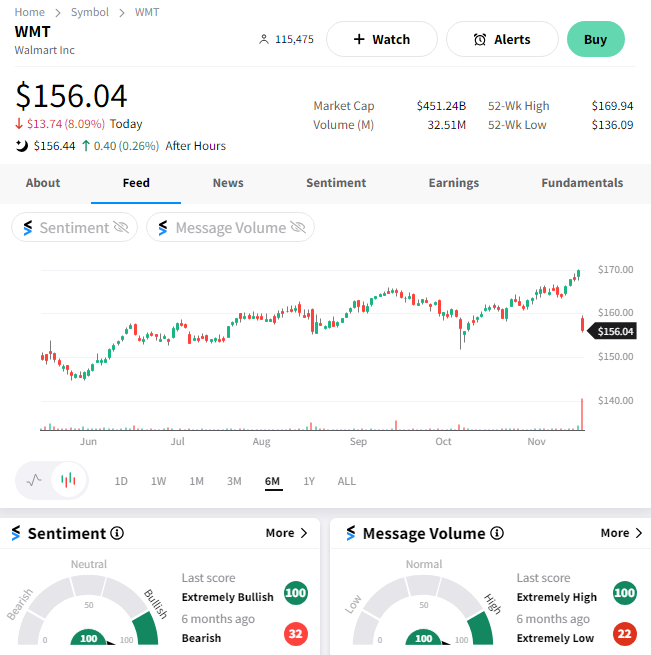

The other factor to consider regarding the stocks is the significant difference in expectations going into these results. Target shares were sitting at 3.5-year lows ahead of its results, so its earnings and revenue beat helped spark a significant rebound. On the other hand, Walmart shares were at all-time highs ahead of its report. So good news — but not great news — was enough to send the stock lower. 🤔

Sentiment among the community remains bullish despite the stock’s initial reaction. Investors are betting the challenging macroeconomic environment will cause more consumers to continue “trading down” from other retailers to Walmart. $WMT was a top trending ticker most of the day as investors/traders debated the earnings report and outlook. 🐂

Big-box retailers aren’t the only ones expressing caution and focusing on costs. For example, Macy’s experienced a 15% jump today but faded throughout the day. The department store’s third-quarter earnings beat was driven by cost and inventory management, not sales growth. So, investors remain concerned about the ability to drive performance in a prolonged slowdown. 😬

Defense continues to win Wall Street over, with companies focused on boosting earnings through cost and inventory management and not allowing sales to fall more than analysts expect. The retailers that can do that are currently being rewarded in the market, especially if expectations are low going into their reports. As for Walmart, it was down today, but many say it’s approaching the holiday quarter and 2024 from a position of strength if the consensus consumer view proves true. 🤷