Earlier this year, the talk of the town was China’s “reopening,” where the country did away with its COVID-19 lockdown measures and set its eye on growth. That optimism lasted through April, but as more data has emerged, the market has turned increasingly sour toward the country. 😝

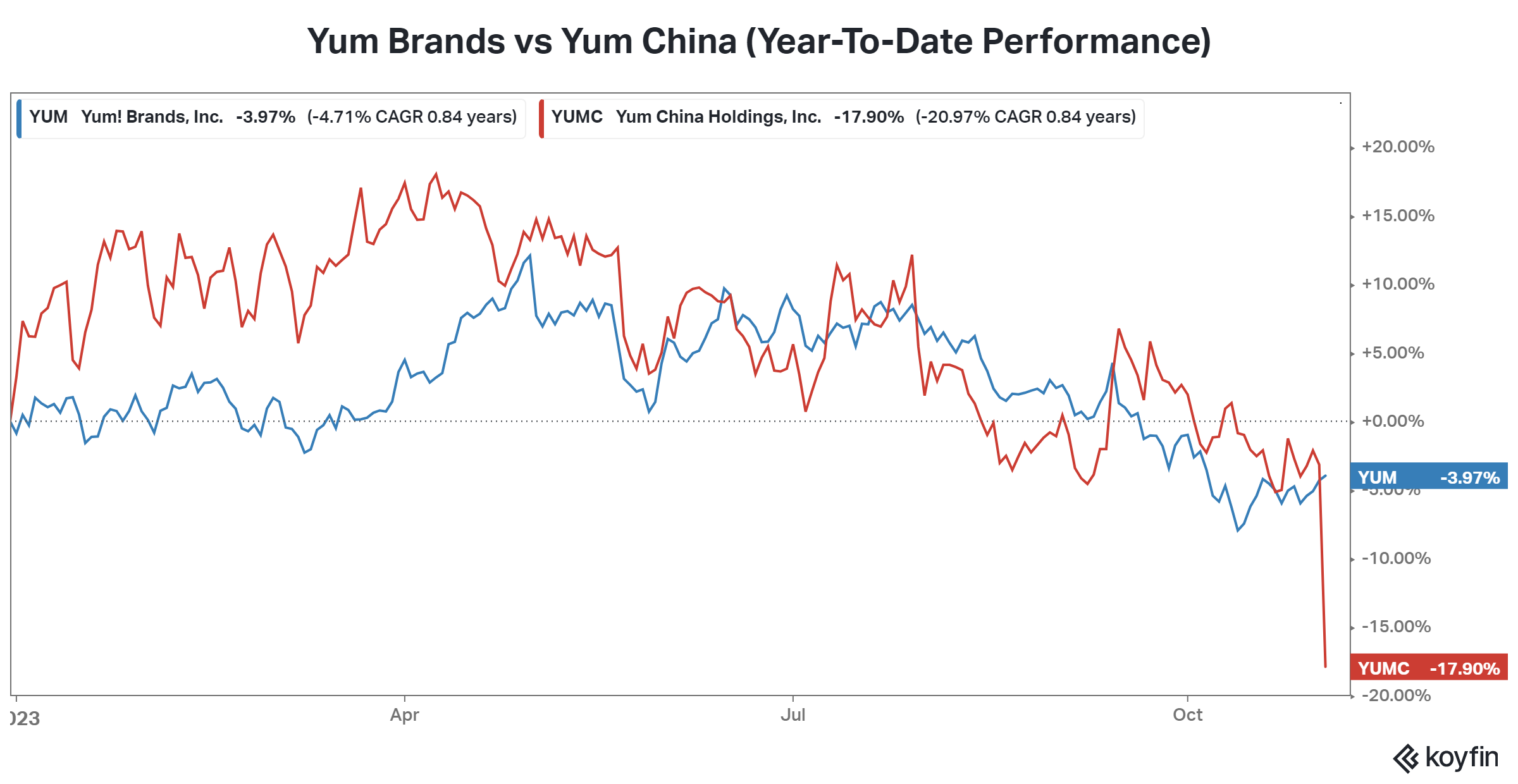

A prime example of this in practice is Yum Brands vs. Yum China, which operates its Chinese restaurants. The chart below shows the Chinese-based company outperforming early in the year but turning south as we headed into the summer. That underperformance escalated today after both companies reported earnings results.

Yum China’s core message: macroeconomic headwinds and softening consumer demand. Both its third-quarter earnings and revenue came in below analyst estimates, with the company saying a slowdown in recent weeks is casting doubt about current-quarter results. That sent shares plummeting 15% today, widening the gap between the U.S.-focused and Chinese-focused parts of the business. 📉

Investors are adding Yum to the growing list of companies seeing a lackluster performance in China. For example, here are two more from today. 📝

Cosmetics giant Estee Lauder crashed to six-year lows after its second-quarter and full-year profit outlook came in well below expectations. It cited incremental external headwinds, specifically slower growth in Asia travel retail and mainland China. It also cited risks of business disruption due to the ongoing Israel-Hamas and Russia-Ukraine wars.

Luxury parka retailer Canada Goose cut its full-year earnings outlook, also citing macroeconomic pressure. In the past, the company had pointed to weakening appetite in North America, but now it’s blaming supposed “growth driver” China for the miss.

Overall, these are unlikely to be the last headlines we see this earnings season about China’s slow growth. With the market turning sour on the country, investors will look elsewhere for growth potential until signs emerge that the country’s efforts to stimulate growth are beginning to work.