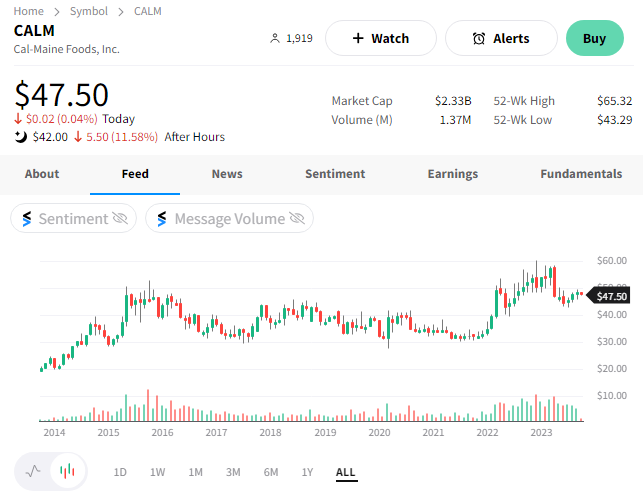

Cracks formed in egg-producer Cal-Maine Foods’ chart after it missed analyst estimates. 🐣

The company’s adjusted earnings per share of $0.02 were well shy of the $0.33 expected and last year’s $2.57. Revenues of $459.3 million were down 30% YoY to $459.3 million, as the company’s average selling price per dozen fell 48% YoY to $1.24.

Falling prices for its eggs and elevated costs are squeezing the company’s profits. Specialty sales as a percentage of volume were down slightly YoY but rose to 47.7% in dollar terms as its higher-priced products deliver better margins. 🔺

Given where the current market for eggs is, it continues to focus on this specialty segment to drive longer-term growth. It’s also focused on cutting costs where applicable but continues to deal with high feed and other commodity-related prices that are largely out of its control.

$CALM shares fell 12% after hours, settling back to levels they first reached back in 2015. 🙃