Last time we talked about egg producer Cal-Maine Foods’, its stock price was cracking due to lower egg prices. Unfortunately, this quarter didn’t fare much better, with shares once again falling after its quarterly report.

The company’s second-quarter earnings per share of $0.35 were down over 90% from last year’s $4.07. And revenues of $523.2 million were down about 35% YoY. Both numbers missed analyst expectations of $0.83 and $525 million. 🔻

Chief Executive Officer Sherman Miller said, “Our sales reflect a different market environment from a year ago, with significantly lower average selling prices.” 🥚

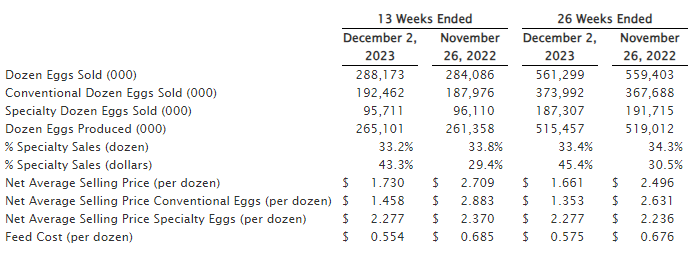

The chart from its filing shows that overall volumes were up marginally YoY, but conventional eggs’ net average selling price took a significant hit. As a result, its specialty egg sales made up a much larger percentage of sales despite flat volumes since they were able to maintain pricing power.

Looking ahead, egg demand is expected to grow marginally in 2024, with prices attempting to stabilize. The outbreaks of Highly Pathogenic Avian Influenza (HPAI) that devastated the industry over the last eighteen months remain a risk but are impacting a much smaller portion of the hen population. And while the U.S. flock is still about 2.6% below its five-year average of 330.1 million hens, the hen flock is expected to grow in 2024 and help close that gap. 🐣

As a result, the company remains opportunistic. For example, it’s taking over a broiler processing plant, hatchery, and feed mill that was recently shuttered by Tyson Foods. It also completed the acquisition of Fassio Egg Farms’ assets, adding production capacity, especially for cage-free “specialty” eggs. 🚜

It’s also maintaining its dividend yield above 5.00% at current levels, which it hopes will keep investors on board as it works through the industry’s current challenges.

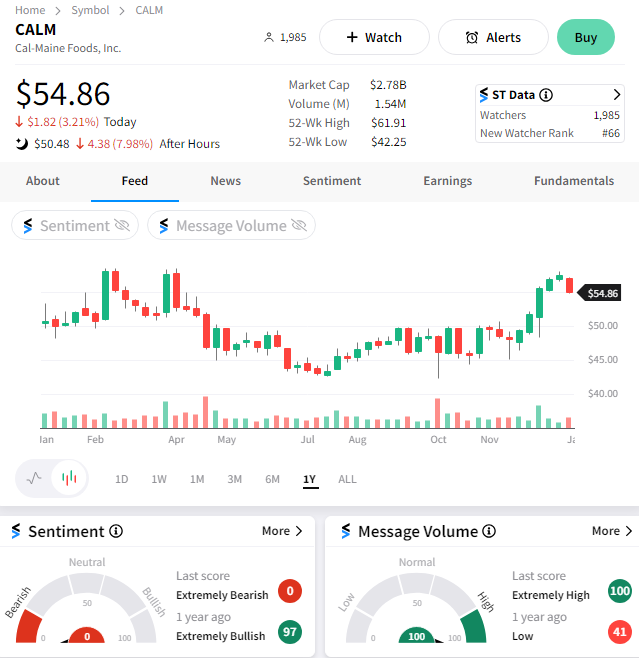

So far, it doesn’t seem like investors are willing to wait it out. $CALM shares fell about 11% on the day, and sentiment in the Stocktwits community read as extremely bearish. We’ll have to see if that changes in the weeks ahead, but for right now, these eggs are cooked. 🍳