Fed Chair Jerome Powell’s highly-anticipated Jackson Hole speech initially sent the market indexes lower before rebounding to close the week mixed. 📝

Although he acknowledged the progress higher monetary policy has made on inflation, he reiterated that prices are still above the central bank’s target. As a result, the Fed is prepared to raise rates further and intends to hold policy at a restrictive level until confidence improves that inflation is sustainably moving towards its target. ⏯️

However, the Fed doesn’t know exactly what interest rate level is restrictive enough. Powell said, “We see the current stance of policy as restrictive, putting downward pressure on economic activity, hiring, and inflation. But we cannot identify with certainty the neutral rate of interest, and thus there is always uncertainty about the precise level of monetary policy restraint.”

Additionally, he squashed some rumors that the Fed was considering raising its 2% inflation target to give it more policy flexibility. As he has in the past, he once again reiterated that “two percent is and will remain our inflation target.” 🎯

As for which aspects of core inflation the Fed is monitoring most closely, he said there are three broad components: goods, housing services, and nonhousing services. He noted that continued progress in these areas is critical to restoring price stability. 🕵️♂️

Ultimately, Powell signaled that the central bank needs to ‘proceed carefully.’ Moreover, he said, “At upcoming meetings, we will assess our progress based on the totality of the data and the evolving outlook and risks. Based on this assessment, we will proceed carefully as we decide whether to tighten further, or, instead, to hold the policy rate constant and await further data.” ⚠️

One poetic line in his conclusion summed up the Fed’s current predicament. He said, “As is often the case, we are navigating by the stars under cloudy skies.”

All in all, there were no major surprises in today’s speech. For now, the Fed continues to toe the line of bringing down inflation without significant economic adverse impacts. As such, it’s keeping its options open and will make decisions based on the next few months of data. 🗓️

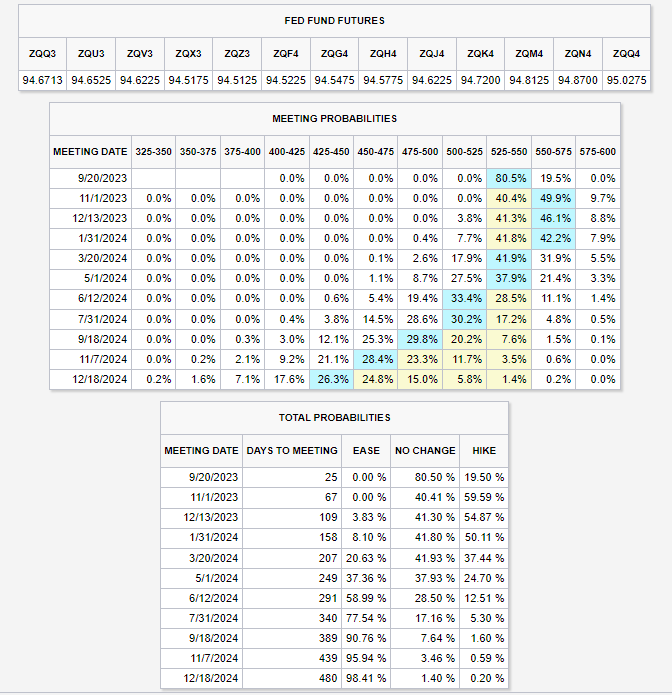

As for the bond market, it’s now pricing in a 50/50 shot of another 25 bp hike at the Fed’s November meeting. We’ll see how that changes as more data rolls in.